CHANDLER, Ariz. — May 15, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the first quarter ended March 31, 2023. The financial statements are available on VirTra’s website and here.

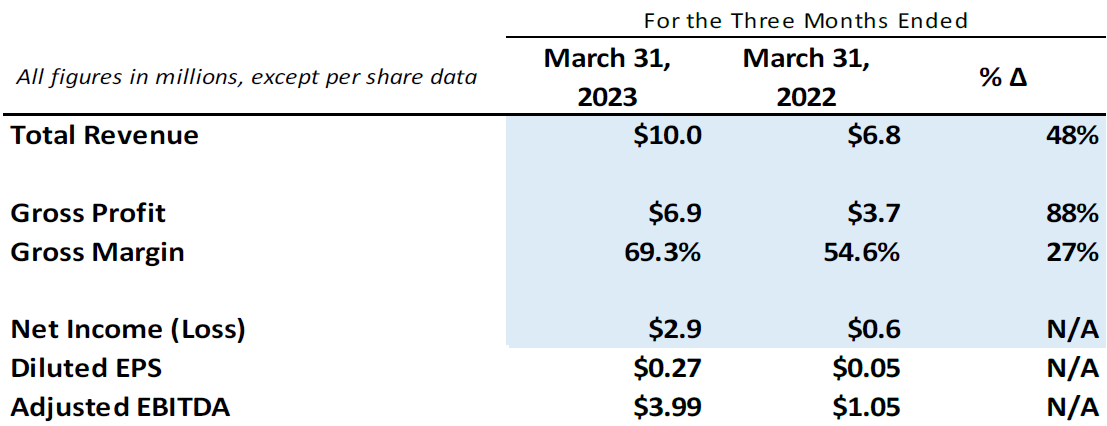

First Quarter 2023 Financial Summary:

- Total revenue increased 48% to a record $10.0 million

- Gross profit increased 88% to $6.9 million, or 69% of total revenue

- Net income increased by $2.4 million to $2.9 million

- Adjusted EBITDA increased to $4.0 million

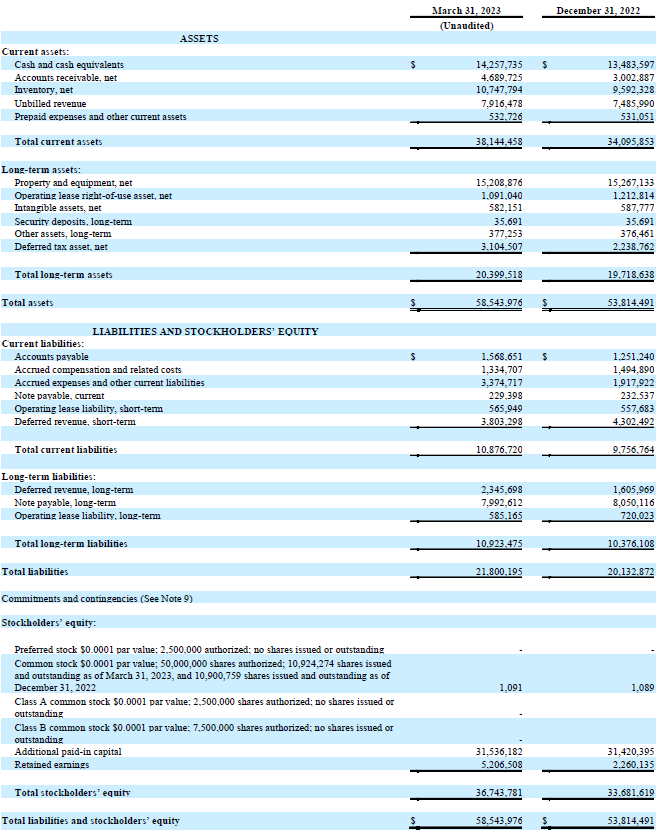

- Improved strong balance sheet with cash and cash equivalents of $14.3 million at March 31, 2023

First Quarter 2023 Financial Highlights:

Management Commentary

“Coming off our 17th consecutive year of revenue growth in 2022, in Q1 we worked from our record backlog to deliver VirTra’s first ever quarterly revenue performance in the double-digit millions,” said Bob Ferris, chairman and co-CEO of VirTra. “Simultaneously, our actions to improve internal processes and streamline the overall business have significantly enhanced the efficiency of our operations, leading to the strongest bottom-line performance in the Company’s history. To build on our market-leading position and expand our revenue pathways, we are pursuing additional product and content development to make VirTra’s training capabilities even stronger.”

John Givens, co-CEO of VirTra added: “We remain committed to optimizing our business operations and driving profitability while ramping up our sales efforts as we move into the second quarter and beyond. While we are making strides in clearing our backlog and fulfilling orders more efficiently, we recognize that there are still many untapped opportunities in the market, both domestic and international. To capitalize on this potential, we are implementing sales initiatives to maximize our market penetration and prioritize areas with the greatest growth potential. We are focused on continued success in the coming quarters as we execute our growth strategies.”

First Quarter 2023 Financial Results

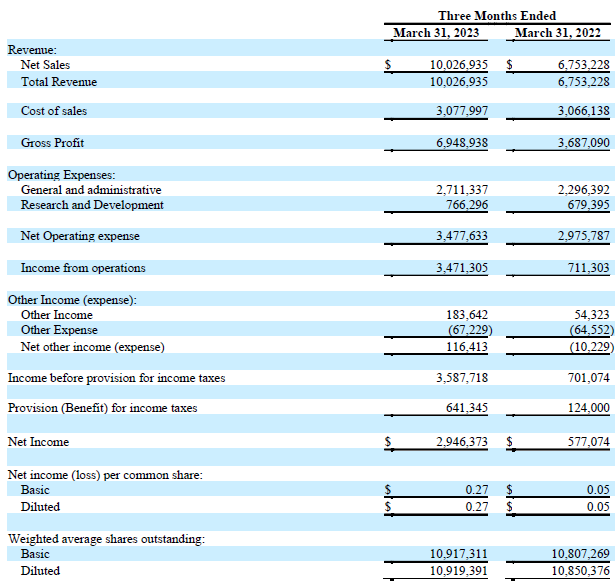

Total revenue increased 48% to $10.0 million from $6.8 million in the first quarter of 2022. The increase in revenue was the result of the deliveries of two major government contracts and one large international contract.

Gross profit increased 88% to $6.9 million from $3.7 million in the first quarter of 2022. Gross profit margin, defined as total revenue less cost of sales, was 69.3%, an improvement compared to 54.6% in the first quarter of 2022. The increase in gross profit was primarily due to the increased sales achieved while maintaining cost of sales in line with 2022 levels. The increased gross margins resulted from the favorable product mix of systems, accessories and services sold in the quarter.

Net operating expense was $3.5 million, compared to $3.0 million in the first quarter of 2022. The increase in net operating expenses was due to increased R&D expenses additional costs related to the Orlando facility and one-time costs in payroll and related expenses.

Operating income increased by $2.8 million to $3.5 million from $0.7 million in the first quarter of 2022.

Net income was $2.9 million, or $0.27 per diluted share (based on 10.9 million weighted average diluted shares outstanding), compared to net income of $0.6 million, or $0.05 per diluted share (based on 10.8 million weighted average diluted shares outstanding), in the first quarter of 2022.

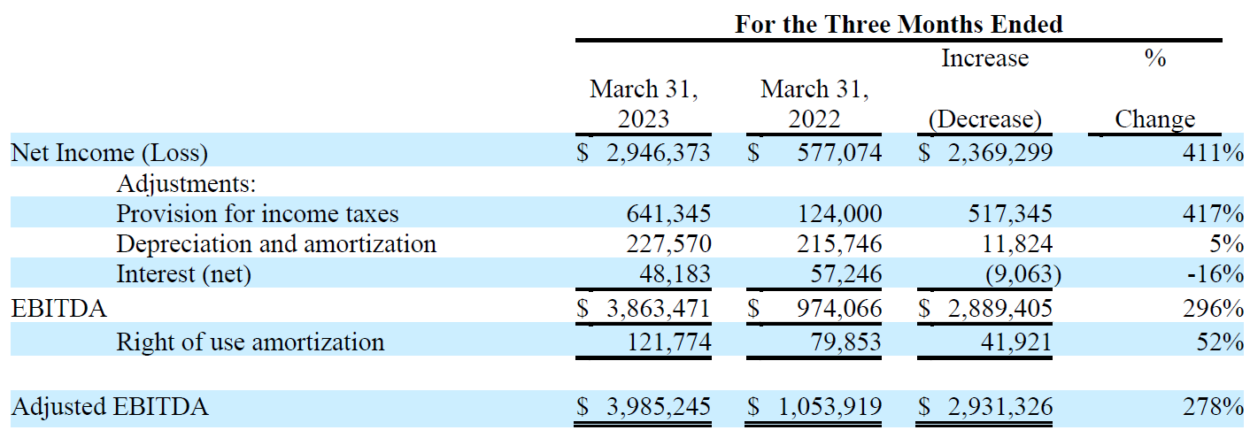

Adjusted EBITDA, a non-GAAP metric, increased to $4.0 million from $1.0 million in the first quarter of 2022.

Financial Commentary

“Our first quarter financial results represent vast year-over-year improvements and demonstrate the success of our ongoing efforts to drive growth and profitability,” said CFO Alanna Boudreau. “We achieved a strong gross profit margin of 69%, a reflection of our focus on maintaining cost of sales while effectively selling a favorable mix of simulators, accessories, and services. Our record net income of $2.9 million and adjusted EBITDA of $4.0 million highlight our ability to execute even amidst operational transformations. These strong results put us on track to meet our financial targets for 2023 and position us well for continued success in the law enforcement and military simulator markets.”

Conference Call

VirTra’s management will hold a conference call today (May 15, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s chairman and co-CEO, Bob Ferris, co-CEO John Givens and Chief Financial Officer Alanna Boudreau, will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13738125

–

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast simultaneously and is available for replay here and via the investor relations section of the company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through May 29, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13738125

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Tom Colton

Gateway Group, Inc.

949-574-3860

VirTra, Inc.

Condensed Balance Sheets

VirTra, Inc.

Condensed Statements of Operations

(Unaudited)

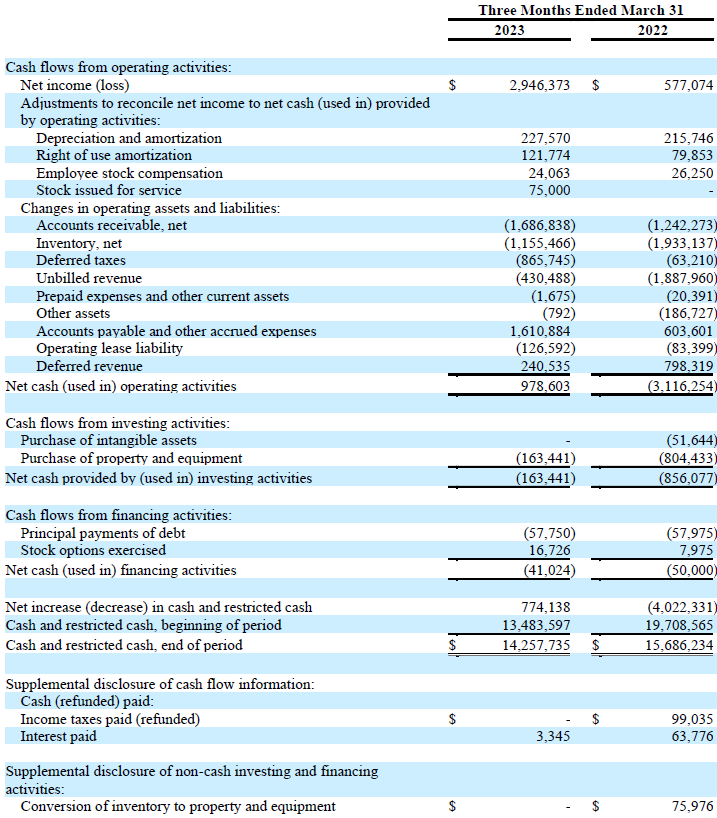

VirTra, Inc.

Condensed Statements of Cash Flows

(Unaudited)

Recently Published

Join Our Newsletter