Record Quarterly and First Half Revenue of $10 Million and $20 Million, Up 29% and 38% Year-Over-Year, Respectively

Quarterly Net Income Increases by $239,000 to $1.0 Million

CHANDLER, Ariz. — August 14, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the second quarter ended June 30, 2023. The financial statements are available on VirTra’s website and here.

Second Quarter 2023 Financial Highlights:

- Total revenue increased 29% to a record $10.3 million

- Gross profit increased 25% to $5.9 million, or 57% of total revenue

- Net income increased by $0.2 million to $1.0 million

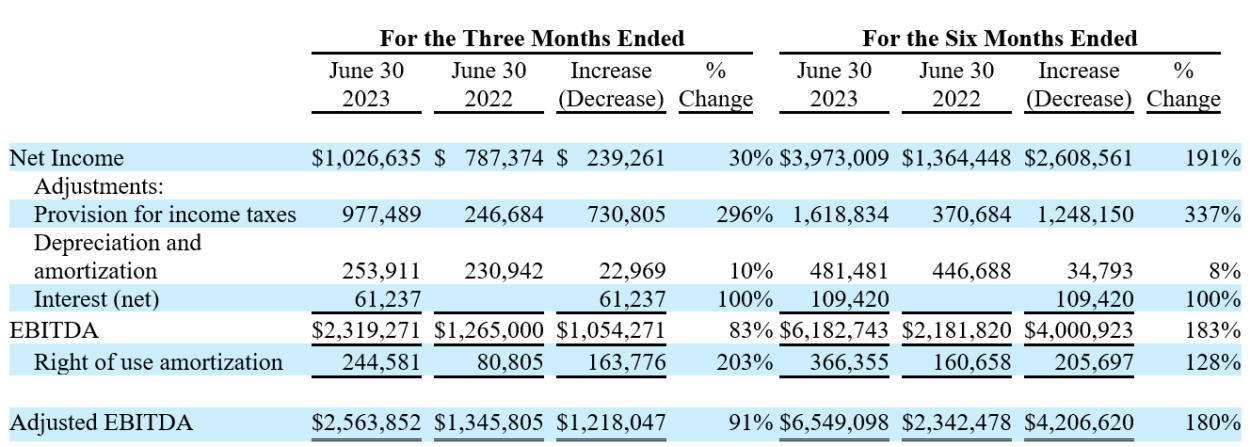

- Adjusted EBITDA increased to $2.6 million

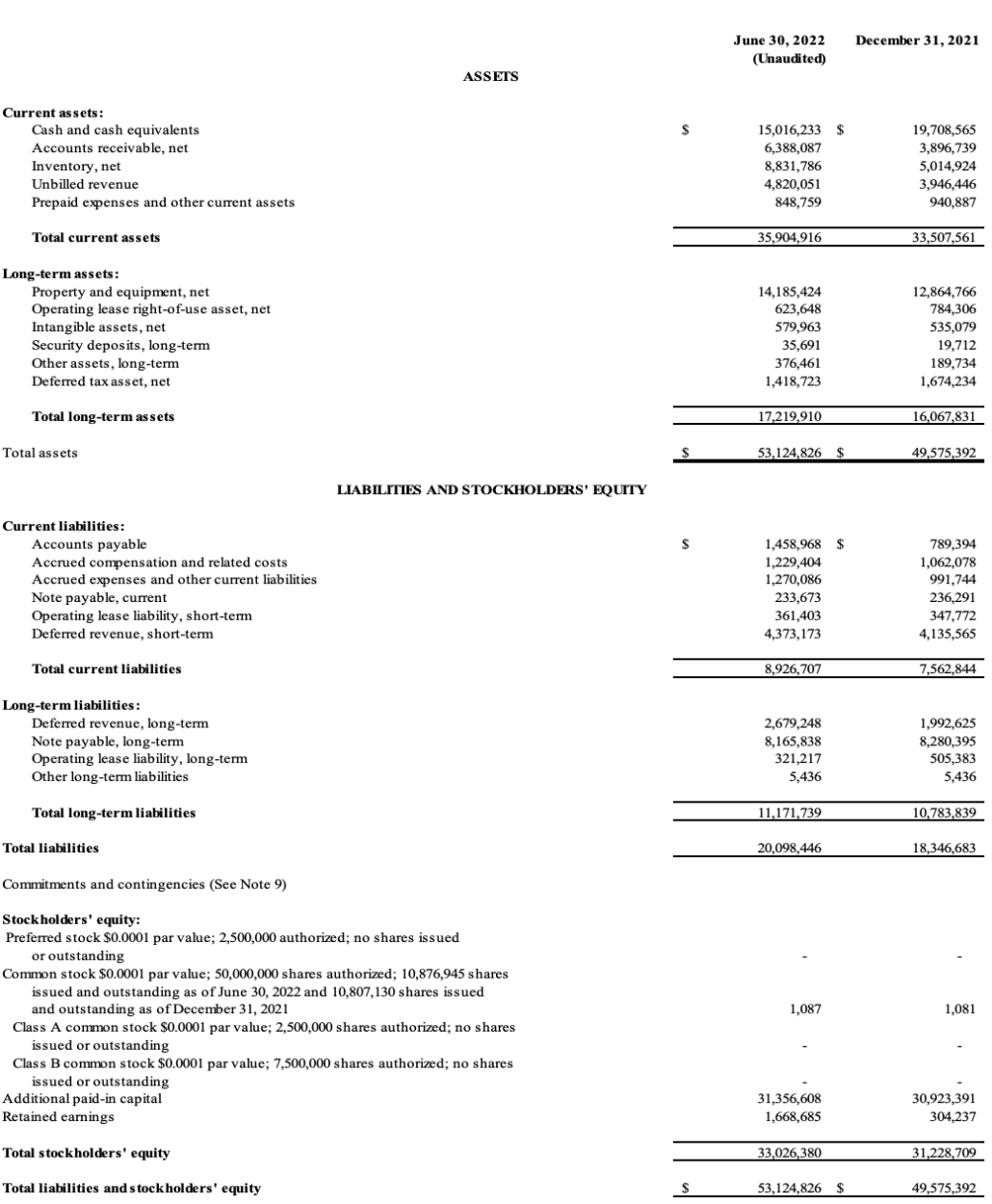

- Cash and cash equivalents of $13.3 million at June 30, 2023

Six Month 2023 Financial Highlights:

- Total revenue increased 38% to $20.4 million

- Gross profit increased 53% to $12.9 million, or 63% of total revenue

- Net income increased by $2.6 million to $4.0 million

- Adjusted EBITDA increased to $6.5 million

Second Quarter and Six Month 2023 Financial Highlights:

Management Commentary

“Led by record-breaking revenue in the double-digit millions during the first two quarters of 2023, we have achieved the best bottom-line results in our 30-year history,” said Bob Ferris, chairman and co-CEO of VirTra. “This exceptional financial performance is a testament to the effectiveness of our internal process improvements and streamlined operations. To further solidify our market leadership and expand revenue streams, we continue to actively pursue additional product and content development initiatives to enhance VirTra’s already powerful training capabilities.”

John Givens, co-CEO of VirTra, added: “Our topline results reflect the transformation we have made in fulfillment efficiency, which serves as a key indicator of our scaling abilities and our long-term operational capabilities. We are now applying that same focus and tenacity by taking proactive measures to increase our bookings and maximize our market potential, both domestically and internationally. Our sales enhancement initiatives are already underway and coupled with our unwavering commitment to product quality and a customer-centric approach, we are advancing along our strategic roadmap while further optimizing our business operations to even greater profitability and efficiency in the years ahead.”

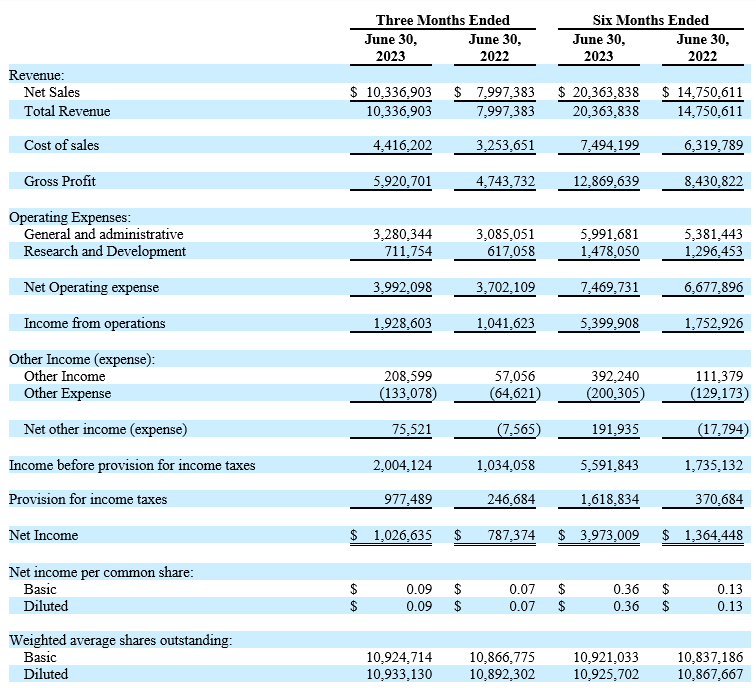

Second Quarter 2023 Financial Results

Total revenue increased 29% to $10.3 million from $8.0 million in the second quarter of 2022. The increase in revenue was driven by an improvement in operations which helped to move through backlog and ship orders at a record pace.

Gross profit increased 25% to $5.9 million from $4.7 million in the second quarter of 2022. Gross profit margin was 57%, a decrease compared to 59% in the second quarter of 2022. The decrease in gross margins resulted from one-time inventory adjustments made when we went live with our new ERP system, which had the effect of increasing the cost of sales in Q2 2023.

Net operating expense was $4.0 million, compared to $3.7 million in the second quarter of 2022. The increase in net operating expense was associated with salary and benefits increase and the Orlando office expenses.

Operating income increased by $0.9 million to $1.9 million from $1.0 million in the second quarter of 2022.

Net income was $1.0 million, or $0.09 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $0.8 million, or $0.07 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the second quarter of 2022.

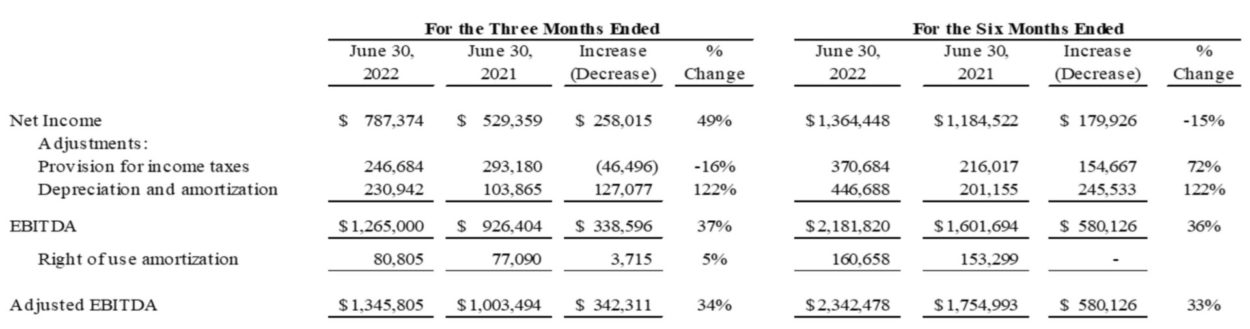

Adjusted EBITDA, a non-GAAP metric, increased to $2.6 million from $1.3 million in the second quarter of 2022.

Six Months Ended June 30, 2023 Financial Results

Total revenue increased 38% to $20.4 million from $14.8 million in the first six months of 2022. The increase in revenue was driven by improvements in operations, which helped the Company to move through the backlog and ship orders at a record pace.

Gross profit increased 53% to $12.9 million from $8.4 million in the first six months of 2022. Gross profit margin was 63%, an increase compared to 57% in the first half of 2022. The increase in gross profit margin was primarily due to the aforementioned increase in revenue while maintaining cost of sales in line with 2022 levels.

Net operating expense was $7.5 million, compared to $6.7 million in the first six months of 2022. The increase in net operating expense was primarily due to an increase in salaries and benefits due to additional staff and the expenses for the new Orlando office, as well as an increase in R&D spend.

Operating income jumped to $5.4 million, a $3.6 increase from $1.8 million in the prior year period.

Net income was $4.0 million, or $0.36 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $1.4 million, or $0.13 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the first half of 2022.

Adjusted EBITDA, a non-GAAP metric, increased to $6.5 million from $2.3 million in the first six months of 2022.

Financial Commentary

“The strong first half results underscore the successful execution of our growth and profitability initiatives,” said CFO Alanna Boudreau. “Achieving a robust gross profit margin of 63%, we exemplify our dedication to maintaining cost of sales while effectively selling a favorable mix of simulators, accessories, and services. Our record net income of $4.0 million and adjusted EBITDA of $6.5 million demonstrate the leverage in our model and our ability to effectively manage expenses. As we progress into the second half of the year with a markedly lower backlog of $16.4 million, we’ve clearly proven our new and enhanced ability to promptly fulfill orders. Simultaneously, it presents a challenge that encourages us to continue operating efficiently as we proactively optimize our sales pipeline. These efforts, combined with the impressive first half performance, set us well on pace to exceed our targets for the year.”

Conference Call

VirTra’s management will hold a conference call today (August 14, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s chairman and co-CEO, Bob Ferris, co-CEO John Givens and Chief Financial Officer Alanna Boudreau, will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13739497

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through August 28, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13739497

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

-Financial Tables to Follow-

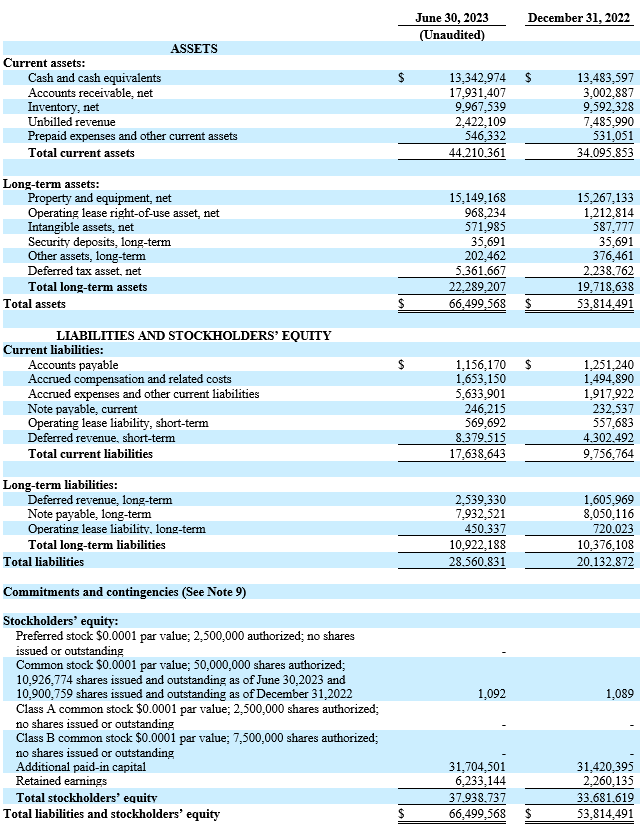

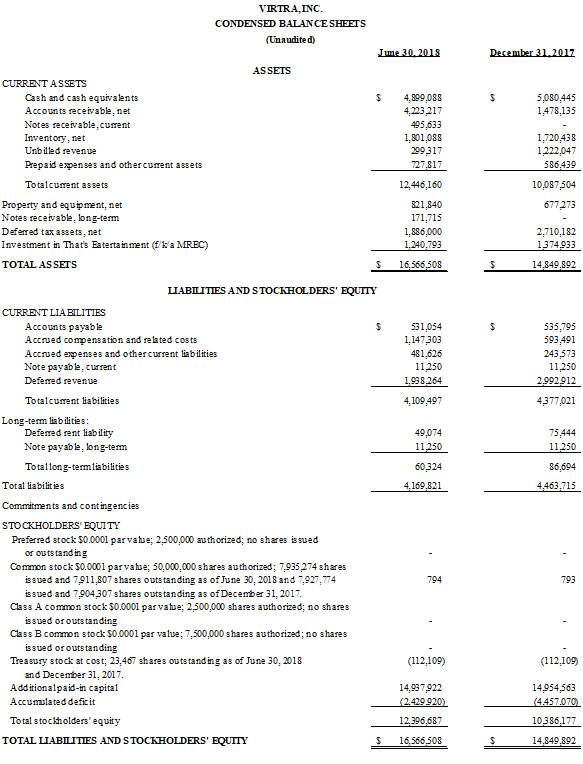

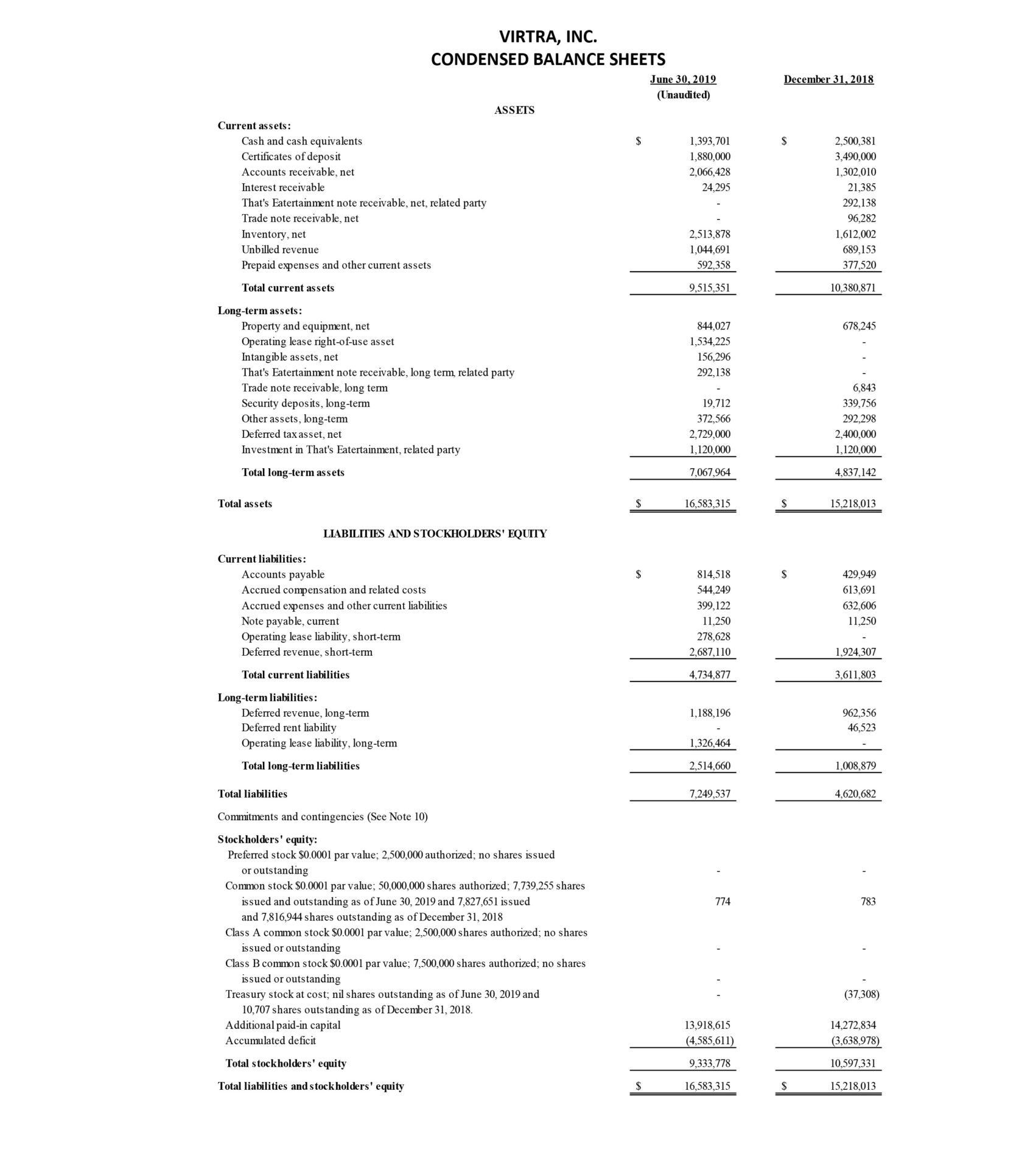

VIRTRA, INC.

CONDENSED BALANCE SHEETS

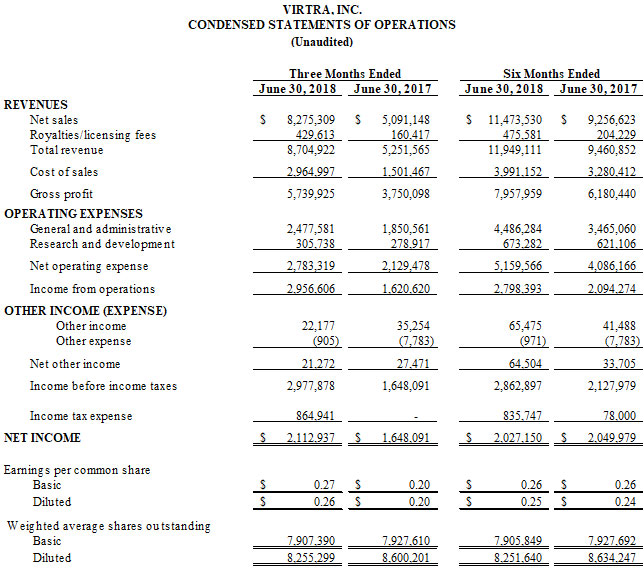

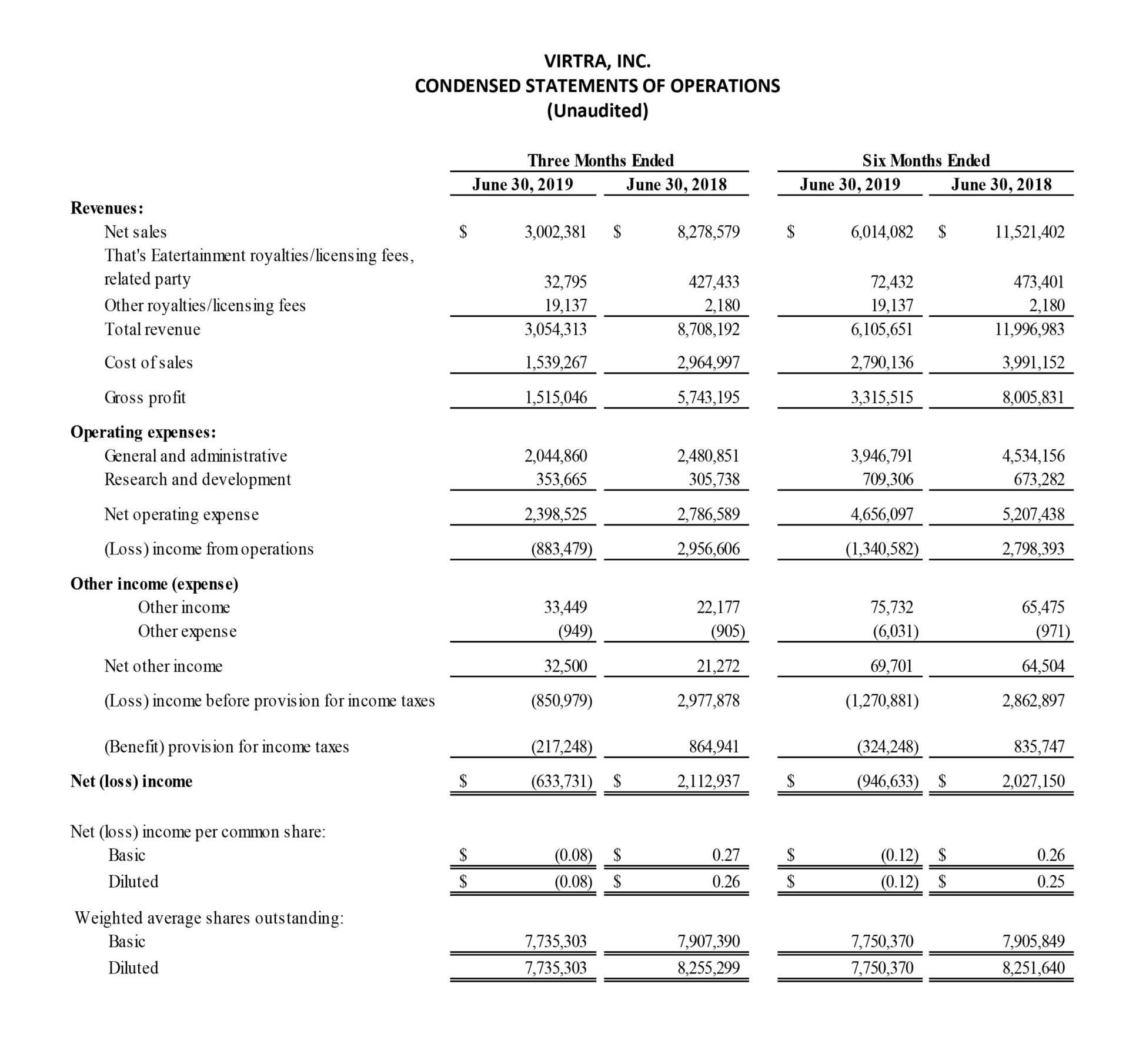

VIRTRA, INC.

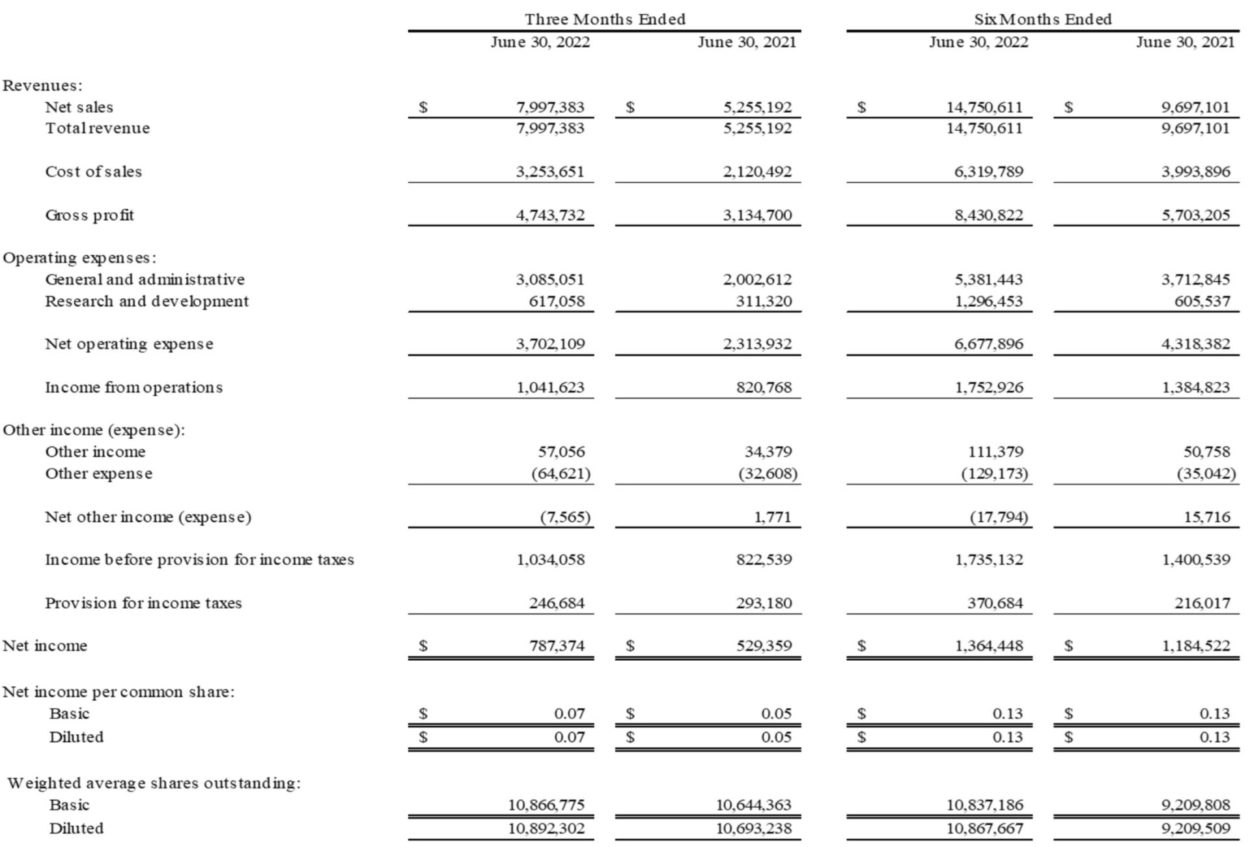

CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

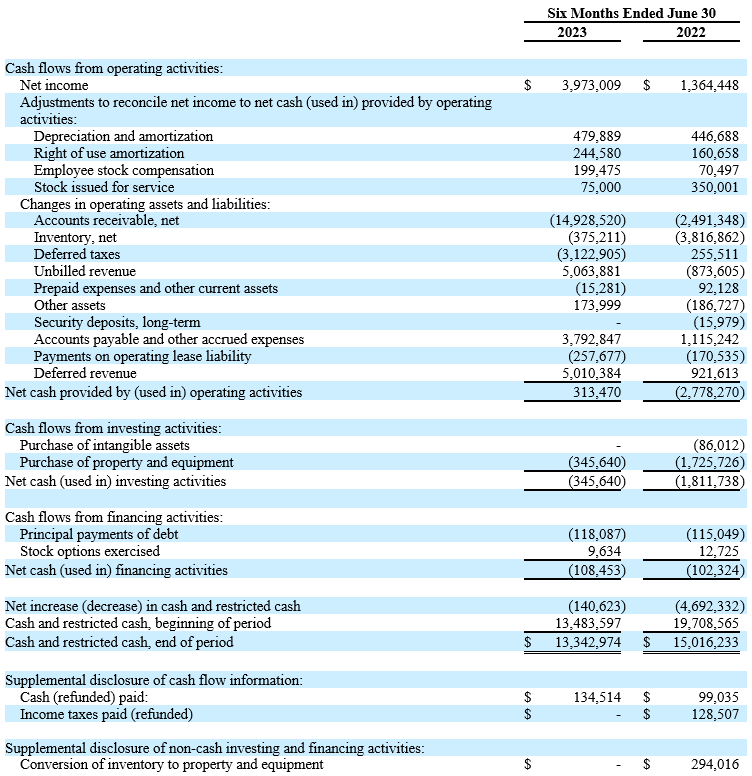

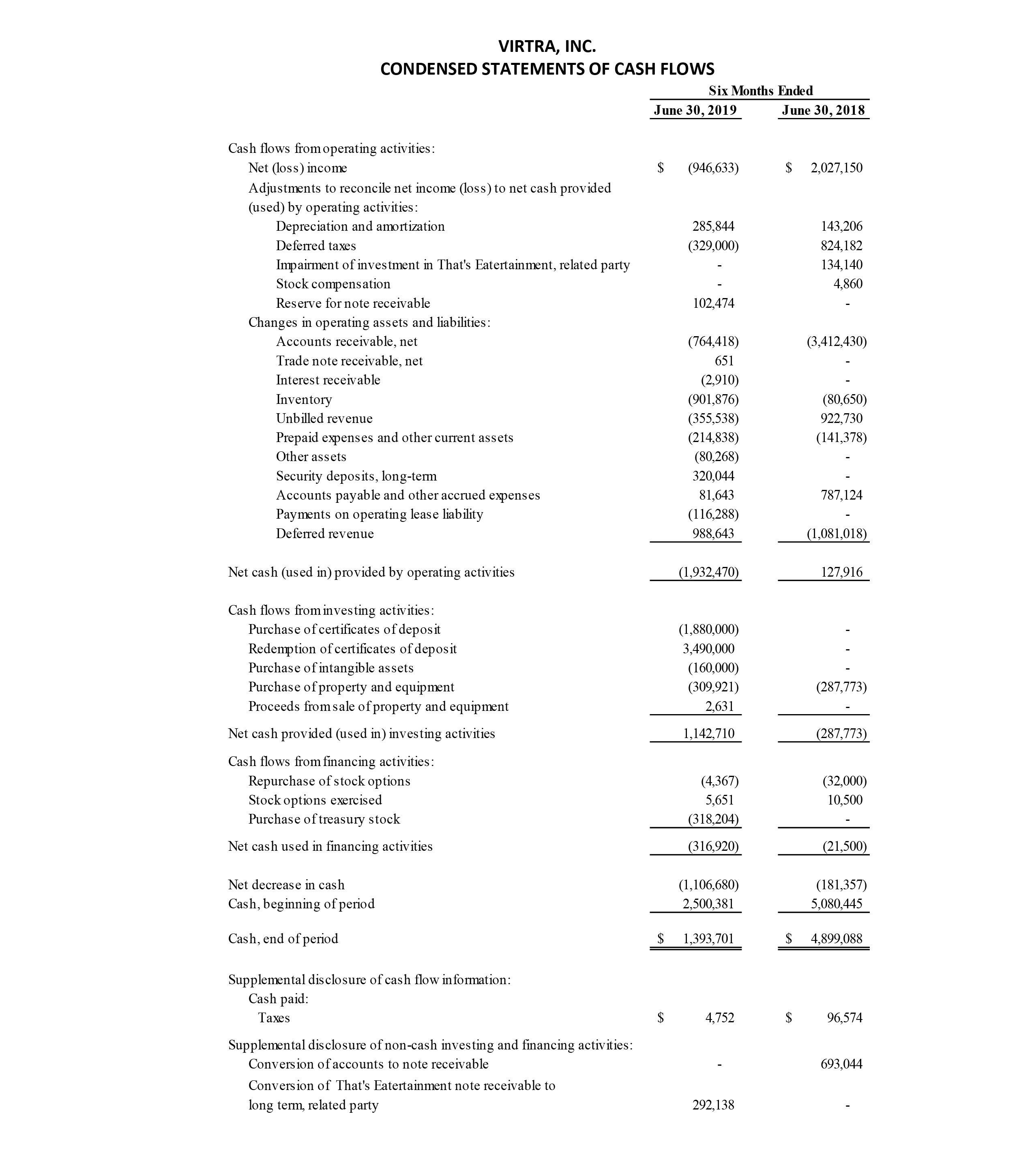

VIRTRA, INC.

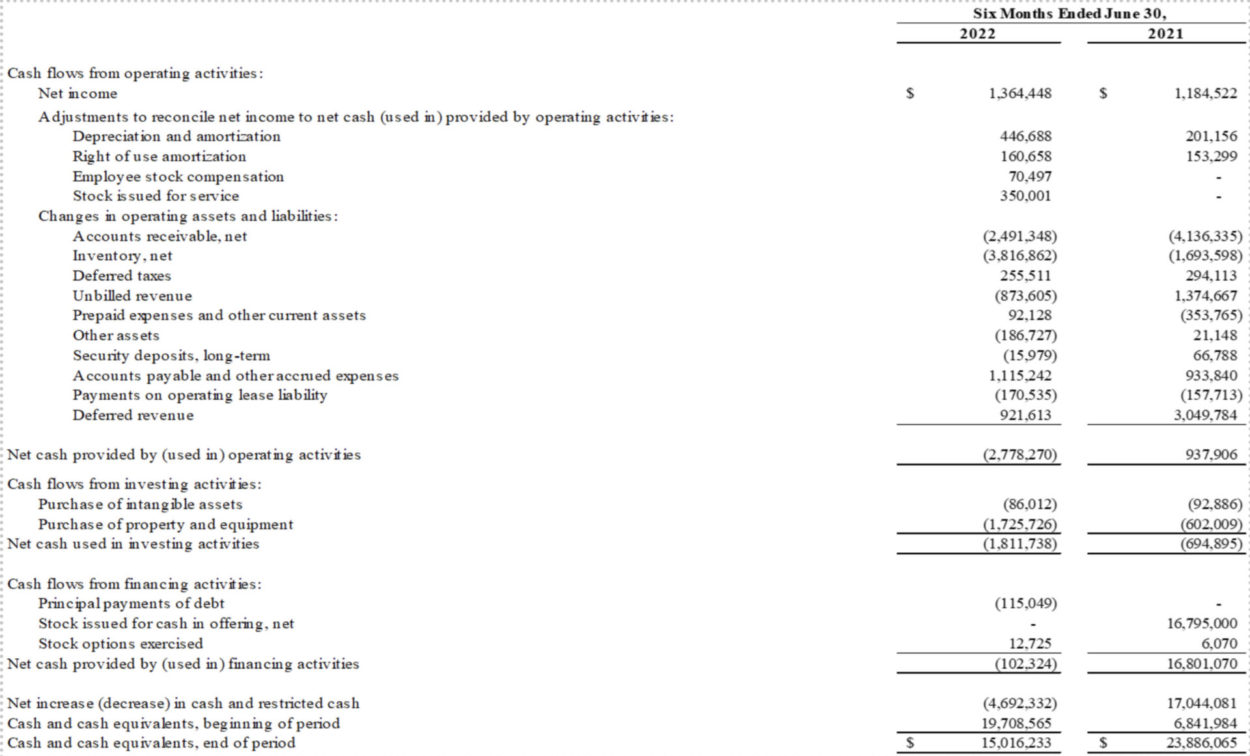

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

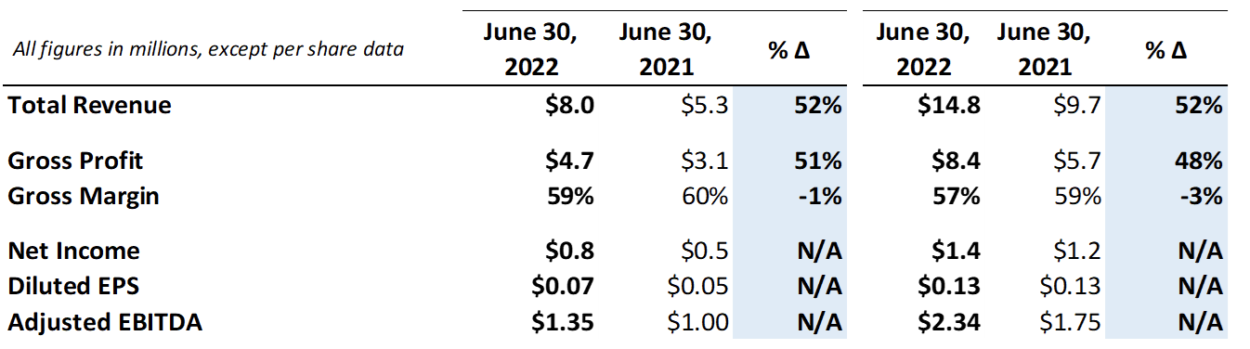

Total Revenue up 52%, Driving 51% Increase in Gross Profit and 34% Increase in Adjusted EBITDA

CHANDLER, Ariz. — August 19, 2022 — VirTra, Inc. (NASDAQ: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators and firearms training simulators for the law enforcement and military markets, reported results for the second quarter and six months ended June 30, 2022. The financial statements are available on VirTra’s website and here.

Second Quarter 2022 Financial Highlights:

- Total revenue increased 52% to $8.0 million

- Gross profit increased 51% to $4.7 million, or 59% of total revenue

- Net income increased to $$787,000

- Adjusted EBITDA increased to $1.3 million

- Backlog at June 30, 2022 of $16.5 million

- Working capital surplus totaled $27.0 million, including unrestricted cash and cash equivalents of $15.0 million

Six Month 2022 Financial Highlights:

- Total revenue increased 52% to $14.8 million

- Gross profit increased 48% to 8.4 million, or 57% of total revenue

- Net income increased to $1.4 million

- Adjusted EBITDA increased to $2.3 million

Second Quarter and Six Month 2022 Financial Highlights:

Management Commentary

“We reported another strong quarter of growth in the second quarter of 2022 as we continue to deliver higher volumes of our world-class training solutions domestically and internationally,” said Bob Ferris, chairman and co-CEO of VirTra. “Total revenue and adjusted EBITDA increased 52% and 34% year-over-year, respectively, while gross profit margin expanded from the first quarter 2022 to 59%,. Further, market demand was noticeably strong in the commercial market, which includes the military market, as we recorded $3.6 million in commercial revenue in Q2, eclipsing the $3.2 million of commercial revenue we recorded for all of 2021.

“Our deliveries are accelerating, allowing us to convert backlog into revenue and resulting in backlog decreasing from the first quarter 2022 to $16.5 million. Additionally, our core law enforcement market tends to be seasonally stronger in the second half of the year so we remain optimistic regarding our sales pipeline and commercial opportunities, which provide us with significant growth opportunities. Complemented with a strong balance sheet that includes a $27.0 million working capital surplus, VirTra remains well-positioned for continued success. Additionally, I would like to thank the entire VirTra team and our advisors for their dedication and hard work in getting our financial filing status back up-to-date.”

Management Change

Effective August 16, 2022, VirTra Chief Operating Officer, Vice President, and Director, Matt Burlend, departed the Company. Mr. Burlend’s departure was not the result of any disagreement with VirTra on any matters relating to its operations, policies, or practices. VirTra will not seek an immediate replacement for Mr. Burlend at the company-level but plans to fill the Board vacancy resulting from his departure. The Company thanks Mr. Burlend for his many years of service and all his contributions to VirTra.

Second Quarter 2022 Financial Results

Total revenue increased 52% to $8.0 million from $5.3 million in the second quarter of 2021. The increase in revenues resulted from an increase in the number of simulators and accessories completed, delivered and revenue recognized compared to the same period in 2021.

Gross profit increased 51% to $4.7 million from $3.1 million in the second quarter of 2021. The increase in gross profit was driven by an increase in the number of simulators and accessories completed, delivered and revenue recognized compared to the same period in 2021. Gross profit margin was 59%, a decrease compared to 60% in the second quarter of 2021.

Net operating expense was $3.7 million, compared to $2.3 million in the second quarter of 2021. The increase was primarily due to expenses related to the move into the new building and increased payroll costs.

Income from operations totaled $1.0 million compared to $823,000 in the second quarter of 2021.

Net income totaled $787,000, or $0.07 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to a net income of $529,000, or $0.05 per diluted share (based on 10.7 million weighted average diluted shares outstanding), in the second quarter of 2021.

Adjusted EBITDA, a non-GAAP metric, totaled $1.3 million, an improvement from $1.0 million in the second quarter of 2021.

Backlog at the end of the second quarter totaled $16.5 million, compared to $17.0 million at the end of the second quarter of 2021.

Six Months Ended June 30, 2022 Financial Results

Total revenue increased 52% to $14.8 million from $9.7 million for the first six months of 2021. The increase in revenues resulted from an increase in the number of simulators and accessories completed, delivered and revenue recognized compared to the same period in 2021.

Gross profit increased 48% to $8.4 million from $5.7 million for the first six months of 2021. The increase in gross profit was driven by an increase in the number of simulators and accessories completed, delivered and revenue recognized compared to the same period in 2021. Gross profit margin was 57%, a decrease compared to 59% for the first six months of 2021.

Net operating expense was $6.7 million, compared to $4.3 million for the first six months of 2021. The increase was primarily due to expenses related to the move into the new building and increased payroll costs.

Operating income was $1.8 million, an improvement compared to an operating income of $1.4 million for the first six months of 2021.

Net income totaled $1.4 million, or $0.13 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to a net income of $1.2 million, or $0.13 per diluted share (based on 9.2 million weighted average diluted shares outstanding), for the first six months of 2021.

Adjusted EBITDA, a non-GAAP metric, totaled $2.3 million, an improvement from $1.8 million for the first six months of 2021.

Conference Call

VirTra’s management will hold a conference call today (August 19, 2022) at 10:00 a.m. Eastern Time (7:00 a.m. Pacific Time) to discuss these results. VirTra’s chairman and co-CEO, Bob Ferris, co-CEO John Givens and chief accounting officer, Marsha Foxx, will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference Code: 13732200

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact VirTra’s IR team at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the call will be available on the same day after 1:00 p.m. ET through September 2, 2022.

U.S. replay dial-in: 1-844-512-2921

International replay dial-in: 1-412-317-6671

Replay ID: 13732200

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of judgmental use of force training simulators and firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Jeff Grampp, CFA

Gateway Group, Inc.

949-574-3860

VirTra, Inc.

Condensed Balance Sheets

VirTra, Inc.

Condensed Statements of Operations

(Unaudited)

VirTra, Inc.

Condensed Statements of Cash Flows

(Unaudited)

TEMPE, Ariz. — August 13, 2019 — VirTra, Inc. (NASDAQ: VTSI) (“VirTra”), a global provider of training simulators for the law enforcement, military, educational and commercial markets, reported results for the second quarter and six months ended June 30, 2019. The unaudited financial statements and notes thereto are available on VirTra’s website and here.

Second Quarter 2019 and Recent Highlights:

- Received two new orders for driving simulators from the Department of State for Pakistan in support of U.S. Foreign Assistance programs, with a total contract value of approximately $782,000

- Expanded simulator deployments across Southern California with recent contract wins and installations in four separate departments for a cumulative value of nearly $780,000

- Received a follow-on order from the U.S. Department of Homeland Security for Customs and Border Protection (CBP) valued at approximately $630,000 for annual service agreements

- Engaged JL O’Connell & Associates, a highly regarded business development consultancy, to expand VirTra’s sales and marketing efforts in the military market

Second Quarter and Six Month 2019 Financial Highlights:

| All figures in millions, except per share data | Q2 2019 | Q2 2018 | % Δ | YTD 2019 | YTD 2018 | % Δ |

| Total Revenue | $3.05 | $8.71 | -65% | $6.11 | $12.00 | -49% |

| Gross Profit | $1.52 | $5.74 | -74% | $3.32 | $8.01 | -59% |

| Gross Margin | 49.6% | 66.0% | -25% | 54.3% | 66.7% | -19% |

| Net (Loss)/ Income | ($0.63) | $2.11 | N/A | ($0.95) | $2.03 | N/A |

| Diluted Earnings per Share (EPS) | ($0.08) | $0.26 | N/A | ($0.12) | $0.25 | N/A |

Management Commentary

“In the second quarter of 2019, we continued implementing new business expansion initiatives, which will take time to mature, but which we believe will increase our competitive advantage, expand and diversify our revenue base, and ultimately, create a more stable and robust business,” said Bob Ferris, Chairman and CEO of VirTra. “While our financial results for the second quarter were lighter than we would have liked, we made significant progress against our strategic, long-term growth plan.

“Due to our traditional hardware sales model and the way in which revenue is recognized, our business has historically experienced fluctuations from quarter-to-quarter. From a financial perspective, the second quarter was an extreme example of these quarterly oscillations. Our year-over-year results were exacerbated by a tough comparison from the second quarter of 2018, in which we recognized a $4.2 million order for simulators and accessories from one of our federal customers. This was further exacerbated by several installation postponements from multiple customers in Q2 2019. However, the good news is our new sales are robust as evidenced by our record backlog of approximately $10.1 million.

“Nevertheless, we made substantial operational progress this past quarter generating new business, increasing our sales pipeline, and pursuing our strategic initiatives. We expanded our presence in Southern California and recently received two new orders from the Department of State for driving simulators. We’ve also made progress building our recurring revenue base by securing multiple STEP contracts. We hired an experienced consultant to help propel our sales and marketing efforts in the massive military market. In addition, we’ve strengthened VirTra’s brand by expanding our relationships with strategic partners, performing a record number of product demonstrations for potential customers, and exhibiting at a variety of trade shows.

“Ultimately, we remain encouraged by the operational success we’ve experienced in the first half of the year and are confident that the strategic initiatives we’ve implemented will have positive, material impacts on our business over the long-run. We’re excited about what the future holds for VirTra as we work diligently to scale these new programs, improve the quality of training worldwide, and grow our business over the next several quarters and years.”

Second Quarter 2019 Financial Results

Total revenue was $3.1 million compared to $8.7 million in the second quarter of 2018. The decrease in total revenue was due to a reduction in the number of simulators and accessories delivered compared to the same period in 2018.

Gross profit was $1.5 million (49.6% of total revenue) compared to $5.7 million (66.0% of total revenue) in the second quarter of 2018. The decrease in gross profit was primarily due to differences in the product mix and the quantity of systems, accessories, and services sold.

Net operating expense was $2.4 million compared to $2.8 million in the second quarter of 2018. The decrease in net operating expense was due to reduced selling, general and administrative expenses (“SG&A”), costs for labor, benefits, professional services, and public company expense compared to the second quarter of 2018.

Loss from operations was $883,000 compared to income from operations of $3.0 million in the second quarter of 2018.

Net loss totaled $634,000, or $(0.08) per diluted share, compared to net income of $2.1 million, or $0.26 per diluted share in the second quarter of 2018.

Adjusted EBITDA loss, a non-GAAP financial measure, was $604,000 compared to positive adjusted EBITDA of $3.2 million in the same period a year-ago.

As of June 30, 2019, cash and cash equivalents and certificates of deposit totaled $3.3 million compared to $4.6 million at the end of the prior quarter and working capital was $4.8 million.

Financial Results for the Six Months Ended June 30, 2019

Total revenue was $6.1 million compared to $12.0 million in the first six months of 2018. The decrease in total revenue was due to a reduction in the number of simulators and accessories delivered compared to the same period in 2018.

Gross profit was $3.3 million (54.3% of total revenue) compared to $8.0 million (66.7% of total revenue) in the first six months of 2018. The decrease in gross profit was primarily due to differences in the product mix and the quantity of systems, accessories, and services sold.

Net operating expense was $4.7 million compared to $5.2 million in the first six months of 2018. The decrease in net operating expense was due to reduced SG&A, costs for labor, benefits, professional services, and public company expense compared to the same period in 2018.

Loss from operations was $1.3 million compared to income from operations of $2.8 million in the first six months of 2018.

Net loss totaled $947,000, or $(0.12) per diluted share, compared to net income of $2.0 million, or $0.25 per diluted share in the comparable period a year ago.

Adjusted EBITDA loss was $883,000 compared to positive adjusted EBITDA of $3.1 million in the first six months of 2018.

Deferred revenue totaled $3.9 million as of June 30, 2019, compared to $2.9 million as of June 30, 2018. The current portion of deferred revenue was $2.7 million as of June 30, 2019, compared to $1.9 million as of June 30, 2018. The increase in deferred revenue was primarily due to customer deposits received on new orders, new service agreements, and new STEP agreements received.

Conference Call

VirTra management will hold a conference call today (August 13, 2019) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s Chairman and CEO, Bob Ferris, and CFO, Judy Henry, will host the call, followed by a question and answer period.

U.S. dial-in number: 888-428-7458

International number: 862-298-0702

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact VirTra’s IR team at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of VirTra’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through August 27, 2019.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 52547

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net loss to Adjusted EBITDA is provided in the following table:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the SEC. You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the Securities and Exchange Commission before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

###

Investor Relations Contact:

Matt Glover or Charlie Schumacher

[email protected]

949-574-3860

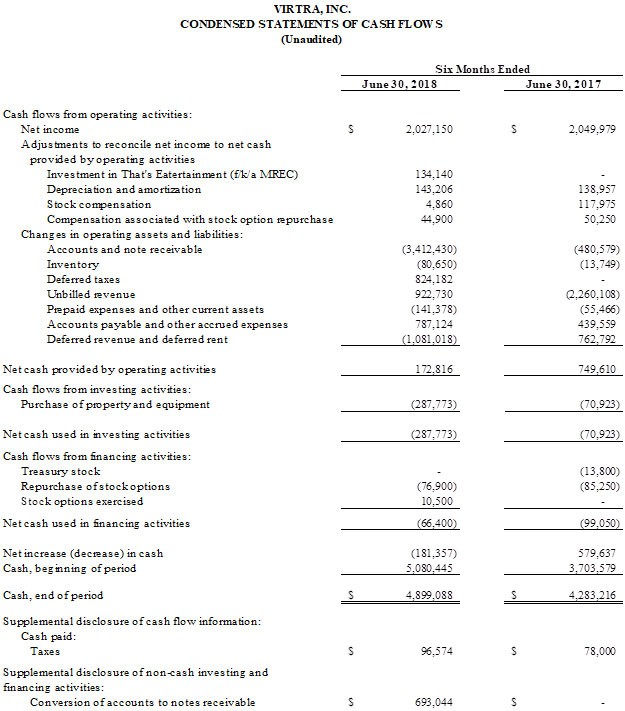

FINANCIALS FOLLOWING

TEMPE, Ariz. — August 13, 2018 — VirTra, Inc. (NASDAQ: VTSI) (“VirTra”), a global provider of training simulators for the law enforcement, military, educational and commercial markets, reported results for the second quarter ended June 30, 2018. The financial statements are available on VirTra’s website and here.

Second Quarter 2018 Operational and Financial Highlights:

- Total revenue increased 66% year-over-year to $8.7 million

- Gross profit increased 53% year-over-year to $5.7 million

- Income from operations increased 82% year-over-year to $3.0 million

- Delivered training simulators and accessories valued, in aggregate, at more than $1.15 million to three of the largest U.S. law enforcement agencies representing over 6,000 officers

- Backlog totaled approximately $5.2 million

- VirTra’s common stock was added to the Russell Microcap Index

Second Quarter and Six Month 2018 Financial Highlights:

| All figures in millions, except per share data |

Q2 2018 |

Q2 2017 | % Δ | YTD 2018 | YTD 2017 |

% Δ |

| Total Revenue |

$8.7 |

$5.3 | 66% | $11.9 | $9.5 |

26% |

|

Gross Profit |

$5.7 | $3.8 | 53% | $8.0 | $6.2 |

29% |

| Gross Margin |

65.9% |

71.4% | -8% | 66.6% | 65.3% |

2% |

| Net Income |

$2.1 |

$1.6 | 28% | $2.0 | $2.0 |

-1% |

| Diluted Earnings per Share (EPS) |

$0.26 |

$0.2 | 30% | $0.25 | $0.24 |

4% |

|

Adjusted EBITDA |

$3.2 | $1.8 | 81% | $3.1 | $2.4 |

32% |

Management Commentary

“In the second quarter of 2018 we saw the hard work of the prior quarters come to fruition as we achieved several important financial milestones, including record total revenue and adjusted EBITDA, while maintaining solid gross margins,” said Bob Ferris, Chairman and Chief Executive Officer of VirTra. “To us, these figures validate the decisions we recently made to expand our staff and shift additional responsibilities of our production in-house. Our success in Q2 demonstrates that we are capable of both procuring and delivering larger volumes of orders, which we hope to continue in the coming years.

“We remain optimistic about the remainder of 2018 thanks to a strong first half of the year and opportunity pipeline but believe it is critical to bear in mind that our long sales cycle, as well as the timing of large contracts, necessitate evaluation of our results on a year-over-year rather than a quarter-by-quarter basis. This is because much of the revenue we recognized in one quarter is primarily a direct result of our work in prior quarters. That being said, we look forward to capitalizing on the momentum created by this quarter’s strong results. When combined with our recent up-listing to NASDAQ and inclusion in the Russell Microcap Index, we believe we are in an even stronger position today to continue expanding our business, with the ultimate goal of delivering lasting shareholder value over the long run.”

Second Quarter 2018 Financial Results

Total revenue increased 66% to $8.7 million from $5.3 million in the second quarter of 2017. The increase in total revenue was due to higher sales of VirTra’s simulators, accessories, warranties and other services.

Gross profit increased 53% to $5.7 million (65.9% of total revenue) from $3.8 million (71.4% of total revenue) in the second quarter of 2017. The increase in gross profit was primarily due to the increase in total revenue.

Net operating expense increased 31% to $2.8 million from $2.1 million in the second quarter of 2017. The increase in net operating expense was due to investments in sales and marketing personnel as well as higher non-recurring professional services fees related to VirTra’s qualification and completion of its NASDAQ exchange listing in March 2018.

Income from operations increased 82% to $3.0 million from $1.6 million in the second quarter of 2017.

Net income totaled $2.1 million, or $0.26 per diluted share, an improvement from $1.6 million, or $0.20 per diluted share in the second quarter of 2017. VirTra recognized an income tax expense of $865,000 in the second quarter of 2018 compared to none in the same period a year-ago as a result of a change in management’s assessment and reporting of deferred taxes.

Adjusted EBITDA, a non-GAAP financial measure, increased 81% to $3.2 million from $1.8 million in the second quarter of 2017.

As of June 30, 2018, cash and cash equivalents increased 9% to $4.9 million from $4.5 million at the end of the prior quarter.

Financial Results for the Six Months Ended June 30, 2018

Total revenue increased 26% to $11.9 million from $9.5 million in the first six months of 2017. The increase in total revenue was due to higher sales of VirTra’s simulators, accessories, warranties and other services.

Gross profit increased 29% to $8.0 million (66.6% of total revenue) from $6.2 million (65.3% of total revenue) in the first six months of 2017. The increase in gross profit was primarily due to the increase in total revenue.

Net operating expense increased 26% to $5.2 million from $4.1 million in the first six months of 2017. The increase in net operating expense was due to investments in sales and marketing personnel as well as higher non-recurring professional services fees related to VirTra’s qualification and completion of its NASDAQ exchange listing in March 2018.

Income from operations increased 34% to $2.8 million from $2.1 million in the first six months of 2017.

Net income totaled $2.0 million, or $0.25 per diluted share, compared to $2.0 million, or $0.24 per diluted share in the comparable period a year ago.

Adjusted EBITDA increased 32% to $3.1 million from $2.4 million in the first six months of 2017.

Conference Call

VirTra management will hold a conference call today (August 13, 2018) at 4:30 p.m. Eastern time (1:30 p.m. local time) to discuss these results.

VirTra’s Chairman and CEO Bob Ferris and CFO Judy Henry will host the call, followed by a question and answer period.

U.S. dial-in number: 877-407-8031

International number: 201-689-8031

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Liolios at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of VirTra’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through August 27, 2018.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 36073

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of training simulators for the law enforcement, military, educational and commercial markets. VirTra’s patented technologies, software and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real world situations. VirTra’s mission is to save and improve lives worldwide through realistic and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

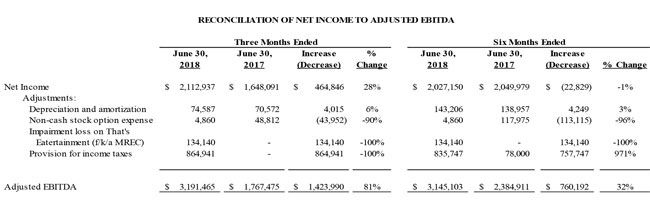

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following table:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this Form 10-Q are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the SEC. You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the Securities and Exchange Commission before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Media Contact:

VirTra

[email protected]

480-968-1488

Investor Relations Contact:

Matt Glover or Tom Colton

[email protected]

949-574-3860

Download Full Financial Report Here

FINANCIALS FOLLOWING

TEMPE, Ariz. — July 30, 2018 — VirTra, Inc. (NASDAQ: VTSI), a global provider of training simulators for the law enforcement, military, educational and commercial markets, will hold a conference call on Monday, August 13, 2018 at 4:30 p.m. Eastern time to discuss its financial results for the second quarter ended June 30, 2018. Financial results will be issued in a press release prior to the call.

VirTra management will host the conference call, followed by a question and answer period.

Date: Monday, August 13, 2018

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in number: 877-407-8031

International number: 201-689-8031

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Liolios at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through August 27, 2018.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 36073

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of training simulators for the law enforcement, military, educational and commercial markets. The Company’s patented technologies, software and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real world situations. VirTra’s mission is to save and improve lives worldwide through realistic and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Media Contact:

VirTra

[email protected]

480-968-1488

Investor Relations Contact:

Matt Glover or Tom Colton

[email protected]

949-574-3860

Tempe, Ariz. (July 20, 2017) – VirTra, Inc. (OTCQX: VTSI), (the “Company”), a global provider of simulators for the law enforcement, military, educational and commercial markets, announced today that it will release its financial results for the second quarter ended June 30, 2017 before the market opens on Monday, August 14, 2017. The Company will host a live webcast later that day at 12:30 p.m. Eastern time/9:30 a.m. local time, to discuss those results. As part of the webcast, management will be answering questions received in advance by email. Shareholders are encouraged to email their questions prior to the call to [email protected]. Individuals interested in listening to the webcast live via the Internet may do so by visiting the Company’s website at www.VirTra.com. A webcast replay will be available for 60 days.

About VirTra

VirTra is a global provider of simulators for the law enforcement, military, educational and commercial markets. The Company’s patented technologies, software and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real world situations. VirTra’s mission is to save and improve lives worldwide through realistic and highly-effective virtual reality and simulator technology. Learn more about VirTra at www.VirTra.com.

TEMPE, AZ – August 10, 2011 – Bob Ferris, VirTra Systems’ CEO (VTSI.PK), today reported results for 2nd quarter 2011 along with multiple corporate changes.

Sales for the 2nd quarter increased $979 thousand to a record setting $2.50 million for the three months ended June 30, 2011, up 64.4% from $1.52 million for the same period last year. Sales for the six months ended June 30, 2011 increased 2.45 million to $4.69 million, up 109% from $2.24 million for the same period last year. The table below illustrates the trend of VirTra’s expanding gross revenue for the past year.