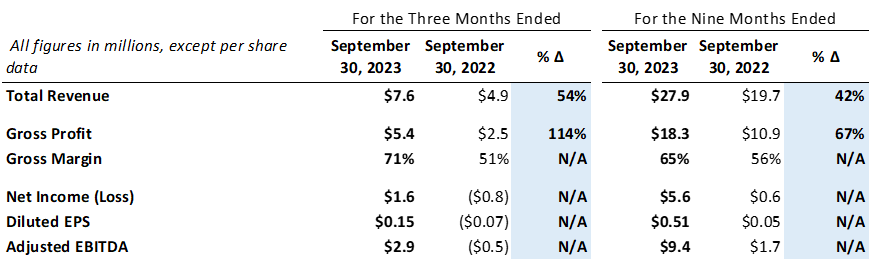

Quarterly Revenue Increases 54% Year-Over-Year to $7.6 Million

Quarterly Net Income Increases by $2.4 Million to $1.6 Million

CHANDLER, Ariz. — November 14, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the third quarter ended September 30, 2023. The financial statements are available on VirTra’s website and here.

Third Quarter 2023 Financial Highlights:

- Total revenue increased 54% to $7.6 million

- Gross profit increased 114% to $5.4 million, or 71% of total revenue

- Net income increased by $2.4 million to $1.6 million

- Adjusted EBITDA increased to $2.9 million

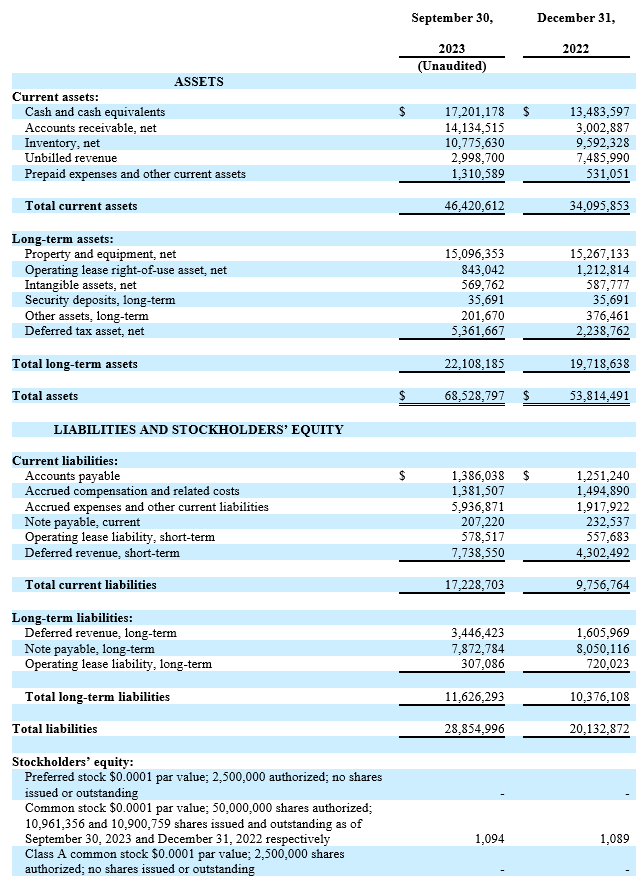

- Cash and cash equivalents of $17.2 million at September 30, 2023

Nine Month 2023 Financial Highlights:

- Total revenue increased 42% to $27.9 million

- Gross profit increased 67% to $18.3 million, or 65% of total revenue

- Net income increased by $5.0 million to $5.6 million

- Adjusted EBITDA increased to $9.4 million

Third Quarter and Nine Month 2023 Financial Highlights:

Management Commentary

“Building on our record-breaking first half, we’ve made further strides in improving our operations and sales activity this quarter, resulting in a robust 54% increase in quarterly revenue,” said VirTra CEO John Givens. “These ongoing improvements, with significant developments made in the third quarter, such as enhancing our production facility and focusing on our machine shop processes and equipment upgrades, are set to continue bearing fruit in future quarters. These efforts have not only accelerated manufacturing but also improved product quality, ultimately leading to higher customer satisfaction. With our significantly improved business operations, we are directing our attention towards increasing sales productivity, and we’re already realizing early progress.

“The changes we’ve made to our sales methodology, compensation, and territory structuring are set to deliver substantial results in the near term and will continue to compound over the coming years. As part of these sales enhancements, we’ve expanded our team to boost customer success and enable our salesforce to focus on driving new business. This concerted effort, combined with our sustained success in the law enforcement market and the solid early progress achieved in key military contracts, positions VirTra for strong, sustained growth in the long term.

“Furthermore, our focus on developing industry-leading technology continues to unlock long-term value. In Q3, we unveiled V-XR®, our extended reality training solution, to our product portfolio. This strategic addition prioritizes the development of essential interpersonal skills crucial for law enforcement professionals, enabling them to navigate sensitive situations, de-escalate conflicts, and build trust with their communities. By integrating soft skills training into our curriculum, we aim to provide law enforcement professionals with the tools and knowledge needed for more meaningful and effective community engagement. Emphasizing empathy, communication, and cultural awareness, V-XR® sets a new industry standard and maintains a competitive price point, making it accessible to law enforcement agencies, large and small. Strong pre-order demand signals its potential as a gateway to larger simulator sales. We’ve also streamlined aspects of our simulators, ensuring easier access to control computers while reducing assembly costs and time. These enhancements, combined with ongoing content updates, further solidify our position as the market leader in training technology.”

Third Quarter 2023 Financial Results

Total revenue increased 54% to $7.6 million from $4.9 million in the third quarter of 2022. The increase in revenue was driven by a continued improvement in sales strategy and continued demand for training solutions.

Gross profit increased 114% to $5.4 million from $2.5 million in the third quarter of 2022. Gross profit margin was 71%, an increase compared to 51% in the third quarter of 2022.

Net operating expense was $3.7 million, compared to $3.6 million in the third quarter of 2022. The slight increase in net operating expense was associated with additional staffing and the opening of our Orlando facility.

Operating income increased by $2.8 million to $1.7 million from $(1.1) million in the third quarter of 2022.

Net income was $1.6 million, or $0.15 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $(0.8) million, or $(0.07) per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the third quarter of 2022.

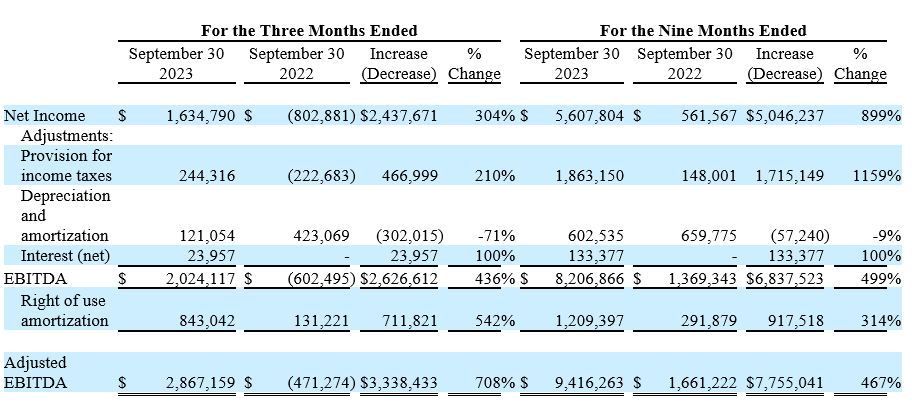

Adjusted EBITDA, a non-GAAP metric, increased to $2.9 million from $(0.5) million in the third quarter of 2022.

Nine Months Ended September 30, 2023 Financial Results

Total revenue increased 42% to $27.9 million from $19.7 million in the first nine months of 2022. The increase in revenue was driven by record first-half performance and continued improvement in sales strategy.

Gross profit increased 67% to $18.3 million from $10.9 million in the first nine months of 2022. Gross profit margin was 65%, an increase compared to 56% in the first nine months of 2022. The increase in gross profit margin was primarily due to the aforementioned increase in revenue while maintaining cost of sales in line with 2022 levels.

Net operating expense was $11.2 million, compared to $10.3 million in the first nine months of 2022. The increase in net operating expense was primarily driven by an increase in salaries and benefits resulting from the addition of new staff, expenses for the new Orlando office, as well as an increase in R&D spend, and the implementation expense related to the launch of the Company’s new ERP system.

Operating income jumped to $7.1 million in the first nine months of 2023, a $6.4 million increase from $0.7 million in the prior year period.

Net income was $5.6 million, or $0.51 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $0.6 million, or $0.05 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the first nine months of 2022.

Adjusted EBITDA, a non-GAAP metric, increased to $9.4 million from $1.7 million in the first nine months of 2022.

Financial Commentary

“The third quarter was highlighted by sustained revenue growth and significant profitability improvements,” said VirTra CFO Alanna Boudreau. “Our 71% gross margins reflect our commitment to managing cost of sales as we drive business expansion. Although we experienced a temporary slowdown in our bookings during Q3, partly due to a brief government shutdown, we expect them to rebound and accelerate as our sales initiatives gain further traction. Our pipeline continues to grow while our backlog remains heathy and will continue to provide our year-over-year revenue increase in the fourth quarter. Based on our excellent performance in the first nine months, we are very confident in surpassing our year-end targets for 2023, and we anticipate continued revenue and profitability expansion as we move into 2024.”

Conference Call

VirTra’s management will hold a conference call today (November 14, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s Chief Executive Officer John Givens, Chief Financial Officer Alanna Boudreau, and Executive Chairman Bob Ferris will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13742019

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through November 28, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13742019

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

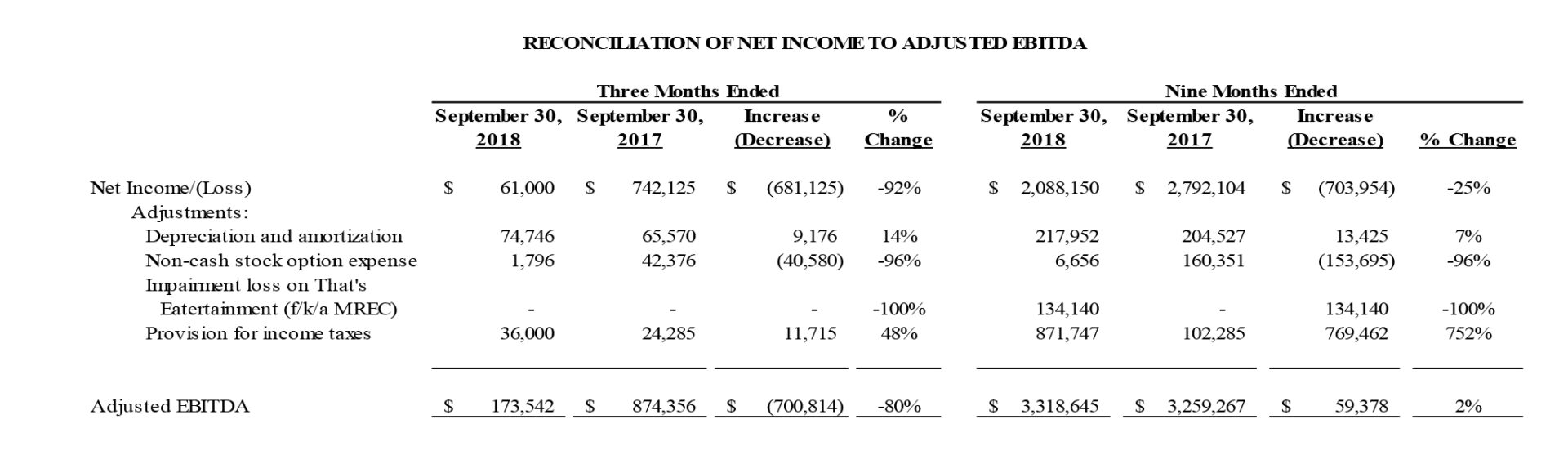

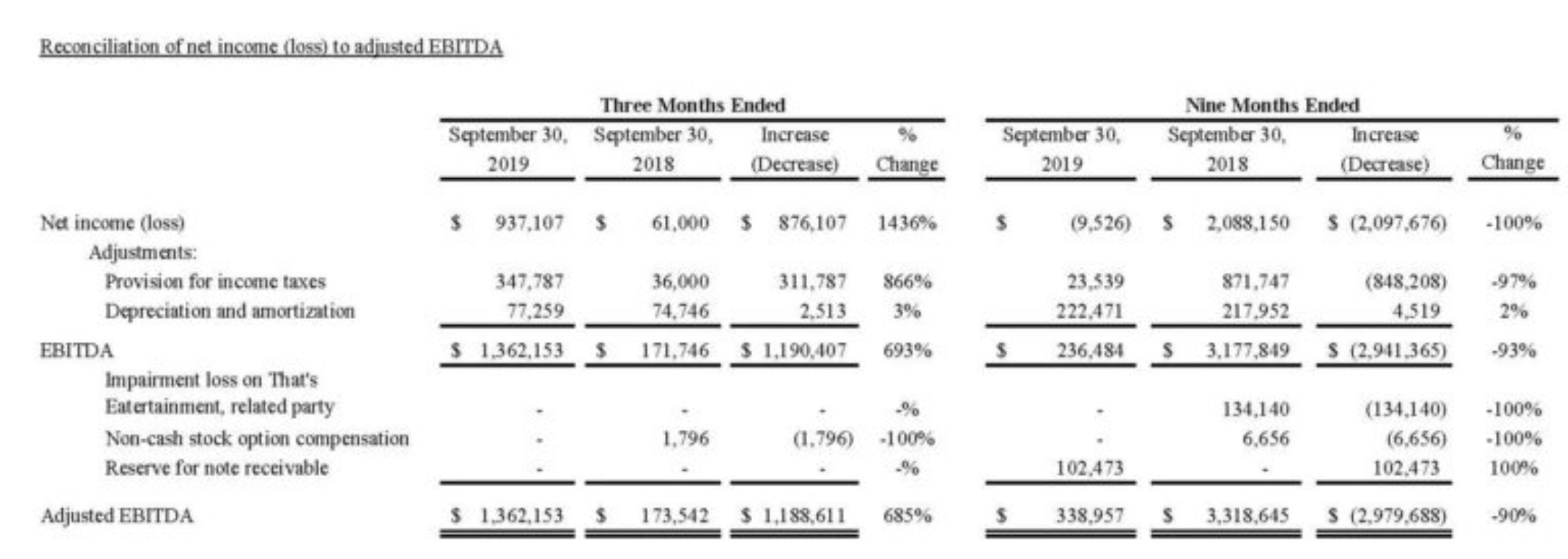

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risks and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

– Financial Tables to Follow –

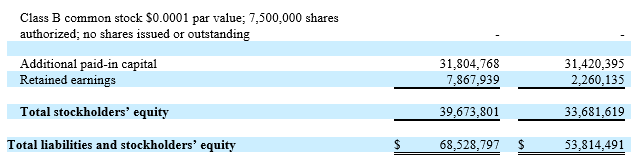

VIRTRA, INC.

CONDENSED BALANCE SHEETS

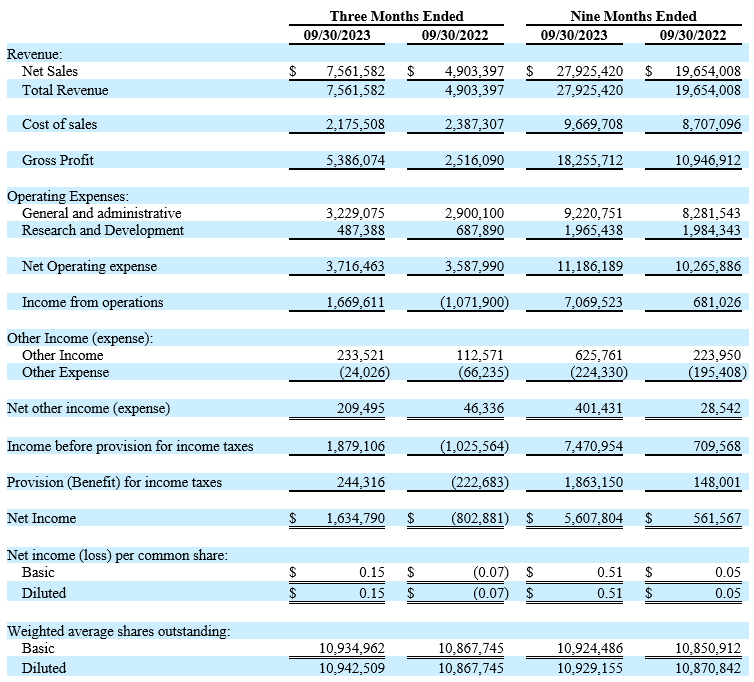

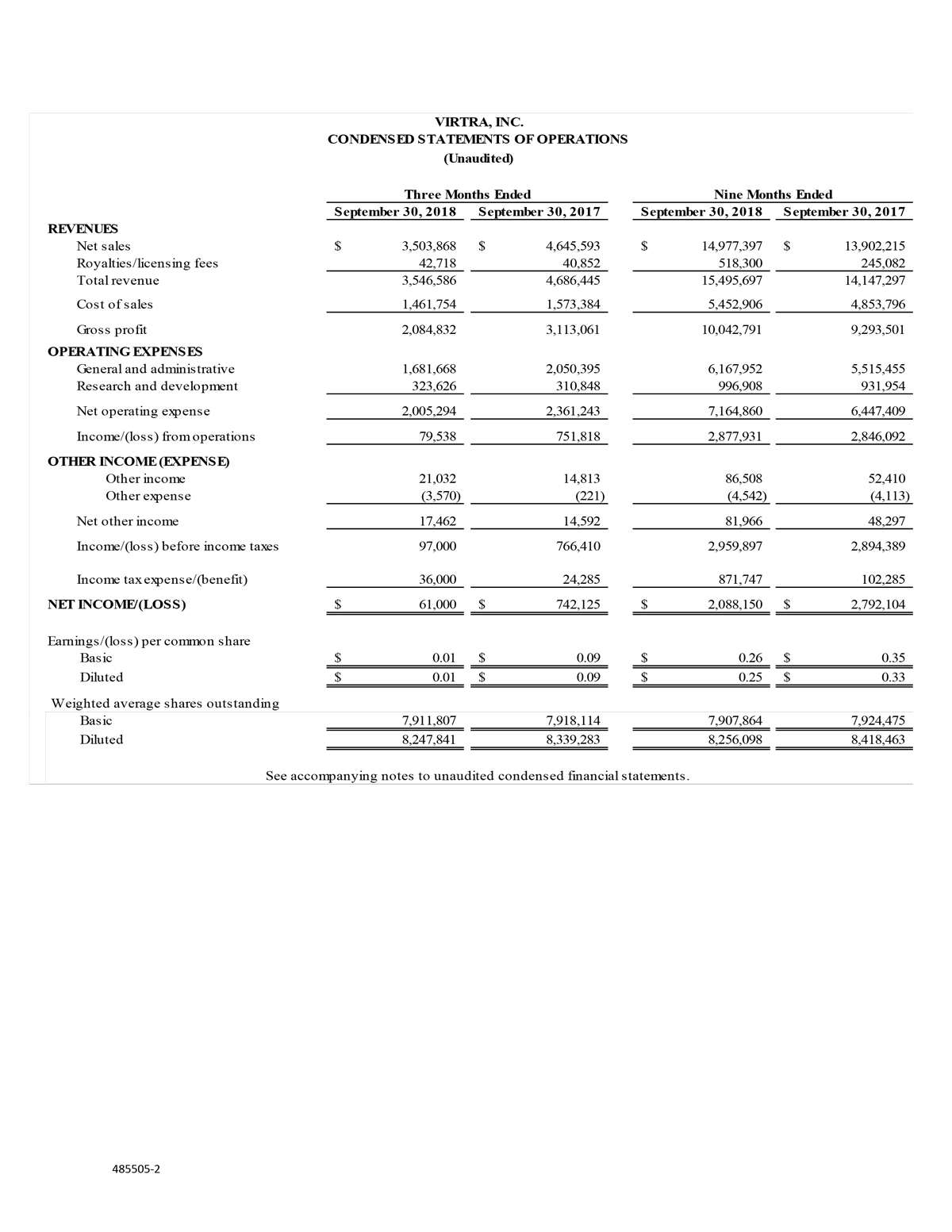

VIRTRA, INC.

CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

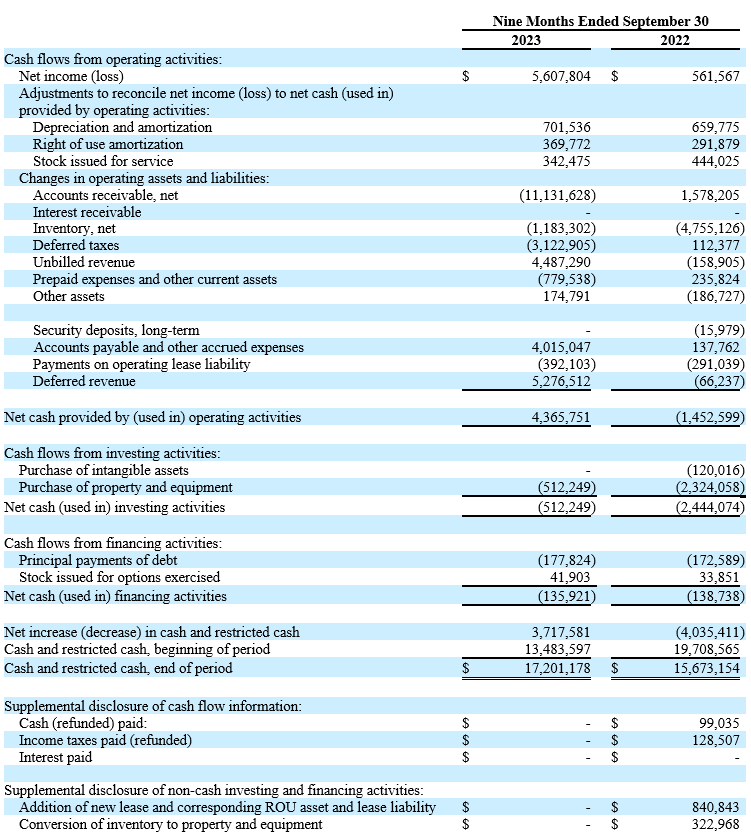

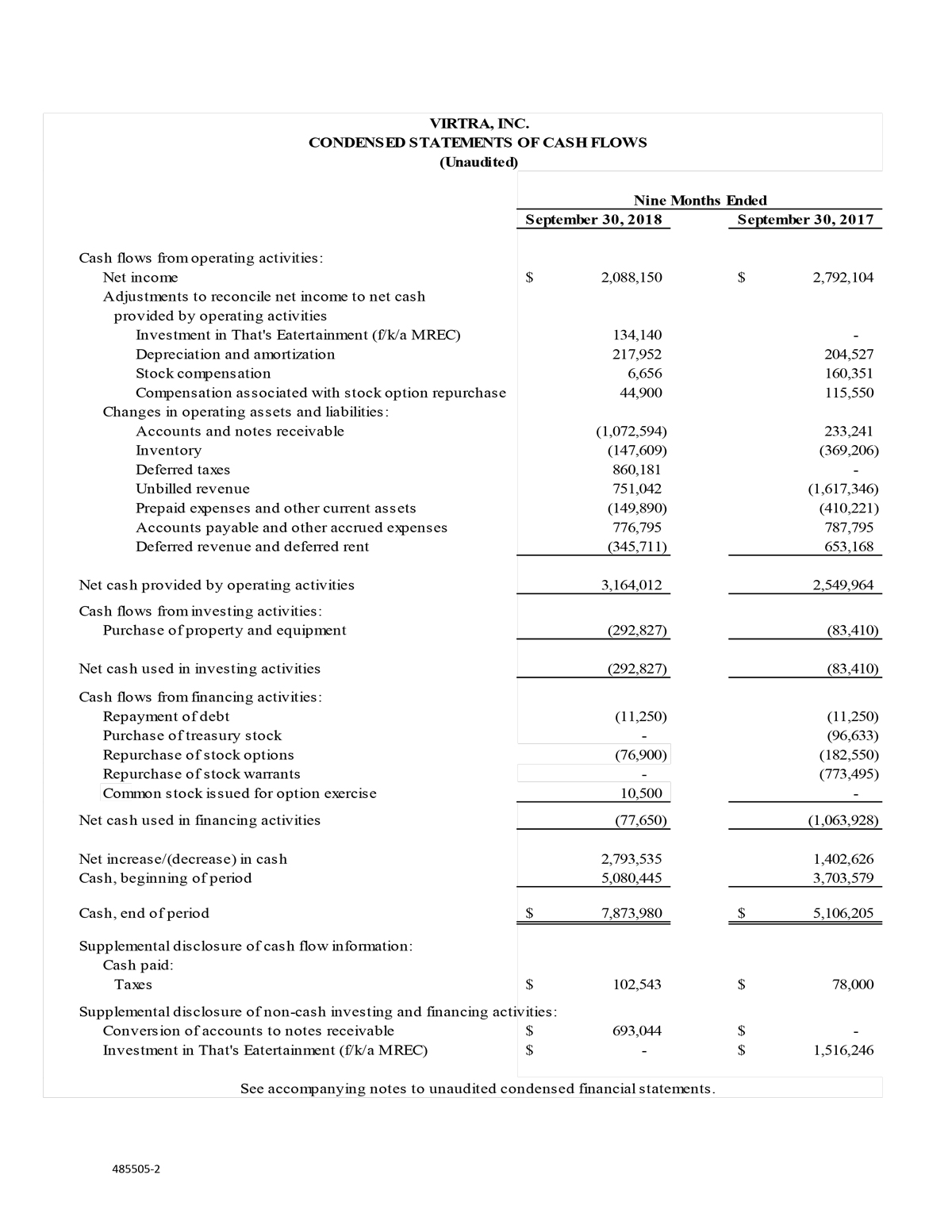

VIRTRA, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

CHANDLER, Ariz. — November 1, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra” or the “Company”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, will hold a conference call on Tuesday, November 14, 2023 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss its financial results for the third quarter ended September 30, 2023. Financial results will be issued in a press release prior to the call.

VirTra management will host the presentation, followed by a question-and-answer period.

Date: Tuesday, November 14, 2023

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: 1-877-407-9208

International dial-in: 1-201-493-6784

Conference ID: 13742019

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through November 28, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13742019

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

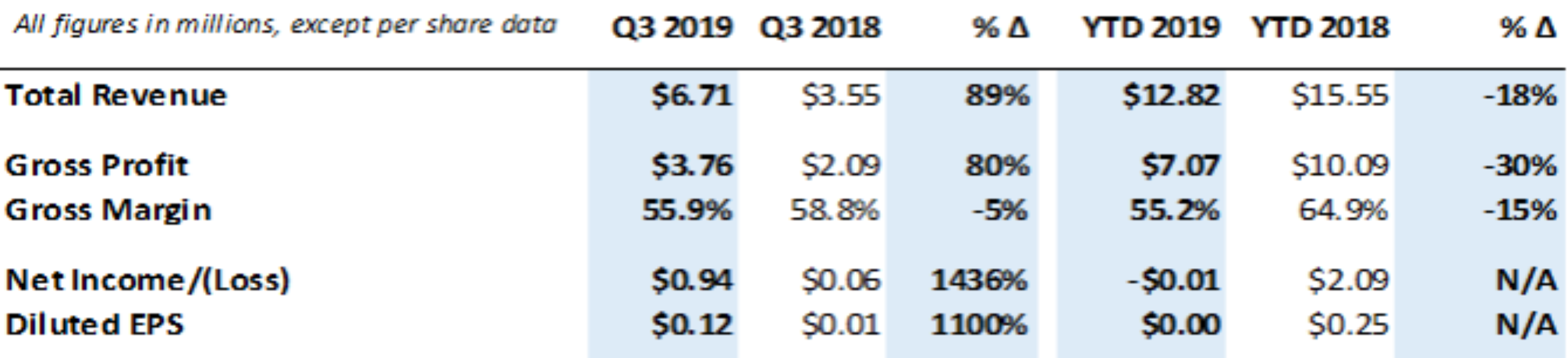

TEMPE, Ariz. — November 12, 2019 —VirTra, Inc. (NASDAQ: VTSI) (“VirTra”), a global provider of training simulators for the law enforcement, military, educational and commercial markets, reported results for the third quarter and nine months ended September 30, 2019. The unaudited financial statements and notes thereto are available on VirTra’s website and here.

Third Quarter 2019 and Recent Highlights:

- Awarded $5.0 million IDIQ contract in addition to a $1.7 million expansion order from the Department of Homeland Security for Customs and Border Protection

- Received $2.3 million follow-on order from the Arizona Department of Public Safety

- Received $1.1 million expansion order from the U.S. Secret Service

- Launched the world’s first ultra-high-definition 4k training simulators and received initial order from the Federal Law Enforcement Training Centers (FLETC)

- Awarded patents for TASER® training and simulating firearms and malfunctions, which strengthens VirTra’s competitive moat and enhances the realism of simulation training

- Launched driving simulators for U.S. law enforcement and debuted additional new products at IACP 2019

- Partnered with Force Science Institute to develop additional advanced simulation training for law enforcement officers

- Engaged JL O’Connell & Associates, a highly regarded business development consultancy, to expand VirTra’s sales and marketing efforts in the military market

Third Quarter and Nine Month 2019 Financial Highlights:

Management Commentary

“In the third quarter of 2019, we saw much of our work from prior quarters come to fruition as we achieved the second most successful quarter in our company’s history in terms of recognized revenue and our best third quarter to date,” said Bob Ferris, Chairman and CEO of VirTra. “Financially, the quarter was highlighted by $6.7 million revenue, $937,000 in net income, $1.4 million in adjusted EBITDA, and a record backlog of $11.3 million. When combined with the results of the prior few quarters, Q3 highlights the importance of continuing to evaluate our business on an annual rather than a quarterly basis.

“The results of the third quarter were in large part driven by the operational progress we’ve made throughout the year, including launching upgraded recoil kits, introducing driving simulators, developing new certified curriculum, and bolstering our competitive moat with new patents, all of which have led to increasing VirTra’s status in the market as the most trusted name for effective simulation training. Given our ability to add to our pipeline while fulfilling orders, we are cautiously optimistic that we will be able to continue this momentum for the rest of the year and enter 2020 from a position of strength.”

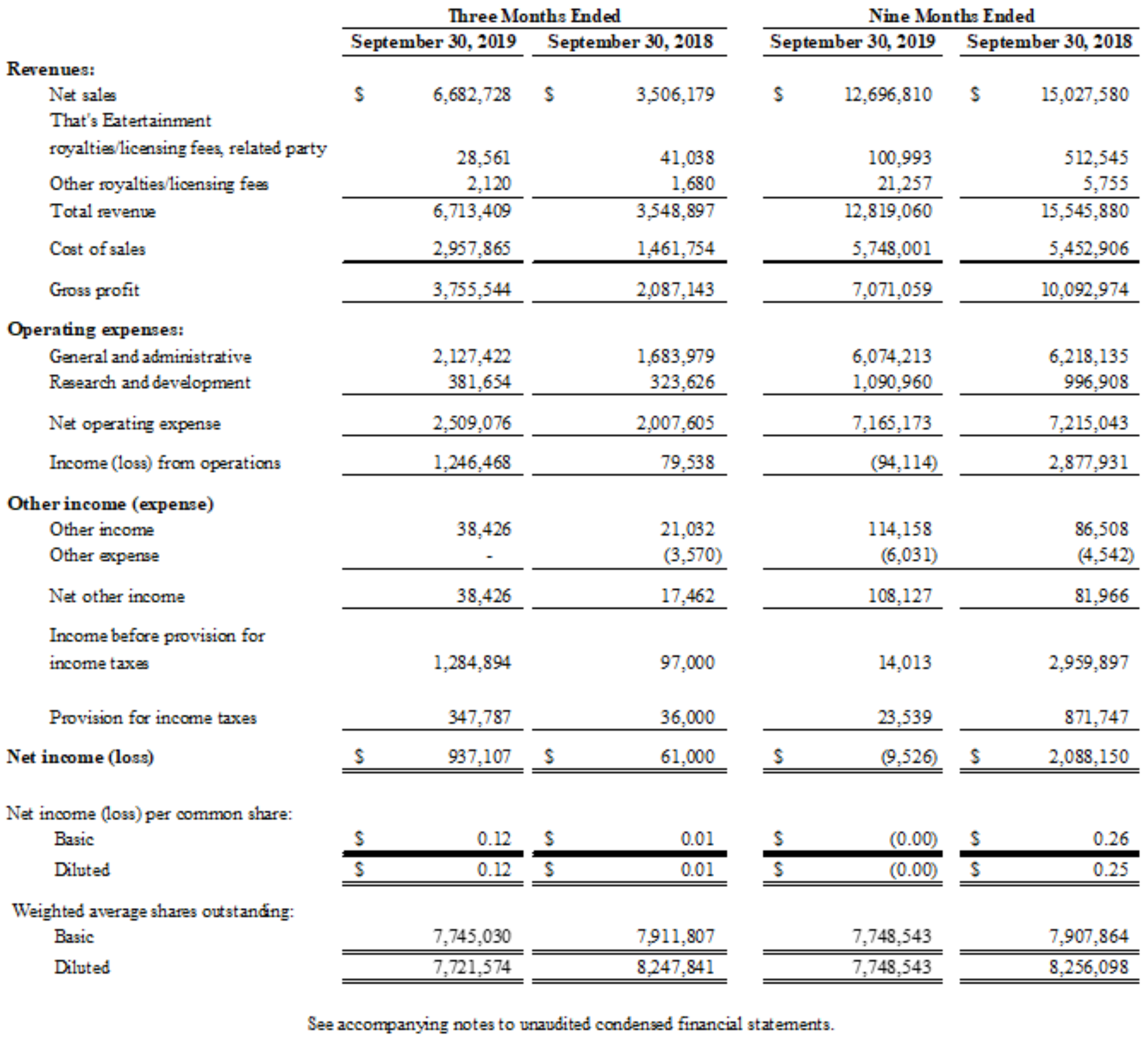

Third Quarter 2019 Financial Results

Total revenue increased by 89% to $6.7 million from $3.5 million in the third quarter of 2018. The increase in total revenue was due to an increase in the number of simulators and accessories completed and delivered and revenue recognized compared to the same period in 2018.

Gross profit increased 80% to $3.8 million (55.9% of total revenue) from $2.1 million (58.8% of total revenue) in the third quarter of 2018. The increase in gross profit was primarily due to differences in the product mix and the varying quantity of systems, accessories, and services sold.

Net operating expense was $2.5 million compared to $2.0 million in the third quarter of 2018. The increase in net operating expense was due to an increase in selling, general, and administrative (SG&A) expense, costs for labor, benefits, professional services, sales and marketing expense, and research and development expense.

Income from operations was $1.2 million compared to income from operations of $80,000 in the third quarter of 2018.

Net income totaled $937,000, or $0.12 per diluted share, compared to net income of $61,000, or $0.01 per diluted share, in the third quarter of 2018.

Adjusted EBITDA, a non-GAAP financial measure, was $1.4 million compared to adjusted EBITDA of $174,000 in the same period a year-ago.

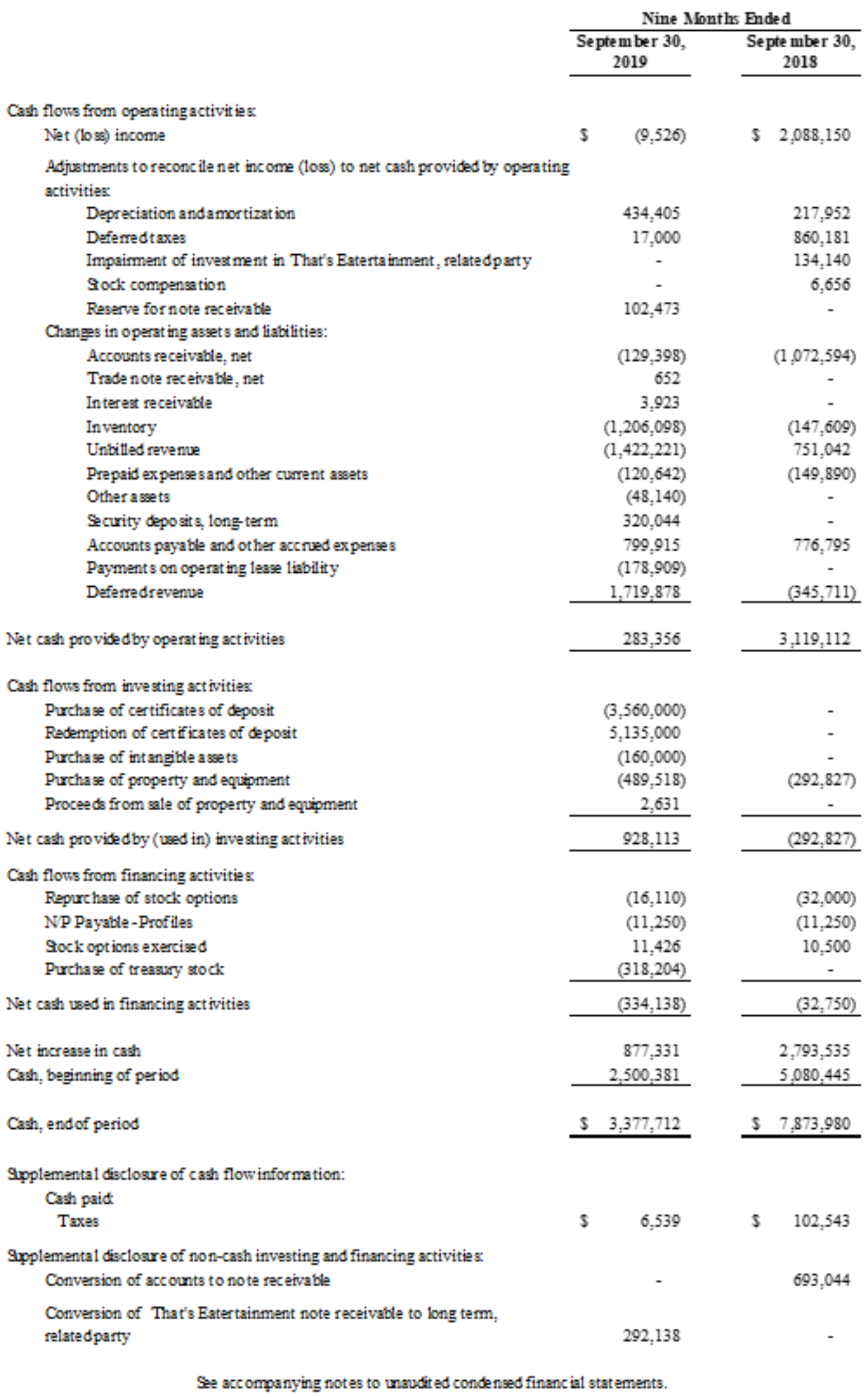

As of September 30, 2019, cash and cash equivalents and certificates of deposit totaled $5.3 million compared to $3.3 million at the end of the prior quarter. At the end of the quarter, the company had working capital of $6.4 million and no debt.

Financial Results for the Nine Months Ended September 30, 2019

Total revenue was $12.8 million compared to $15.5 million in the first nine months of 2018. The decrease in total revenue was due primarily to the delivery of a large, one-time $4.4 million simulator and accessories order in 2018 that helped equip the police force of Pakistan.

Gross profit was $7.1 million (55.2% of total revenue) compared to $10.1 million (64.9% of total revenue) in the first nine months of 2018. The decrease in gross profit was primarily due to differences in the product mix and the varying quantity of systems, accessories, and services sold.

Net operating expense was $7.2 million, which is consistent with the first nine months of 2018.

Loss from operations was $94,000 compared to income from operations of $2.9 million in the first nine months of 2018.

Net loss totaled $10,000, or $(0.00) per diluted share, compared to net income of $2.1 million, or $0.25 per diluted share, in the comparable period a year ago.

Adjusted EBITDA was $339,000 compared to adjusted EBITDA of $3.3 million in the first nine months of 2018.

Deferred revenue totaled $4.6 million as of September 30, 2019, compared to $2.7 million as of September 30, 2018. The current portion of deferred revenue was $3.0 million as of September 30, 2019, compared to $1.9 million as of September 30, 2018. The increase in deferred revenue was primarily due to customer deposits received on new orders, new service agreements, and new STEP agreements received.

Conference Call

VirTra management will hold a conference call today (November 12, 2019) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s Chairman and CEO, Bob Ferris, and CFO, Judy Henry, will host the call, followed by a question and answer period.

U.S. dial-in number: 844-369-8770

International number: 862-298-0840

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact VirTra’s IR team at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of VirTra’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through November 26, 2019.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 56432

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net loss to Adjusted EBITDA is provided in the following table:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the SEC. You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the Securities and Exchange Commission before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover or Charlie Schumacher

949-574-3860

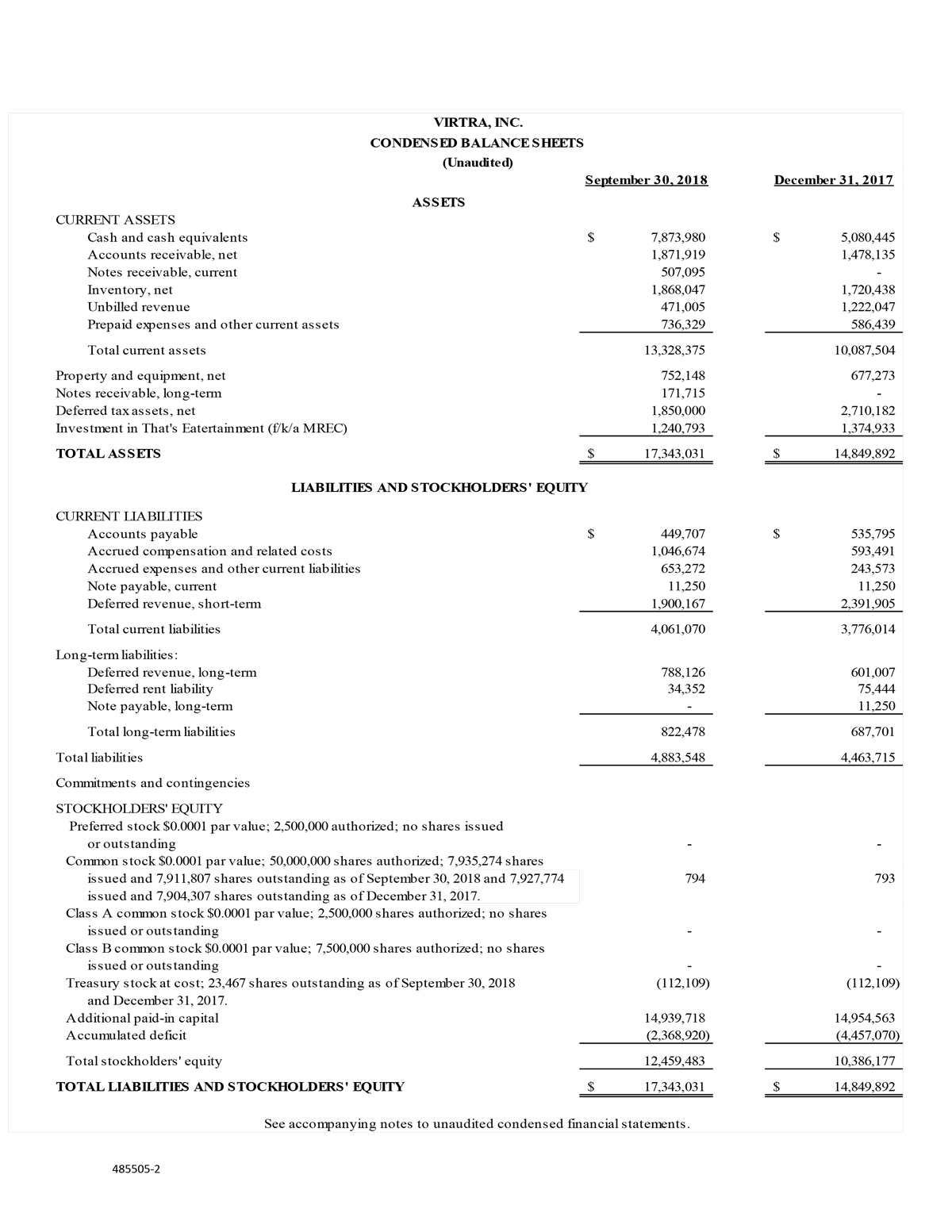

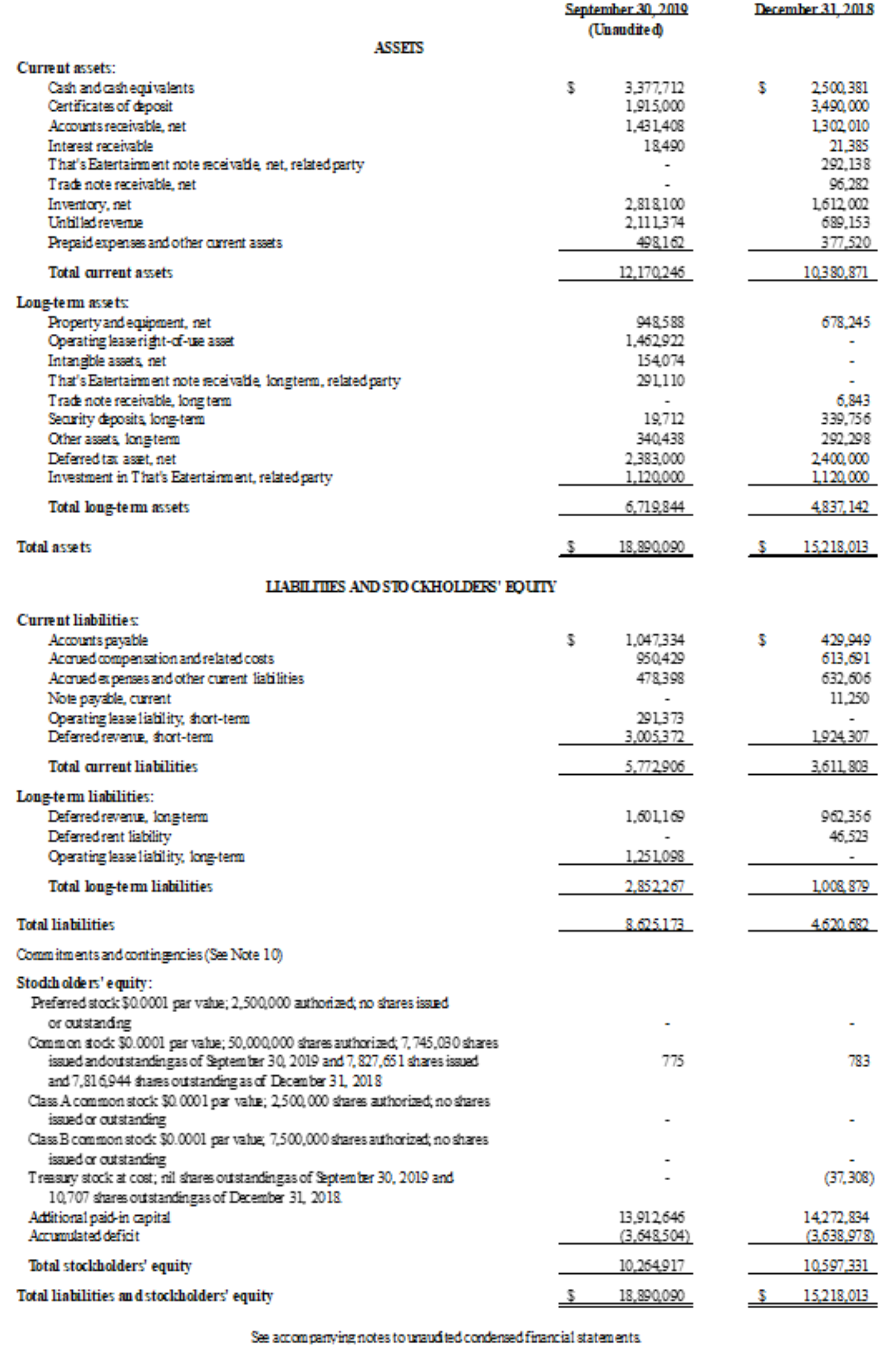

VIRTRA, INC. CONDENSED BALANCE SHEETS

VIRTRA, INC. CONDENSED STATEMENTS OF OPERATIONS (Unaudited)

VIRTRA, INC. CONDENSED STATEMENTS OF CASH FLOWS

TEMPE, Ariz. — October 30, 2019 — VirTra, Inc. (NASDAQ: VTSI), a global provider of training simulators for the law enforcement, military, educational and commercial markets, will hold a conference call on Tuesday, November 12, 2019 at 4:30 p.m. Eastern time to discuss its financial results for the third quarter ended September 30, 2019. Financial results will be issued in a press release prior to the call.

VirTra management will host the conference call, followed by a question and answer period.

- Date: Tuesday, November 12, 2019

- Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

- U.S. dial-in number: 844-369-8770

- International number: 862-298-0840

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through November 26, 2019.

- Toll-free replay number: 877-481-4010

- International replay number: 919-882-2331

- Replay ID: 56432

About VirTra

VirTra (NASDAQ: VTSI) is a global

provider of judgmental use of force training simulators, firearms

training simulators and driving simulators for the law enforcement,

military, educational and commercial markets. The company’s patented

technologies, software, and scenarios provide intense training for

de-escalation, judgmental use-of-force, marksmanship and related

training that mimics real-world situations. VirTra’s mission is to save

and improve lives worldwide through practical and highly-effective

virtual reality and simulator technology. Learn more about the company

at www.VirTra.com.

Investor Relations Contact:

Matt Glover or Charlie Schumacher

[email protected]

949-574-3860

TEMPE, Ariz. — Tuesday, November 13, 2018 — VirTra, Inc. (NASDAQ: VTSI) (“VirTra”), a global provider of training simulators for the law enforcement, military, educational and commercial markets, reported results for the third quarter ended September 30, 2018. The financial statements are available on VirTra’s website and here.

Third Quarter 2018 Operational and Financial Highlights:

- Total revenue was $3.5 million

- At September 30, 2018, backlog totaled approximately $6.8 million

- Launched nationally accredited coursework, VirTra-Virtual Interactive Coursework Training Academy (V-VICTA), to provide law enforcement agencies the ability to effectively teach, train, test and sustain departmental training requirements

- Rang Nasdaq Opening Bell to celebrate March listing on the exchange

Third Quarter and Nine Month 2018 Financial Highlights:

| All figures in millions, except per share data |

Q3 2018 |

Q3 2017 | % Δ | YTD 2018 | YTD 2017 |

% Δ |

| Total Revenue |

$3.5 |

$4.7 | -24% | $15.5 | $14.1 |

10% |

|

Gross Profit |

$2.1 | $3.1 | -33% | $10.0 | $9.3 |

8% |

| Gross Margin |

58.8% |

66.4% | -12% | 64.8% | 65.7% |

-1% |

| Net Income |

$0.1 |

$0.7 | -92% | $2.1 | $2.8 |

-25% |

| Diluted Earnings per Share (EPS) |

$0.01 |

$0.09 | -89% | $0.25 | $0.33 |

-24% |

|

Adjusted EBITDA |

$0.2 | $0.9 | -80% | $3.3 | $3.3 |

2% |

Management Commentary

“During the third quarter, we continued to profitably grow our business and are on pace for a record 2018,” said Bob Ferris, Chairman and Chief Executive Officer of VirTra. “While our topline recognized revenue for the quarter was down, these types of quarterly fluctuations are part of our current business. Still, we achieved another quarter of both net income and adjusted EBITDA profitability.

“Nevertheless, we believe it is critical to bear in mind that our long sales cycle, as well as the timing of large contracts, necessitate evaluation of our results over a longer term. As such, we think attention to our financial performance for the first nine months of the year is appropriate, highlighted by 10% revenue growth to a record $15.5 million, $2.1 million in net income and $3.3 million in adjusted EBITDA. From an operational standpoint, we increased our backlog by $1.6 million to a total of $6.8 million. This improvement demonstrates the consistent execution by our expanded sales organization and the growing demand from law enforcement professionals around the world for our products.

“We are optimistic that in addition to this growing demand, the momentum we established in the first half of the year, the operational progress we’ve made this quarter by launching new products like the V-VICTA training courses and the additions to our backlog will result in another solid year for VirTra and continued growth and profitability over the long-run.”

Third Quarter 2018 Financial Results

Total revenue was $3.5 million compared to $4.7 million in the third quarter of 2017. The decrease in total revenue was due to lower sales of simulators, accessories, and scenarios.

Gross profit was $2.1 million (58.8% of total revenue) compared to $3.1 million (66.4% of total revenue) in the third quarter of 2017. The decrease in gross profit was primarily due to differences in the type and quantity of systems and accessories sold.

Net operating expense was $2.0 million compared to $2.4 million in the third quarter of 2017. The decrease in net operating expense was due to reduced accounting, legal, and consultant expenses quarter over quarter.

Income from operations was $80,000 compared to $752,000 in the third quarter of 2017.

Net income totaled $61,000, or $0.01 per diluted share, compared to $742,000, or $0.09 per diluted share, in the third quarter of 2017.

Adjusted EBITDA, a non-GAAP financial measure, totaled $174,000 compared to $874,000 in the third quarter of 2017.

As of September 30, 2018, cash and cash equivalents totaled $7.9 million, an improvement of $3.0 million from $4.9 million at the end of the prior quarter.

Financial Results for the Nine Months Ended September 30, 2018

Total revenue was $15.5 million compared to $14.1 million in the first nine months of 2017. The increase in total revenue was due to additional sales of simulators, accessories, licensing fees, warranties and other services.

Gross profit was $10.0 million (64.8% of total revenue) compared to $9.3 million (65.7% of total revenue) in the first nine months of 2017. The increase in gross profit was primarily due to differences in the type and quantity of systems and accessories sold.

Net operating expense was $7.2 million compared to $6.4 million in the first nine months of 2017. The increase in net operating expense was due to increases in general and administrative expenses.

Additionally, the nine months ended September 30, 2018 included an impairment loss on investment in That’s Eatertainment Corp., f/k/a Modern Round, LLC, a wholly owned subsidiary of Modern Round Entertainment Corp., a related party, recorded as operating expense. The year-over-year increase in professional services included non-recurring legal and public company expense directly related to the Company’s qualification and Securities and Exchange Commission registration and Nasdaq listing in March 2018.

Income from operations was $2.9 million compared to $2.8 million in the first nine months of 2017.

Net income totaled $2.1 million, or $0.25 per diluted share, compared to $2.8 million, or $0.33 per diluted share, in the comparable period a year ago. The decrease in net income is primarily due to a $769,000 increase in income tax expense.

Adjusted EBITDA totaled $3.3 million compared to $3.3 million in the first nine months of 2017.

Conference Call

VirTra management will hold a conference call today (November 13, 2018) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results.

VirTra’s Chairman and CEO, Bob Ferris, and CFO, Judy Henry, will host the call, followed by a question and answer period.

U.S. dial-in number: 877-407-8031

International number: 201-689-8031

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Liolios at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of VirTra’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through November 27, 2018.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 38838

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following table:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the SEC. You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the Securities and Exchange Commission before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Media Contact:

VirTra

[email protected]

480-968-1488

Investor Relations Contact:

Matt Glover or Tom Colton

[email protected]

949-574-3860

Download Full Financial Report Here.

FINANCIALS FOLLOWING

TEMPE, Ariz. — October 24, 2018 — VirTra, Inc. (Nasdaq: VTSI), a global provider of training simulators for the law enforcement, military, educational and commercial markets, will hold a conference call on Tuesday, November 13, 2018 at 4:30 p.m. Eastern time to discuss its financial results for the third quarter ended September 30, 2018. Financial results will be issued in a press release prior to the call.

VirTra management will host the conference call, followed by a question and answer period.

Date: Tuesday, November 13, 2018

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in number: 877-407-8031

International number: 201-689-8031

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Liolios at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through November 27, 2018.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 38838

About VirTra

VirTra (Nasdaq: VTSI) is a global provider of training simulators for the law enforcement, military, educational and commercial markets. The Company’s patented technologies, software and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real world situations. VirTra’s mission is to save and improve lives worldwide through realistic and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

###

Public Relations Contact:

VirTra

[email protected]

480-968-1488

Investor Relations Contact:

Matt Glover / Tom Colton

[email protected]

(949) 5743860

Tempe, Ariz. (November 15, 2016) – VirTra, Inc. (OTC Pink: VTSID), a leading provider of judgmental use of force simulators and firearms training simulators, today announced its financial results for the third quarter ended September 30, 2016. The financial statements are available on VirTra’s website and here.

Third Quarter 2016 Financial Highlights:

- Net sales of $3.0 million

- Gross profit of $1.6 million

- Gross profit margin of 55%

- Net loss of $0.1 million

Other Highlights:

- Approved and implemented a corporate redomestication from Texas to Nevada

- Implemented a 1 for 10 reverse stock split, effective October 20, 2016

- Appointed Mitchell A. Saltz to the Board of Directors, effective November 1, 2016, increasing the number of independent directors to two and the total number of directors to four

- Announced a $1.0 million share repurchase authorization

- Submitted an application to uplist the Company’s common stock to the OTCQX®S. market

- On October 20, 2016, the Company exercised its warrant option and purchased 1.7 million shares of stock of Modern Round Entertainment Corporation for approximately $335,000, resulting in the Company’s aggregate holdings of Modern Round to be 3.4 million shares, or 8.9% of its current issued and outstanding common shares

Bob Ferris, Chairman and Chief Executive Officer of VirTra, commented: “We generated $3.0 million in net sales for the third quarter and $12.6 million for the first nine months of 2016, our highest level of revenue through the first nine months of the year in the Company’s history. In addition, we have been very busy with respect to our changes in corporate structure and governance, with the implementation of a number of initiatives that we believe will increase our visibility within the investment community and potentially lead to more trading liquidity and greater institutional ownership of our stock.”

“While we generated another strong quarter of net sales, our profitability was impacted by higher expenses, primarily due to increased professional fees in preparation of our corporate changes, as well as our increased investment in infrastructure, including sales, marketing and product development, which we view as necessary to support our plans for long term growth,” Ferris concluded.

Third Quarter Results for the Three Months Ended September 30, 2016

Net sales were $3.0 million in the quarter, compared to $3.9 million for the third quarter of 2015.

Gross profit was $1.6 million for the quarter, compared to $2.5 million for the third quarter of 2015.

Gross margin for the quarter was 55%, compared to 62% for the third quarter of 2015. The year-over-year decline in gross margin was primarily due to the lower revenues and a shift in the mix of products and services that we delivered between the two periods.

Selling, general and administrative expenses were $1.8 million for the quarter, compared to $1.5 million in the third quarter of 2015. The increase was primarily due to higher professional fees and expenses, as well as increased spending in sales, marketing, research and development.

Operating loss for the quarter was $0.1 million, compared to operating income of $1.0 million in the third quarter of 2015. The decrease was primarily due to the higher selling, general and administrative expenses in the quarter.

Net loss was $0.1 million for the quarter, or break-even per basic share, compared to $1.0 million, or $0.01 per basic share, for the third quarter of 2015. On a pro-forma basis, taking into account the 1 for 10 reverse stock split that occurred on October 20, 2016, net loss per basic share was break-even in the third quarter of 2016, compared to net income per basic share of $0.06 in the third quarter of 2015.

Stockholders’ equity increased to $6.8 million at September 30, 2016, compared to $4.2 million at September 30, 2015.

The Company has approximately $34,000 of outstanding debt as of September 30, 2016.

Cash and cash equivalents were $4.9 million at September 30, 2016, compared to $2.5 million at September 30, 2015.

Matt Burlend, Chief Operating Officer for VirTra, said, “Our record performance for the first nine months of 2016 is the result of our increased investment in our sales, marketing, research and development, combined with our excellent reputation for customer service. We have entered the fourth quarter with solid momentum and look forward to 2016 being another strong year for VirTra.”

About VirTra Systems, Inc.

VirTra is a global leading provider of the world’s most realistic and effective judgmental use of force simulators. VirTra is the higher standard in firearms training simulators, offering a variety of simulator platforms, powerful gas-powered recoil kits and the patented Threat-Fire™ simulated hostile return fire system. VirTra’s products provide the very best simulation training available for personnel that are entrusted with lethal force and critical missions. The Company’s common stock is not registered under the Securities Exchange Act of 1934 and the Company does not currently file periodic or other reports with the Securities and Exchange Commission.

www.VirTra.com

Forward-looking Statements

This news release includes certain information that may constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “proposed,” “planned,” “potential” and similar expressions, or are those, which, by their nature, refer to future events. All statements, other than statements of historical fact, included herein, including statements about VirTra’s beliefs and expectations, are forward-looking statements. Forward-looking information is necessarily based upon a number of assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Although VirTra believes that such statements are reasonable, it can give no assurance that such forward-looking information will prove to be accurate. VirTra cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors. Accordingly, due to the risks, uncertainties and assumptions inherent in forward-looking information, readers and prospective investors in the Company’s securities should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof, is based upon the opinions and estimates of management and information available to management as at the date hereof and is subject to change. The Company assumes no obligation to revise or update forward-looking information to reflect new circumstances, whether as a result of new information, future events or otherwise, except as required by law.

Investor Relations Counsel

Larry Clark

Financial Profiles, Inc.

(310) 622-8223

[email protected]

View/Print PDF Version of Press Release

View/Print PDF Version of 2016 Q3 Financial Report

Tempe, Arizona (May 15, 2013) — VirTra Systems (OTC Pink: VTSI), a leading provider of firearms training simulation systems to military, law enforcement agencies and other organizations, today reported unaudited financial results for its first quarter of 2013, ended March 31. The unaudited financial statements are available on VirTra’s website and here.

The Company posted first quarter revenue of $2.49 million along with a net income of $0.53 million. Last year’s first quarter revenue was $2.61 million and net income for that period totaled $0.25 million. Revenue is down slightly for the first quarter of this year by about 5 percent, due in part to timing of deliveries, while net income increased 115 percent.

VirTra’s cost of goods sold for the quarter was $0.75 million representing a 70 percent gross profit margin compared to 68 percent for the same quarter last year. VirTra’s profit margin does fluctuate from quarter-to-quarter and is influenced by a number of factors such as: revenue recognition, volume, vendor pricing, improved production methods and composition of customer orders. (more…)

Tempe, Arizona (November 14, 2012) — VirTra Systems (OTC Pink: VTSI), a leading provider of firearms training simulation systems to military, law enforcement agencies and other organizations, today reported unaudited financial results for its third quarter of 2012, ended September 30. The unaudited financial statements are available on VirTra’s website and here.

During third quarter 2012 the company reported revenue of $1.42 million along with a net loss of $0.63 million. There were several factors that contributed to less revenue being recorded for the period and in turn the net loss. VirTra’s revenue recognition methods require orders to be fully delivered prior to revenue being recognized and during the third quarter there were a number of product orders that were pre-delivery. Another factor attributable to lower revenue during the quarter was seasonality in sales. Through three quarters of the year VirTra has realized $6.96 million of revenue and $0.22 million of net income, which exceeds 2011 results on a pro rata basis. (more…)