Record Q1 Bookings Drive $8.3 Million Backlog

Tempe, Ariz. (May 14, 2018) – VirTra, Inc. (Nasdaq: VTSI) (the “Company”), a global provider of simulators for the law enforcement, military, educational and commercial markets, today announced its financial results for the first quarter ended March 31, 2018. The financial statements are available on VirTra’s website and here.

First Quarter 2018 Financial Highlights:

| Q1 2018 | Q1 2017 | % Δ | |

| Revenues | $3.2M | $4.2M | (22.9)% |

| Gross Profit | $2.2M | $2.4M | (8.7)% |

| Gross Margin | 68.4% | 57.7% | +1,063 bps |

| Net Income (Loss) | $(0.1)M | $0.4M | (121.3)% |

| Diluted EPS | $(0.01) | $0.05 | (120.0)% |

Business and Financial Highlights:

- Generated a record $8.6 million in bookings in the first quarter of 2018.

- Received a new $1.25 million contract early in the second quarter for training simulators from the United States Department of State.

- Gross profit margin of 68.4% for the first quarter of 2018 compared to 57.7% in the year ago period.

- VirTra’s backlog as of March 31, 2018, was approximately $8.3 million.

“VirTra generated a record level of bookings in the first quarter, demonstrating strong execution by our expanded and improved sales organization and the growing demand from law enforcement professionals around the world for our products,” commented Bob Ferris, Chairman and Chief Executive Officer of VirTra. “However, a large portion of these orders were booked too late in the quarter to convert to revenue, and instead have created a meaningful backlog to be filled during 2018. The $8.3 million backlog, combined with the $3.2 million in recognized revenue and a $1.25 million order secured early in the second quarter, represents a strong start to 2018 and provides confidence that this will be another year of growth. In the aggregate, this represents more than $12.5 million in revenue and potential revenue, approaching the $16.5 million in recognized revenue for all of 2017.”

“I am encouraged by our sales pipeline and the strong performance in closing bookings during the first quarter,” continued Mr. Ferris. “Our margin for the quarter was boosted based on deliveries of higher margin products to customers and some improvements in production methods. However, our operating expenses for the first quarter absorbed many one-time costs, totaling $132,000, which were directly related to our qualification and completion of our Regulation A+ offering, completion of SEC registration, and Nasdaq listing.”

“The market for simulators to help train the police, military personnel and civilians is robust. With growing demand, accelerating adoption of simulation training as a way to improve skills and reduce costs, we are positioned for an outstanding 2018,” concluded Mr. Ferris. “The Board of Directors, management and the entire VirTra team are committed to serving our worldwide customers and creating sustainable value for our shareholders, and I am increasingly optimistic about the future of VirTra.”

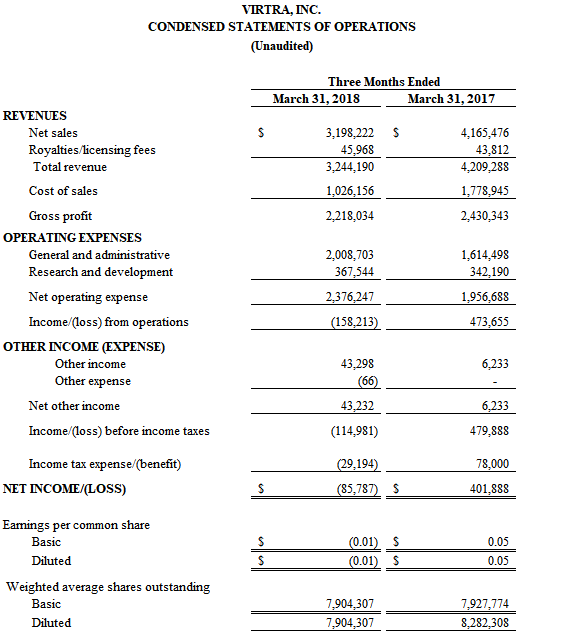

Financial Results for the Three Months Ended March 31, 2018

Total revenues were $3.2 million for the first quarter of 2018 compared to $4.2 million for the first quarter of 2017, a decrease of 22.9%. The year-over-year decrease was due to the receipt of contracts late in the quarter, resulting in lower deliveries of simulators and accessories and consequentially not being able to recognize revenue in the current period, partially offset by increased sales of scenarios and warranties.

As of March 31, 2018, the Company’s backlog was approximately $8.3 million. The Company’s backlog consists of orders (all products and services, including extended warranties) for which a signed purchase order is in place but delivery is scheduled for a future date or has not yet been scheduled. Management expects the majority of the backlog received in the first quarter to be converted to revenue during 2018 with the exception of the extended warranties which will convert to revenue on a straight-line basis over the term of the warranty period ranging between 1-5 years.

Gross profit was $2.2 million, or 68.4% gross profit margin, for the first quarter of 2018 compared to gross profit of $2.4 million, or 57.7% gross profit margin, for the first quarter of 2017, a gross profit decrease of 8.7% but a gross margin improvement of 1,063 basis points. The year-over-year increase in gross profit margin was primarily due to a reduction in the cost of the Company’s machine shop manufacturing system and product components and increases in the sales mix of higher margin products, combined with a reduction in material costs due to favorable pricing of raw materials and systems components in 2018 compared to the same period in 2017.

Operating expense was $2.4 million for the three months ended March 31, 2018 compared to $2.0 million for the same period in 2017, an increase of $419,559. SG&A increases resulted from expanding staffing levels and increases in payroll and benefit costs, professional services increases in annual audit, accounting and legal fees, public company expense and other fees, licenses, subscriptions and professional services. The year-over-year increase in professional services included approximately $132,000 of non-recurring legal and public company expense directly related to the Company’s qualification and conclusion of its Regulation A+ offering, completion of SEC registration, and Nasdaq listing.

Inclusive of the $132,000 in non-recurring legal and public company costs, VirTra’s loss from operations for the first quarter of 2018 was $158,000 compared to income from operations of $474,000 in the first quarter of 2017. Income tax benefit was $29,194 compared to income tax expense of $78,000 for the same period in 2017, an increase of 137%. In accordance with accounting guidance, the Company made updates to provisional estimates for the deferred taxes of the Company based on new information obtained during the three months ended March 31, 2018 and re-measured the updated provision estimates using the new effective tax rate under the Tax Act.

Inclusive of the $132,000 in non-recurring legal and public company costs, Net loss for the first quarter of 2018 was $85,787, or $(0.01) per basic and diluted share, compared to net income of $402,000, or $0.05 per basic and diluted share, for the prior year’s first quarter.

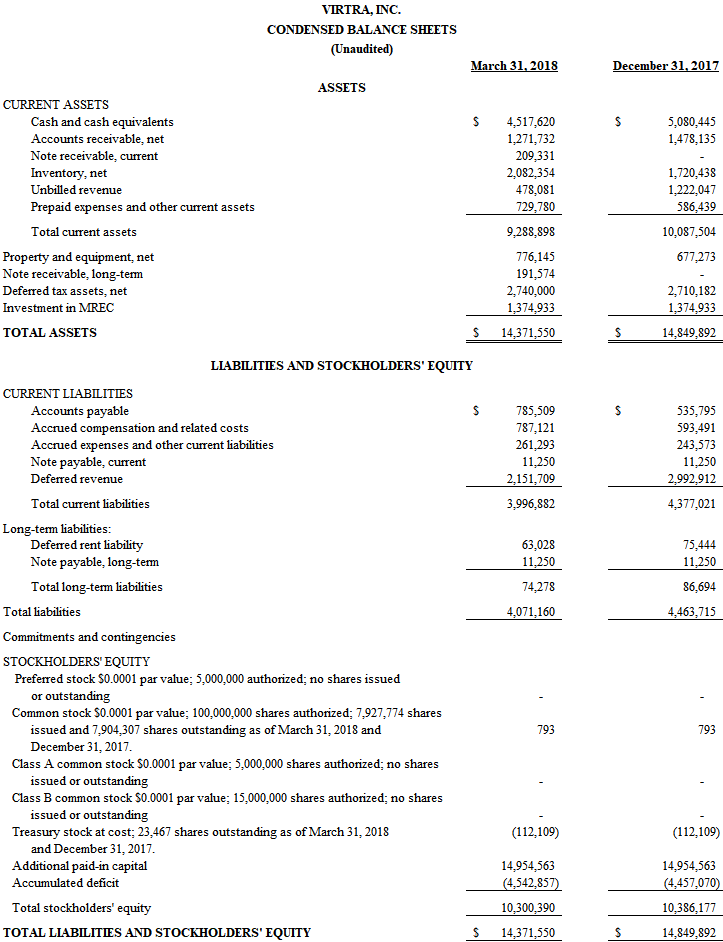

Balance Sheet Summary

Stockholders’ equity decreased to $10.3 million at March 31, 2018 compared to $10.4 million at December 31, 2017. Cash and cash equivalents were $4.5 million at March 31, 2018 compared to $5.1 million at December 31, 2017. The Company had essentially no outstanding bank debt at March 31, 2018.

Conference Call and Webcast

The Company will host a first quarter 2018 results and business update investor conference call and webcast on Monday, May 14, 2018. Individuals interested in listening to the webcast live via the Internet may do so by visiting the Company’s website at www.VirTra.com. A webcast replay will be available for 60 days.

Date: Monday, May 14, 2018

Time: 4:30 p.m. ET / 1:30 p.m. local

Dial-in Number: 877-407-8031

International Dial-in Number: 201-689-8031

Webcast: http://www.investorcalendar.com/event/29320

Participants are recommended to dial-in approximately 10 minutes prior to the start of the event. A replay of the call will be available approximately two hours after completion through May 28, 2018. To listen to the replay, dial (877) 481-4010 (domestic) or (919) 882-2331 (international) and use replay ID 29320. The webcast replay will be available through August 14, 2018.

About VirTra

VirTra is a global provider of simulators for the law enforcement, military, educational and commercial markets. The Company’s patented technologies, software and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real world situations. VirTra’s mission is to save and improve lives worldwide through realistic and highly-effective virtual reality and simulator technology. Learn more about VirTra at www.VirTra.com.

Forward-looking Statements

This news release includes certain information that may constitute forward-looking statements. Forward-looking statements are typically identified by terminology such as “could,” “may,” “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “proposed,” “planned,” “potential” and similar expressions, or are those, which, by their nature, refer to future events. All statements, other than statements of historical fact, included herein, including statements about VirTra’s beliefs and expectations, are forward-looking statements. Forward-looking information is necessarily based upon a number of assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Although VirTra believes that such statements are reasonable, it can give no assurance that such forward-looking information will prove to be accurate. VirTra cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors. Accordingly, due to the risks, uncertainties and assumptions inherent in forward-looking information, readers and prospective investors in the Company’s securities should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof, and is based upon the opinions and estimates of management and information available to management as at the date hereof and is subject to change. The Company assumes no obligation to revise or update forward-looking information to reflect new circumstances, whether as a result of new information, future events or otherwise, except as required by law.

Media contact:

VirTra

[email protected]

480-968-1488

Investor Relations contact:

Brett Maas

[email protected]

(646) 536-7331

View/Print PDF Version of Press Release/Financials

FINANCIALS FOLLOWING

Recently Published

Join Our Newsletter