Fourth Quarter Bookings Grow 37% Sequentially to $12.2 Million

Year-End Backlog Expands to $22.0 Million

CHANDLER, Ariz. — March 27, 2025 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra” or the “Company”), a global provider of judgmental use of force training simulators and firearms training simulators for the law enforcement and military markets, reported results for the fourth quarter and full year ended December 31, 2024. The financial statements are available on VirTra’s website and here.

Fourth Quarter 2024 and Recent Operational Highlights:

- Fourth quarter bookings totaled $12.2 million, a 37% increase from Q3 2024, with a significant portion recorded in December, positioning VirTra for revenue conversion in early 2025.

- Backlog grew to $22.0 million as of December 31, 2024, reflecting continued sales momentum despite federal funding delays.

- Secured contracts with government and law enforcement agencies in Europe and Latin America, reinforcing VirTra’s expansion in international government and security training programs.

- Secured first sale of the V-XR® training platform in Canada, marking early adoption of the Company’s extended reality training technology.

- Maintained robust working capital at $34.8 million, positioning the Company for sustained growth and operational agility.

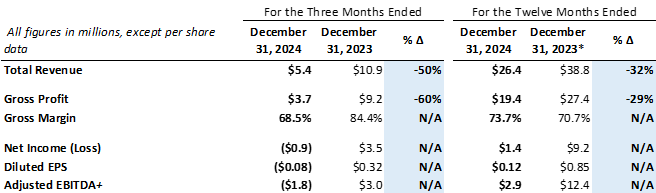

Fourth Quarter and Full Year 2024 Financial Highlights:

*The December 31, 2023 full-year column reflects restated financials.

+The adjusted EBITDA calculation for the three months ended December 31, 2024 gives effect to a negative $750,000 revenue adjustment.

Management Commentary

VirTra CEO John Givens stated, “We closed out 2024 with strong bookings momentum and an expanding backlog despite persistent challenges in the federal funding environment. Bookings increased sequentially each quarter in 2024, demonstrating our ability to navigate the constraints of the federal government’s Continuing Resolution and the resulting delays in contract execution. While we remain encouraged by our growing backlog and international traction, the broader funding environment remains fluid, and we are actively working with policymakers to ensure law enforcement agencies can access critical training resources. Over the past several months, we have met with dozens of legislators, officials at the Department of Justice, and leadership in federal grant offices to advocate for clearer funding structures that prioritize modern training systems. As a trusted partner for Customs and Border Protection (CBP), the Secret Service, and the Federal Law Enforcement Training Center (FLETC), we remain focused on expanding our role in federal law enforcement training initiatives.

“We are also advancing our military initiatives, with key milestones in the U.S. Army’s Integrated Visual Augmentation System (IVAS) program. Our final IVAS development phase was completed 42 days ahead of schedule, leading the Army to finalize testing early and forgo previously planned soldier assessments due to our system’s outstanding performance. The transition of IVAS to Anduril, one of the most capable defense technology firms with a well-established track record in Department of Defense contracting, is a significant positive development. We are actively conducting reliability testing on recoil kits as part of the final prototyping phase and remain confident in our continued involvement, strategically positioning us to effectively support future production-stage opportunities.

“While our sales pipeline has improved, we recognize that there is still work to be done to reach full efficiency. We are laser-focused on accelerating sales growth through a disciplined, strategic approach. This includes expanding and refining our sales organization, improving conversion efficiency, and deepening engagement across our core federal and military customer base. Additionally, we are leveraging AI to drastically reduce video editing time from days to minutes, accelerating high-quality content creation. Training content remains a key differentiator for VirTra, and our ability to rapidly expand and enhance our scenario library strengthens our position as the industry leader in immersive training.

“Looking ahead, we anticipate continued variability in federal funding cycles in the near term, but the long-term need for de-escalation and tactical training continues to expand. The steps we’ve taken to improve operational efficiency, deepen engagement with key federal agencies, and expand our content and scenario development capabilities provide a solid foundation as we navigate 2025.”

Fourth Quarter and Full Year 2024 Financial Results

Total revenue for the fourth quarter was $5.4 million, compared to $10.9 million in the prior year period. This decrease reflects the impact of federal budget delays and grant disbursement pauses, which slowed contract execution and order conversion. While Q4 bookings saw strong sequential growth, many orders came late in the quarter, limiting the Company’s ability to fulfill and recognize revenue within the period.

For the full year 2024, total revenue was $26.4 million, compared to $38.8 million (as restated) in 2023. The decline reflects the impact of budget delays, resulting in softer bookings in early 2024 and delayed order conversion throughout the year.

Gross profit for the fourth quarter was $3.7 million (69% of total revenue), compared to $9.2 million (84% of total revenue) in the prior year period. The decline primarily reflects lower revenue.

For the full year 2024, gross profit totaled $19.4 million (74% of total revenue), compared to $27.4 million (as restated) (71% of total revenue) in 2023. This improvement in gross margin reflects a shift in product mix and operational efficiencies.

Net operating expense for the fourth quarter was $4.2 million, a 13% increase from $3.7 million in the prior year period. The increase was driven by investments in higher-level staff to support long-term growth, expanded sales and marketing efforts, and enhancements to IT infrastructure and compliance for current and future contracts.

For the full year 2024, net operating expense was $17.4 million, compared to $17.0 million in 2023.

Operating (loss) income for the fourth quarter was $(0.5) million, compared to $1.7 million in the fourth quarter of 2023.

For the full year 2024, operating income was $2.0 million, compared to $10.4 million in 2023.

Net (loss) income for the fourth quarter was $(0.9) million, or $(0.08) per diluted share (based on 11.2 million weighted average diluted shares outstanding), compared to $3.5 million, or $0.32 per diluted share (based on 11.0 million weighted average diluted shares outstanding), in the fourth quarter of 2023.

For the full year 2024, net income was $1.4 million, or $0.12 per diluted share (based on 11.2 million weighted average diluted shares outstanding), compared to net income of $9.2 million (as restated), or $0.85 per diluted share (based on 11.0 million weighted average diluted shares outstanding), in 2023.

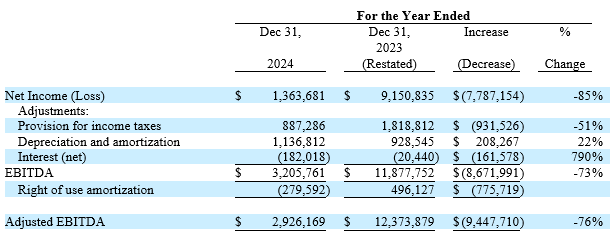

Adjusted EBITDA, a non-GAAP metric, was ($1.8) million (which included the $750,000 negative revenue adjustment), compared to $3.0 million in the fourth quarter of 2023.

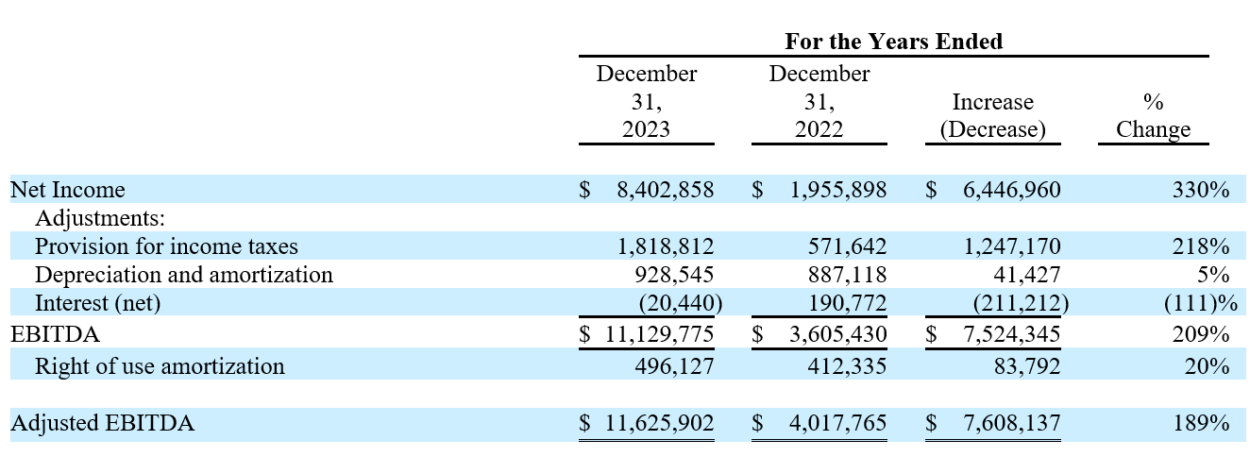

For the full year 2024, adjusted EBITDA, a non-GAAP metric, was $2.9 million, compared to $12.4 million in 2023.

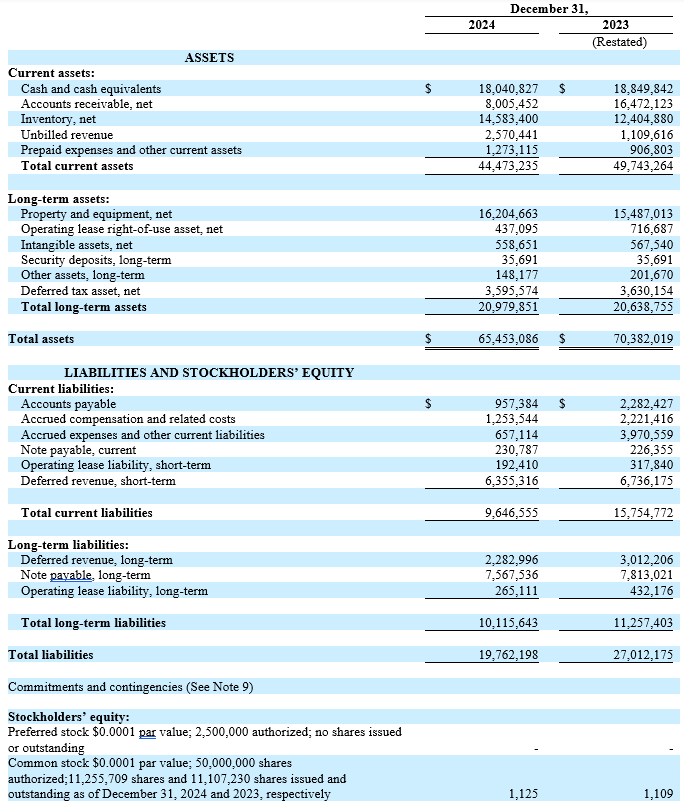

Cash and cash equivalents were $18.0 million at December 31, 2024.

Financial Commentary

CFO Alanna Boudreau stated, “We saw strong momentum in Q4 bookings, with many orders coming late in the quarter. While the timing limited revenue recognition in the period, it contributed to a growing $22.0 million backlog that positions us well for future revenue growth. Full-year 2024 results included a one-time revenue adjustment related to a 2021 international sale, which reduced reported 2024 revenue and increased 2023 results. Additionally, net operating expense included a $275,000 lease settlement tied to a legacy facility contract. Both adjustments were necessary to properly align financial reporting and have now been addressed. Looking ahead, we remain focused on managing costs effectively, increasing operational efficiency even further, and converting backlog into revenue as market conditions evolve. With a $22.0 million backlog, scalable operational infrastructure, and an expanding international pipeline and footprint, we are well-positioned to benefit as opportunities emerge.”

Conference Call

VirTra’s management will hold a conference call today (March 27, 2025) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s Chief Executive Officer John Givens and Chief Financial Officer Alanna Boudreau will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13751824

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through April 10, 2025.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13751824

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risks and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

– Financial Tables to Follow –

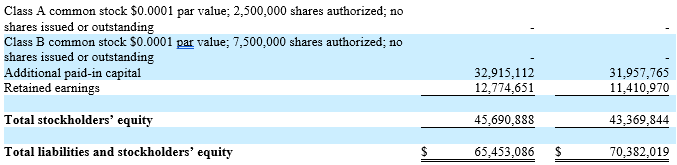

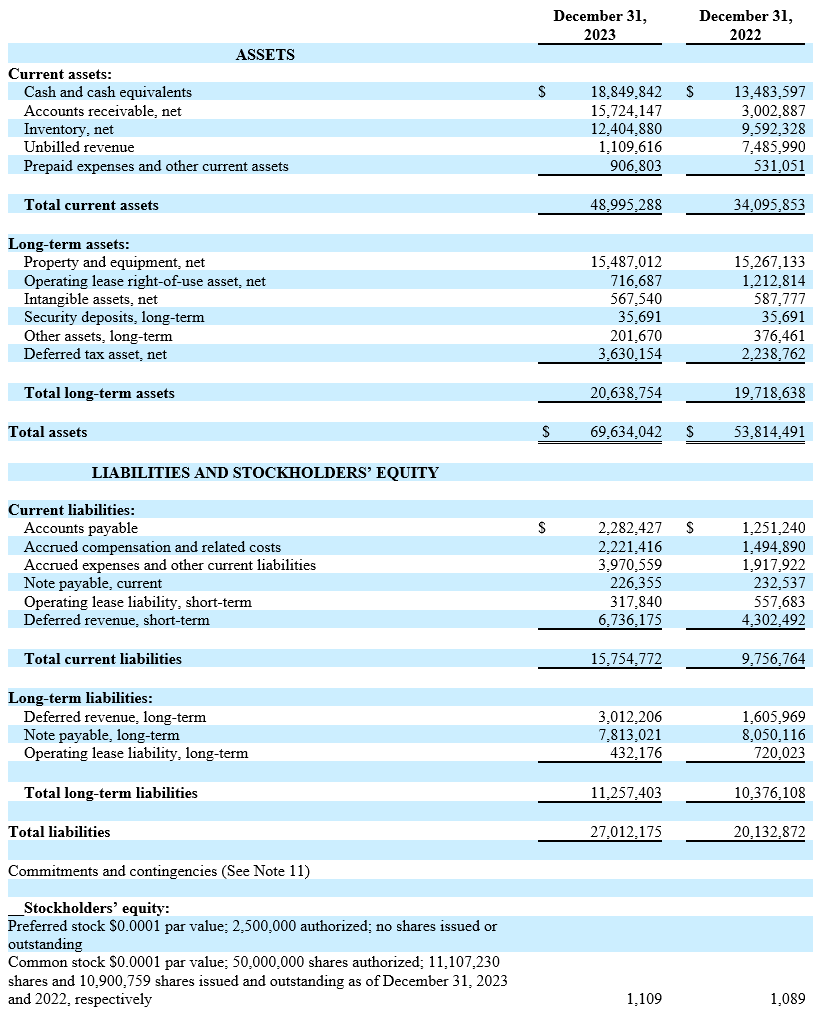

VIRTRA, INC.

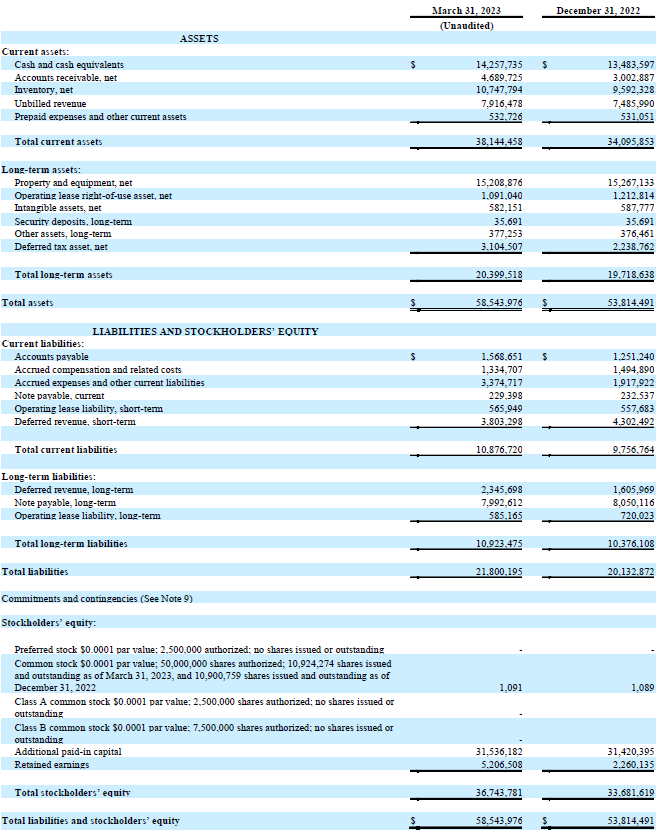

CONDENSED BALANCE SHEETS

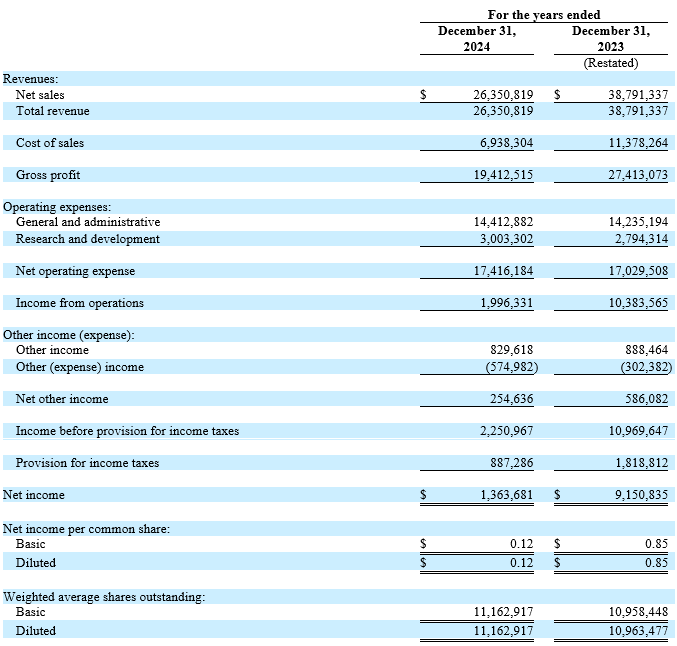

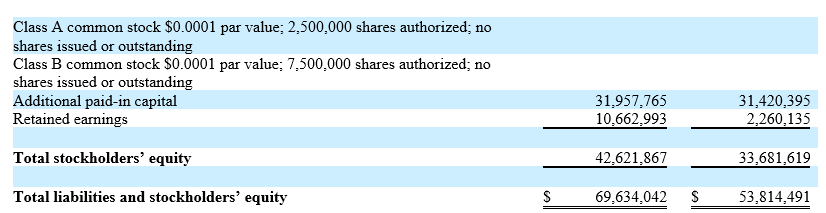

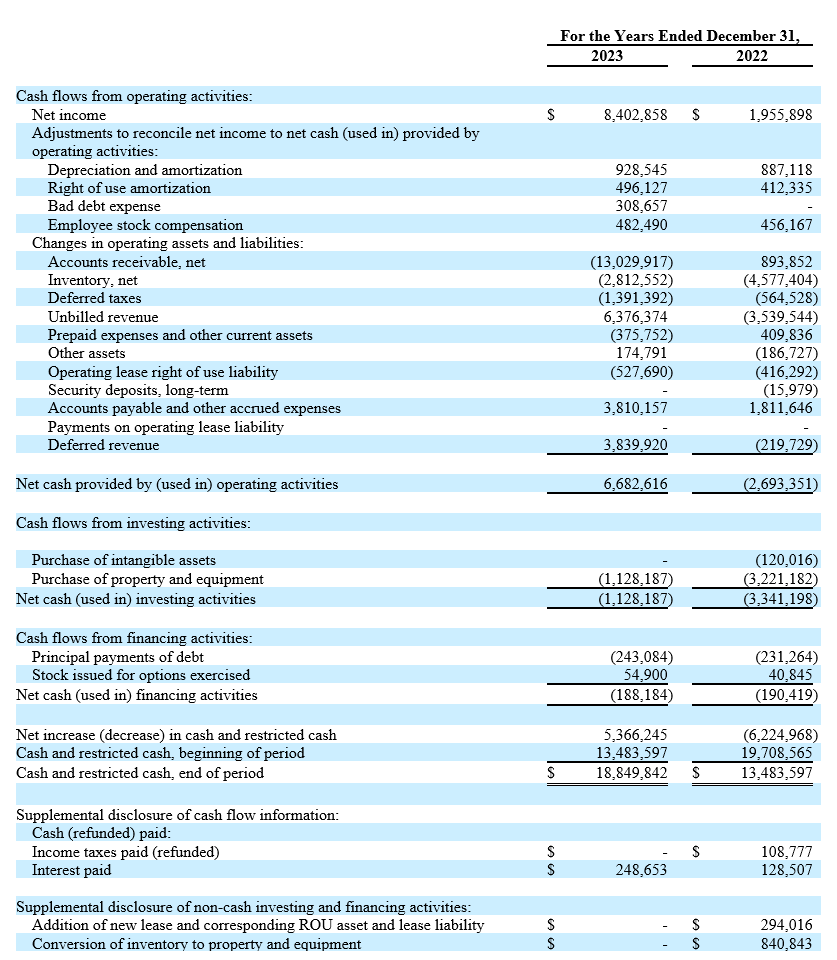

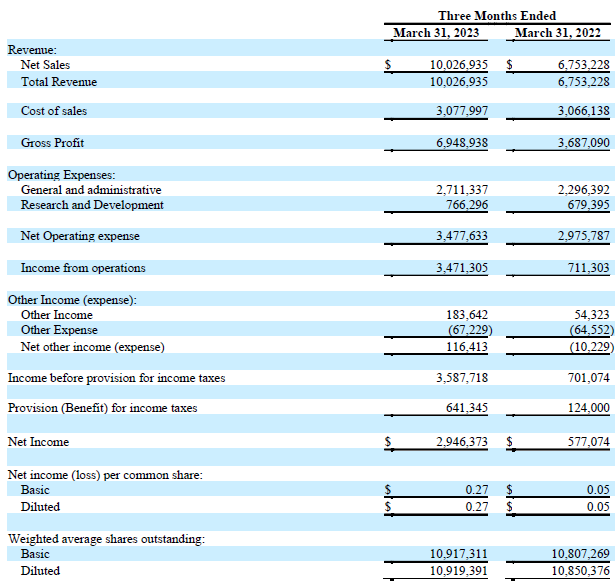

VIRTRA, INC.

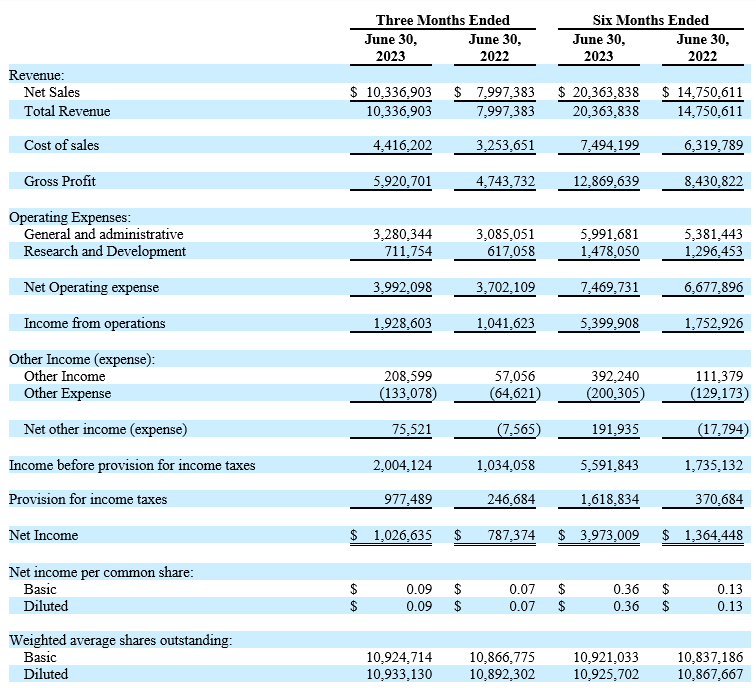

CONDENSED STATEMENTS OF OPERATIONS

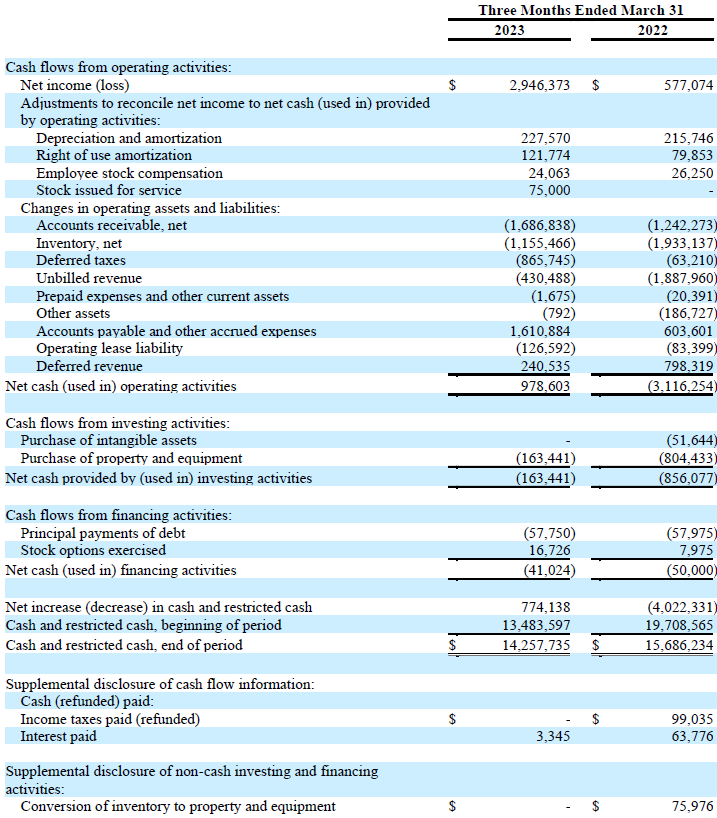

VIRTRA, INC.

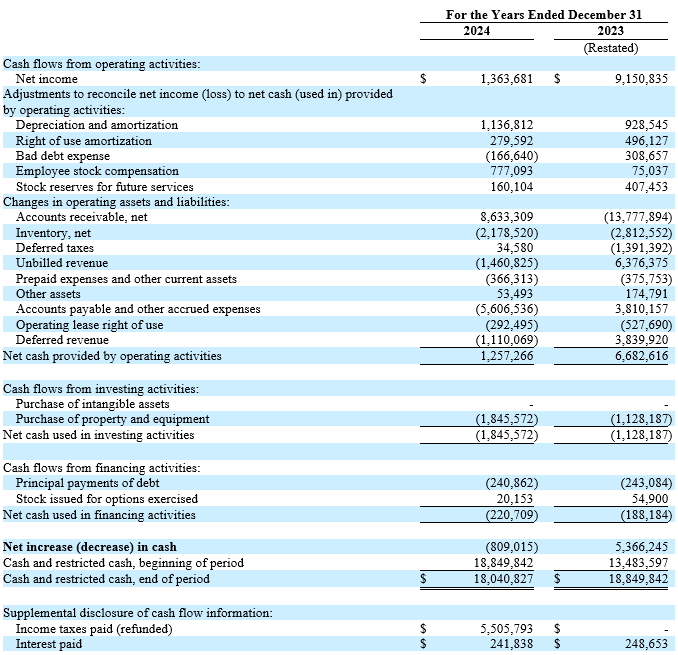

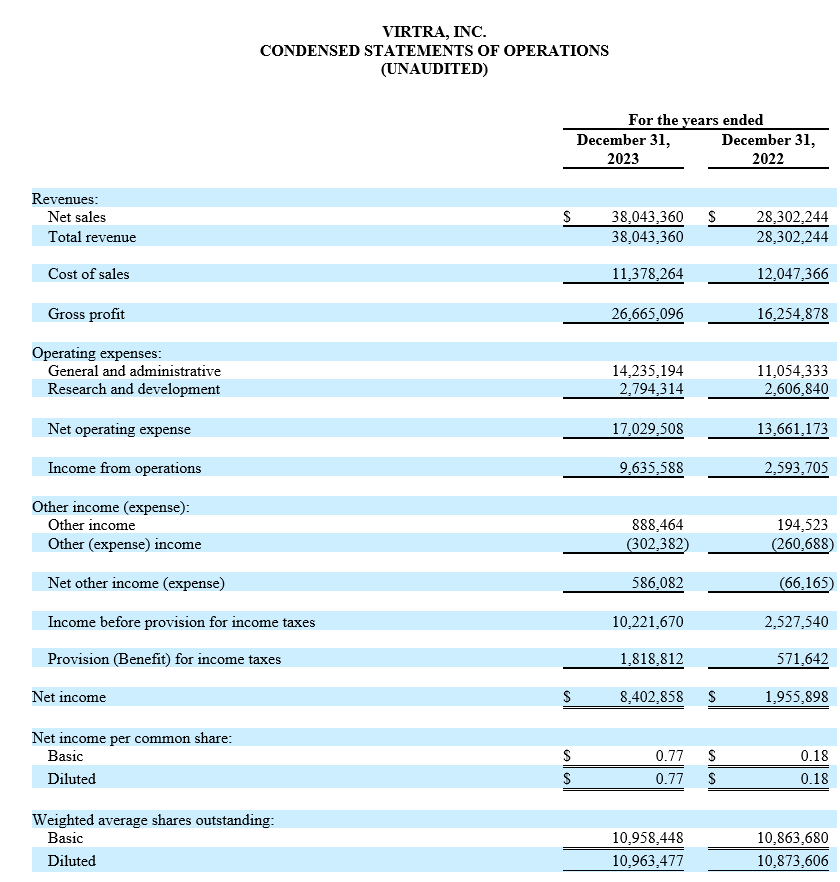

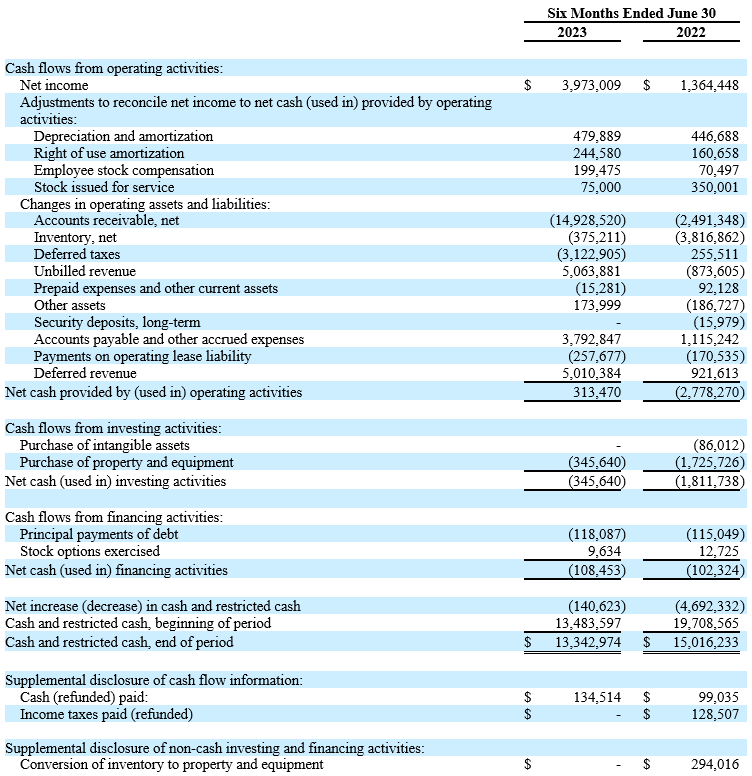

CONDENSED STATEMENTS OF CASH FLOWS

Annual Revenue Grows to a Record $38.0 Million, Marking a 34% Increase

Net Income Increases to $8.4 Million in 2023

CHANDLER, Ariz. — April 1, 2024 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the fourth quarter and full year ended December 31, 2023. The financial statements are available on VirTra’s website and here.

Fourth Quarter 2023 Financial Summary:

- Total revenue increased 17% year-over-year to $10.1 million

- Gross profit increased 58% year-over-year to $8.4 million, or 83% of total revenue

- Net income increased by $1.4 million year-over-year to $2.8 million

- Adjusted EBITDA totaled $2.2 million

- Cash and cash equivalents of $18.9 million at December 31, 2023

Full Year 2023 Financial Summary:

- Total revenue increased 34% to $38.0 million

- Gross profit increased 64% to $26.7 million, or 70% of total revenue

- Net income increased by $6.4 million to $8.4 million

- Adjusted EBITDA totaled $11.6 million

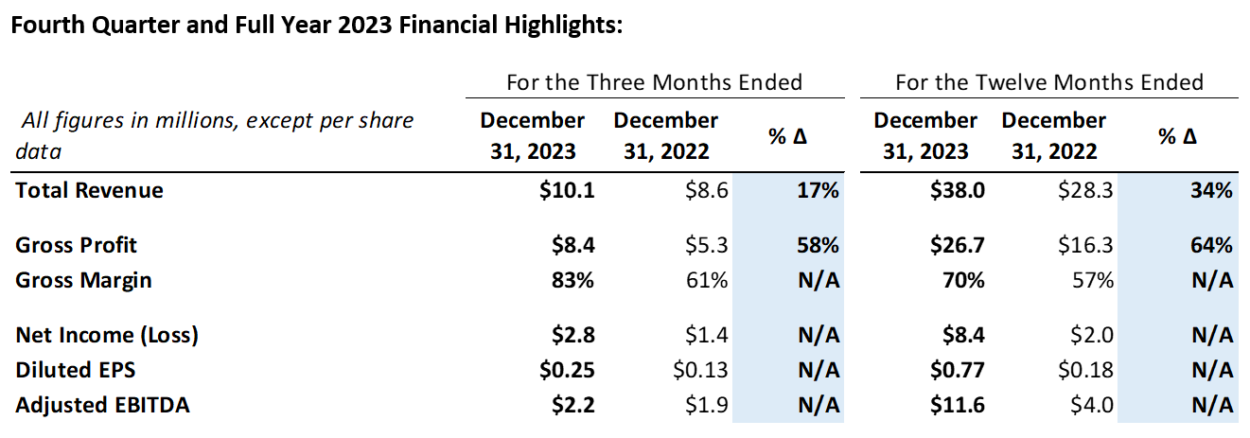

Fourth Quarter and Full Year 2023 Financial Highlights:

“2023 was a year of substantial transformation, which culminated in a strong fourth quarter with revenue of $10.1 million – our third double-digit million revenue quarter in 2023. This performance led to record-breaking annual revenue of $38.0 million, representing a 34% increase from 2022,” said VirTra CEO John Givens. “Our success has been the result of strategic changes we’ve implemented across our business, particularly in enhancing our internal operations. Last year, we successfully upgraded our machine shop and consolidated production into a single facility, implemented a new ERP system, and revised our processes for scalability, just to name a few of the operational strides we took. These actions have increased our throughput significantly and improved our book-to-ship ratio, all while reducing production costs and maintaining excellent product quality. We are now shipping orders that we receive within days instead of years, and we have set a solid foundation for future success as demand for our solutions continues to rise.”

“This strategic overhaul was instrumental in effectively working through the substantial backlog we faced entering 2023. With that backlog down to $19.4 million entering 2024, growing bookings and our pipeline will be critical to our growth trajectory going forward. To align more closely with future growth opportunities, we also restructured our sales team, introducing new methodologies, adopting a territory-based approach, and revising our compensation structure. We expect these adjustments to enhance our sales productivity and bolster our customer success functions.

“As our newly implemented sales strategies begin to take root, we expect that the technological innovations we made in 2023 will drive further interest from the core law enforcement market and the military sector. The introduction of V-XR®, our extended reality training platform, has been met with great interest, with a very positive market reception setting us up for strong delivery volume starting in the next few months. V-XR’s emphasis on training soft skills, such as managing mental health crises, is set to broaden our reach within our core target markets but also in wider settings, such as in hospitals and educational institutions. Additionally, to better serve military customers, we integrated VBS, a premier military software that facilitates the creation of real-time, geo-specific training into our simulators. Despite the typically longer sales cycles in the military market, our foothold is expanding ahead of schedule.

“Building on our operating momentum, we are moving into the second quarter with high confidence in our trajectory for continued growth for 2024.”

Fourth Quarter 2023 Financial Results

Total revenue increased 16% to $10.1 million from $8.7 million in the fourth quarter of 2022. The increase in revenue was driven by continued demand for training solutions with government customers, both domestically and internationally.

Gross profit increased 58% to $8.4 million from $5.3 million in the fourth quarter of 2022. Gross profit margin was 83%, an increase compared to 61% in the fourth quarter of 2022.

Net operating expense was $5.8 million, compared to $3.4 million in the fourth quarter of 2022. The increase in net operating expense was associated with additional staffing and the opening of the Company’s Orlando facility.

Operating income increased by $0.7 million to $2.6 million from $1.9 million in the fourth quarter of 2022.

Net income was $2.8 million, or $0.25 per diluted share (based on 11.0 million weighted average diluted shares outstanding), an improvement compared to net income of $1.4 million, or $0.13 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the fourth quarter of 2022.

Adjusted EBITDA, a non-GAAP metric, was $2.2 million, compared to $1.9 million in the fourth quarter of 2022.

Full Year 2023 Financial Results

Total revenue increased 34% to $38.0 million from $28.3 million in 2022. The increase in revenue was primarily the result of increases in simulator and accessory sales, STEP sales, and design and prototyping revenue.

Gross profit increased 64% to $26.7 million from $16.3 million in 2022. Gross profit margin was 70%, an increase compared to 57% in 2022. The increase in gross profit margin was primarily due to the aforementioned increase in revenue while maintaining cost of sales in line with 2022 levels. Also contributing to this increase was an unusual event of the Company’s receiving a $3 million kickoff milestone payment in connection with a contract for custom work, for which no significant costs were associated.

Net operating expense was $17.0 million in 2023, compared to $13.7 million in 2022. The increase in net operating expense was primarily driven by an increase in salaries and benefits resulting from the addition of new staff, expenses for the new Orlando office, as well as an increase in R&D spend, and the implementation expense related to the launch of the Company’s new ERP system.

Operating income jumped to $9.6 million in 2023, a $7.0 million increase from $2.6 million in the prior year period.

Net income was $8.4 million, or $0.77 per diluted share (based on 11.0 million weighted average diluted shares outstanding), an improvement compared to net income of $2.0 million, or $0.18 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in 2022.

Adjusted EBITDA, a non-GAAP metric, increased to $11.6 million from $4.06 million in 2022.

Financial Commentary

“In the fourth quarter we continued to grow our revenue while making improvements to our profitability metrics,” said VirTra CFO Alanna Boudreau. “The changes we’ve made internally to our operations have also had a significant effect on the margin growth we had in the fourth quarter and throughout the year. Based on our recent performance, we are expecting that our backlog will remain lower than past levels historically as we focus on continuing to improve our book-to-ship ratio moving forward. We anticipate continued revenue and profitability expansion as we move into additional markets outside of law enforcement in 2024.”

Conference Call

VirTra’s management will hold a conference call today (April 1, 2024) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s Chief Executive Officer John Givens and Chief Financial Officer Alanna Boudreau will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13743893

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through April 14, 2024.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13743893

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risks and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

– Financial Tables to Follow –

VIRTRA, INC.

CONDENSED BALANCE SHEETS

VIRTRA, INC.

CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

VIRTRA, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

CHANDLER, Ariz. — March 7, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators and firearms training simulators for the law enforcement and military markets, will be attending the 36th Annual ROTH Conference being held March 17-19, 2024 at The Ritz Carlton, Laguna Niguel located in Dana Point, CA.

VirTra management will hold one-on-one meetings with institutional investors and analysts throughout the conference. For additional information or to schedule a one-on-one meeting with VirTra management, please contact your Roth representative or VirTra’s investor relations team at [email protected].

About VirTra

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators and firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

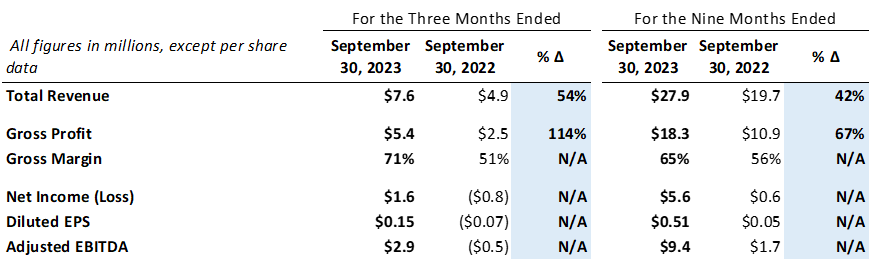

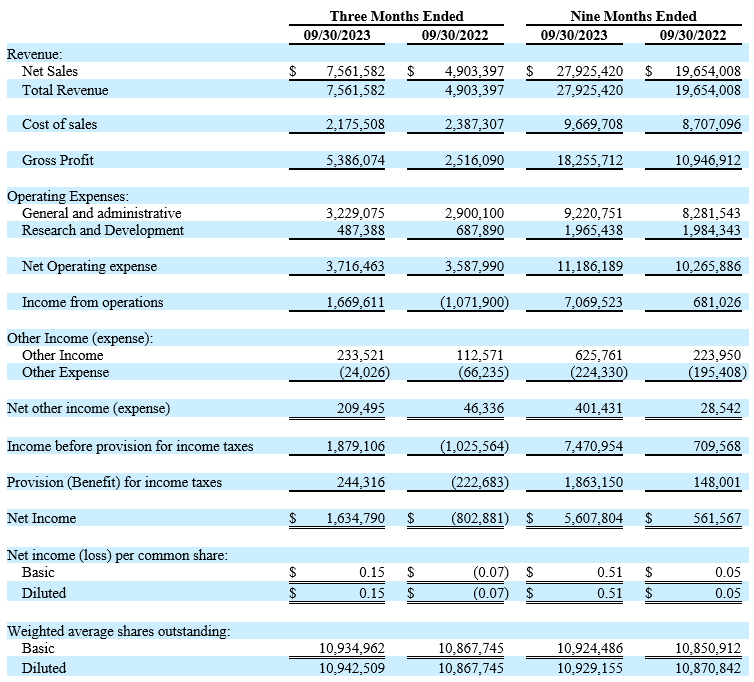

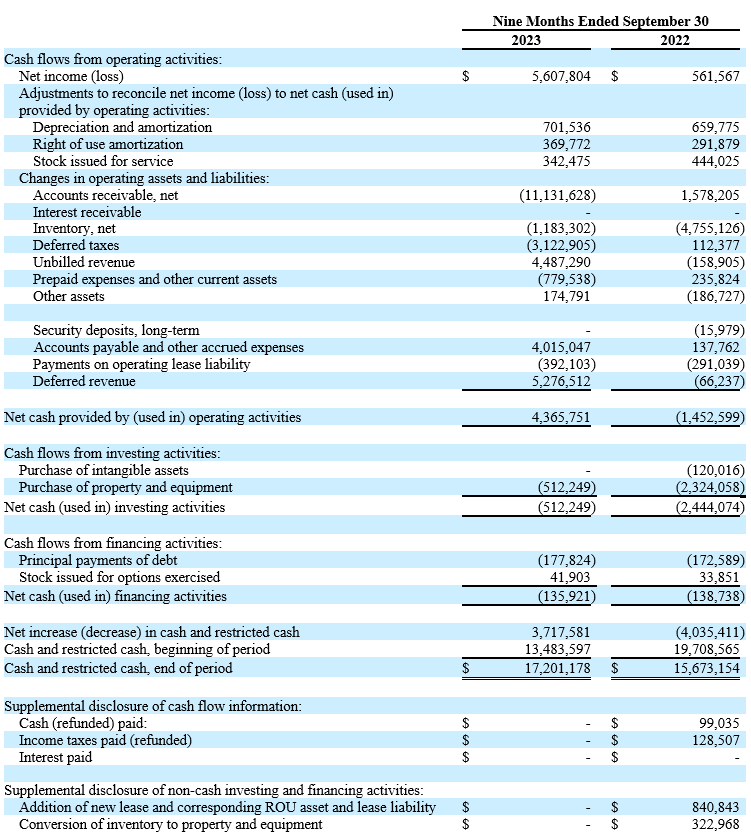

Quarterly Revenue Increases 54% Year-Over-Year to $7.6 Million

Quarterly Net Income Increases by $2.4 Million to $1.6 Million

CHANDLER, Ariz. — November 14, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the third quarter ended September 30, 2023. The financial statements are available on VirTra’s website and here.

Third Quarter 2023 Financial Highlights:

- Total revenue increased 54% to $7.6 million

- Gross profit increased 114% to $5.4 million, or 71% of total revenue

- Net income increased by $2.4 million to $1.6 million

- Adjusted EBITDA increased to $2.9 million

- Cash and cash equivalents of $17.2 million at September 30, 2023

Nine Month 2023 Financial Highlights:

- Total revenue increased 42% to $27.9 million

- Gross profit increased 67% to $18.3 million, or 65% of total revenue

- Net income increased by $5.0 million to $5.6 million

- Adjusted EBITDA increased to $9.4 million

Third Quarter and Nine Month 2023 Financial Highlights:

Management Commentary

“Building on our record-breaking first half, we’ve made further strides in improving our operations and sales activity this quarter, resulting in a robust 54% increase in quarterly revenue,” said VirTra CEO John Givens. “These ongoing improvements, with significant developments made in the third quarter, such as enhancing our production facility and focusing on our machine shop processes and equipment upgrades, are set to continue bearing fruit in future quarters. These efforts have not only accelerated manufacturing but also improved product quality, ultimately leading to higher customer satisfaction. With our significantly improved business operations, we are directing our attention towards increasing sales productivity, and we’re already realizing early progress.

“The changes we’ve made to our sales methodology, compensation, and territory structuring are set to deliver substantial results in the near term and will continue to compound over the coming years. As part of these sales enhancements, we’ve expanded our team to boost customer success and enable our salesforce to focus on driving new business. This concerted effort, combined with our sustained success in the law enforcement market and the solid early progress achieved in key military contracts, positions VirTra for strong, sustained growth in the long term.

“Furthermore, our focus on developing industry-leading technology continues to unlock long-term value. In Q3, we unveiled V-XR®, our extended reality training solution, to our product portfolio. This strategic addition prioritizes the development of essential interpersonal skills crucial for law enforcement professionals, enabling them to navigate sensitive situations, de-escalate conflicts, and build trust with their communities. By integrating soft skills training into our curriculum, we aim to provide law enforcement professionals with the tools and knowledge needed for more meaningful and effective community engagement. Emphasizing empathy, communication, and cultural awareness, V-XR® sets a new industry standard and maintains a competitive price point, making it accessible to law enforcement agencies, large and small. Strong pre-order demand signals its potential as a gateway to larger simulator sales. We’ve also streamlined aspects of our simulators, ensuring easier access to control computers while reducing assembly costs and time. These enhancements, combined with ongoing content updates, further solidify our position as the market leader in training technology.”

Third Quarter 2023 Financial Results

Total revenue increased 54% to $7.6 million from $4.9 million in the third quarter of 2022. The increase in revenue was driven by a continued improvement in sales strategy and continued demand for training solutions.

Gross profit increased 114% to $5.4 million from $2.5 million in the third quarter of 2022. Gross profit margin was 71%, an increase compared to 51% in the third quarter of 2022.

Net operating expense was $3.7 million, compared to $3.6 million in the third quarter of 2022. The slight increase in net operating expense was associated with additional staffing and the opening of our Orlando facility.

Operating income increased by $2.8 million to $1.7 million from $(1.1) million in the third quarter of 2022.

Net income was $1.6 million, or $0.15 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $(0.8) million, or $(0.07) per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the third quarter of 2022.

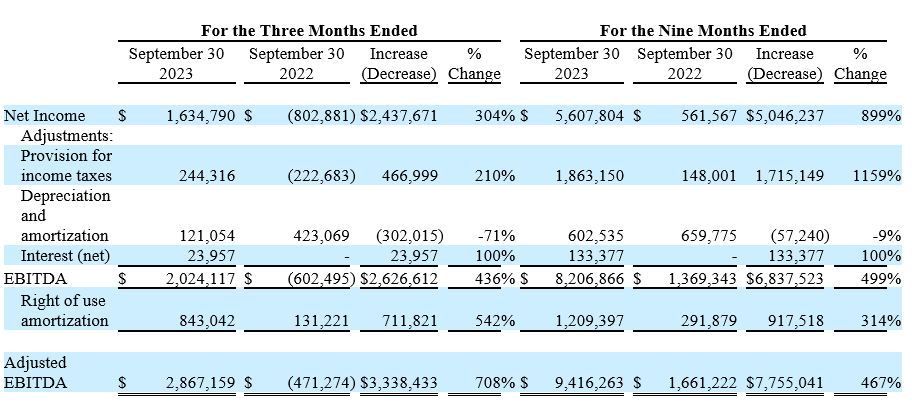

Adjusted EBITDA, a non-GAAP metric, increased to $2.9 million from $(0.5) million in the third quarter of 2022.

Nine Months Ended September 30, 2023 Financial Results

Total revenue increased 42% to $27.9 million from $19.7 million in the first nine months of 2022. The increase in revenue was driven by record first-half performance and continued improvement in sales strategy.

Gross profit increased 67% to $18.3 million from $10.9 million in the first nine months of 2022. Gross profit margin was 65%, an increase compared to 56% in the first nine months of 2022. The increase in gross profit margin was primarily due to the aforementioned increase in revenue while maintaining cost of sales in line with 2022 levels.

Net operating expense was $11.2 million, compared to $10.3 million in the first nine months of 2022. The increase in net operating expense was primarily driven by an increase in salaries and benefits resulting from the addition of new staff, expenses for the new Orlando office, as well as an increase in R&D spend, and the implementation expense related to the launch of the Company’s new ERP system.

Operating income jumped to $7.1 million in the first nine months of 2023, a $6.4 million increase from $0.7 million in the prior year period.

Net income was $5.6 million, or $0.51 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $0.6 million, or $0.05 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the first nine months of 2022.

Adjusted EBITDA, a non-GAAP metric, increased to $9.4 million from $1.7 million in the first nine months of 2022.

Financial Commentary

“The third quarter was highlighted by sustained revenue growth and significant profitability improvements,” said VirTra CFO Alanna Boudreau. “Our 71% gross margins reflect our commitment to managing cost of sales as we drive business expansion. Although we experienced a temporary slowdown in our bookings during Q3, partly due to a brief government shutdown, we expect them to rebound and accelerate as our sales initiatives gain further traction. Our pipeline continues to grow while our backlog remains heathy and will continue to provide our year-over-year revenue increase in the fourth quarter. Based on our excellent performance in the first nine months, we are very confident in surpassing our year-end targets for 2023, and we anticipate continued revenue and profitability expansion as we move into 2024.”

Conference Call

VirTra’s management will hold a conference call today (November 14, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s Chief Executive Officer John Givens, Chief Financial Officer Alanna Boudreau, and Executive Chairman Bob Ferris will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13742019

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through November 28, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13742019

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risks and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

– Financial Tables to Follow –

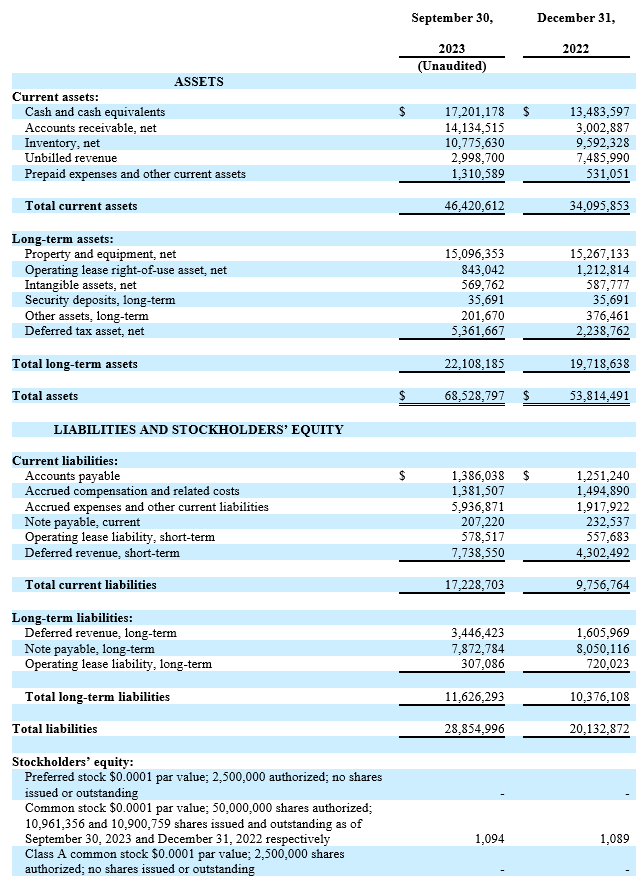

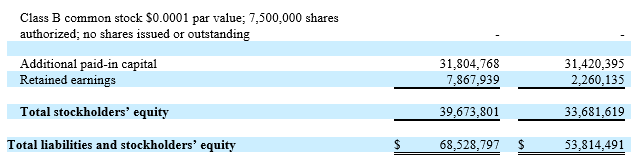

VIRTRA, INC.

CONDENSED BALANCE SHEETS

VIRTRA, INC.

CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

VIRTRA, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

CHANDLER, Ariz. — November 1, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra” or the “Company”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, will hold a conference call on Tuesday, November 14, 2023 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss its financial results for the third quarter ended September 30, 2023. Financial results will be issued in a press release prior to the call.

VirTra management will host the presentation, followed by a question-and-answer period.

Date: Tuesday, November 14, 2023

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: 1-877-407-9208

International dial-in: 1-201-493-6784

Conference ID: 13742019

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through November 28, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13742019

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

CHANDLER, Ariz. — September 19, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra” or the “Company”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, will hold its 2023 Annual Meeting of Shareholders virtually on Monday, October 23, 2023 at 4:30 p.m. Eastern Time (2:30 p.m. Mountain Time) and will be accessible via a live webcast here.

Shareholders of record at the close of business on August 28, 2023, will be entitled to vote. Proxy materials and voting instructions can be found on the investor relations section of the company’s website and here.

About VirTra

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

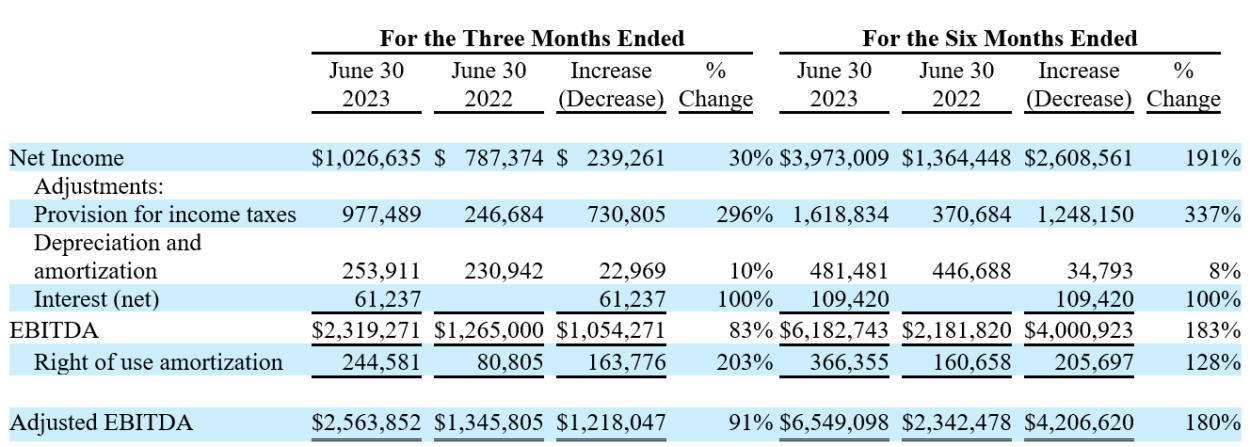

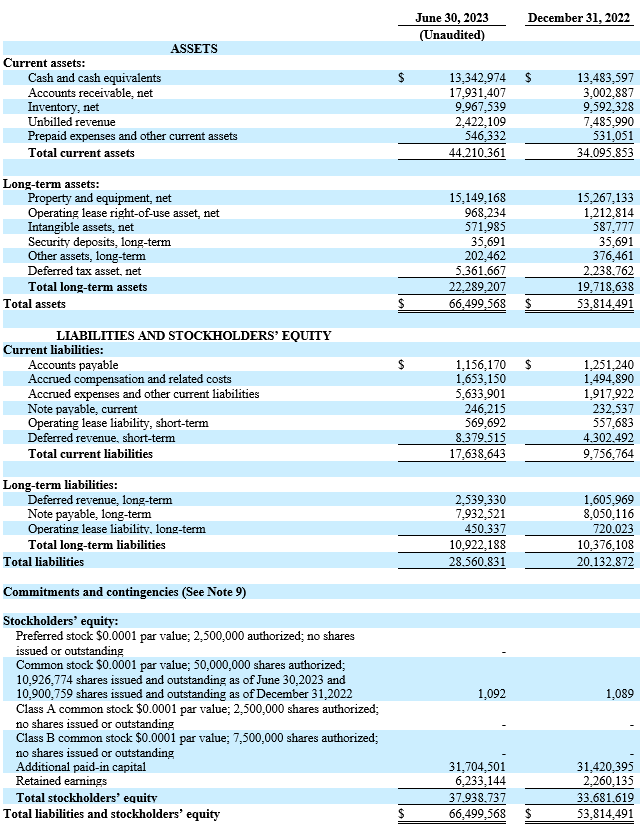

Record Quarterly and First Half Revenue of $10 Million and $20 Million, Up 29% and 38% Year-Over-Year, Respectively

Quarterly Net Income Increases by $239,000 to $1.0 Million

CHANDLER, Ariz. — August 14, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the second quarter ended June 30, 2023. The financial statements are available on VirTra’s website and here.

Second Quarter 2023 Financial Highlights:

- Total revenue increased 29% to a record $10.3 million

- Gross profit increased 25% to $5.9 million, or 57% of total revenue

- Net income increased by $0.2 million to $1.0 million

- Adjusted EBITDA increased to $2.6 million

- Cash and cash equivalents of $13.3 million at June 30, 2023

Six Month 2023 Financial Highlights:

- Total revenue increased 38% to $20.4 million

- Gross profit increased 53% to $12.9 million, or 63% of total revenue

- Net income increased by $2.6 million to $4.0 million

- Adjusted EBITDA increased to $6.5 million

Second Quarter and Six Month 2023 Financial Highlights:

Management Commentary

“Led by record-breaking revenue in the double-digit millions during the first two quarters of 2023, we have achieved the best bottom-line results in our 30-year history,” said Bob Ferris, chairman and co-CEO of VirTra. “This exceptional financial performance is a testament to the effectiveness of our internal process improvements and streamlined operations. To further solidify our market leadership and expand revenue streams, we continue to actively pursue additional product and content development initiatives to enhance VirTra’s already powerful training capabilities.”

John Givens, co-CEO of VirTra, added: “Our topline results reflect the transformation we have made in fulfillment efficiency, which serves as a key indicator of our scaling abilities and our long-term operational capabilities. We are now applying that same focus and tenacity by taking proactive measures to increase our bookings and maximize our market potential, both domestically and internationally. Our sales enhancement initiatives are already underway and coupled with our unwavering commitment to product quality and a customer-centric approach, we are advancing along our strategic roadmap while further optimizing our business operations to even greater profitability and efficiency in the years ahead.”

Second Quarter 2023 Financial Results

Total revenue increased 29% to $10.3 million from $8.0 million in the second quarter of 2022. The increase in revenue was driven by an improvement in operations which helped to move through backlog and ship orders at a record pace.

Gross profit increased 25% to $5.9 million from $4.7 million in the second quarter of 2022. Gross profit margin was 57%, a decrease compared to 59% in the second quarter of 2022. The decrease in gross margins resulted from one-time inventory adjustments made when we went live with our new ERP system, which had the effect of increasing the cost of sales in Q2 2023.

Net operating expense was $4.0 million, compared to $3.7 million in the second quarter of 2022. The increase in net operating expense was associated with salary and benefits increase and the Orlando office expenses.

Operating income increased by $0.9 million to $1.9 million from $1.0 million in the second quarter of 2022.

Net income was $1.0 million, or $0.09 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $0.8 million, or $0.07 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the second quarter of 2022.

Adjusted EBITDA, a non-GAAP metric, increased to $2.6 million from $1.3 million in the second quarter of 2022.

Six Months Ended June 30, 2023 Financial Results

Total revenue increased 38% to $20.4 million from $14.8 million in the first six months of 2022. The increase in revenue was driven by improvements in operations, which helped the Company to move through the backlog and ship orders at a record pace.

Gross profit increased 53% to $12.9 million from $8.4 million in the first six months of 2022. Gross profit margin was 63%, an increase compared to 57% in the first half of 2022. The increase in gross profit margin was primarily due to the aforementioned increase in revenue while maintaining cost of sales in line with 2022 levels.

Net operating expense was $7.5 million, compared to $6.7 million in the first six months of 2022. The increase in net operating expense was primarily due to an increase in salaries and benefits due to additional staff and the expenses for the new Orlando office, as well as an increase in R&D spend.

Operating income jumped to $5.4 million, a $3.6 increase from $1.8 million in the prior year period.

Net income was $4.0 million, or $0.36 per diluted share (based on 10.9 million weighted average diluted shares outstanding), an improvement compared to net income of $1.4 million, or $0.13 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the first half of 2022.

Adjusted EBITDA, a non-GAAP metric, increased to $6.5 million from $2.3 million in the first six months of 2022.

Financial Commentary

“The strong first half results underscore the successful execution of our growth and profitability initiatives,” said CFO Alanna Boudreau. “Achieving a robust gross profit margin of 63%, we exemplify our dedication to maintaining cost of sales while effectively selling a favorable mix of simulators, accessories, and services. Our record net income of $4.0 million and adjusted EBITDA of $6.5 million demonstrate the leverage in our model and our ability to effectively manage expenses. As we progress into the second half of the year with a markedly lower backlog of $16.4 million, we’ve clearly proven our new and enhanced ability to promptly fulfill orders. Simultaneously, it presents a challenge that encourages us to continue operating efficiently as we proactively optimize our sales pipeline. These efforts, combined with the impressive first half performance, set us well on pace to exceed our targets for the year.”

Conference Call

VirTra’s management will hold a conference call today (August 14, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s chairman and co-CEO, Bob Ferris, co-CEO John Givens and Chief Financial Officer Alanna Boudreau, will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13739497

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through August 28, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13739497

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

-Financial Tables to Follow-

VIRTRA, INC.

CONDENSED BALANCE SHEETS

VIRTRA, INC.

CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

VIRTRA, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

CHANDLER, Ariz. — July 31, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra” or the “Company”), a global provider of judgmental use of force training simulators, and firearms training simulators for the law enforcement and military markets, will hold a conference call on Monday, August 14, 2023 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss its financial results for the second quarter ended June 30, 2023. Financial results will be issued in a press release prior to the call.

VirTra management will host the presentation, followed by a question-and-answer period.

Date: Monday, August 14, 2023

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: 1-877-407-9208

International dial-in: 1-201-493-6784

Conference ID: 13739497

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through August 28, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13739497

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators and firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover and Tom Colton

Gateway Group, Inc.

949-574-3860

CHANDLER, Ariz. — May 15, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the first quarter ended March 31, 2023. The financial statements are available on VirTra’s website and here.

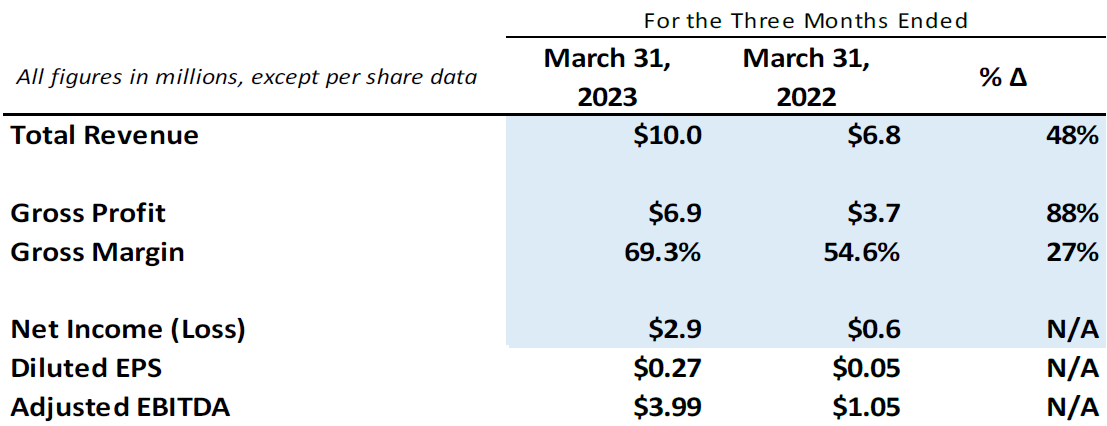

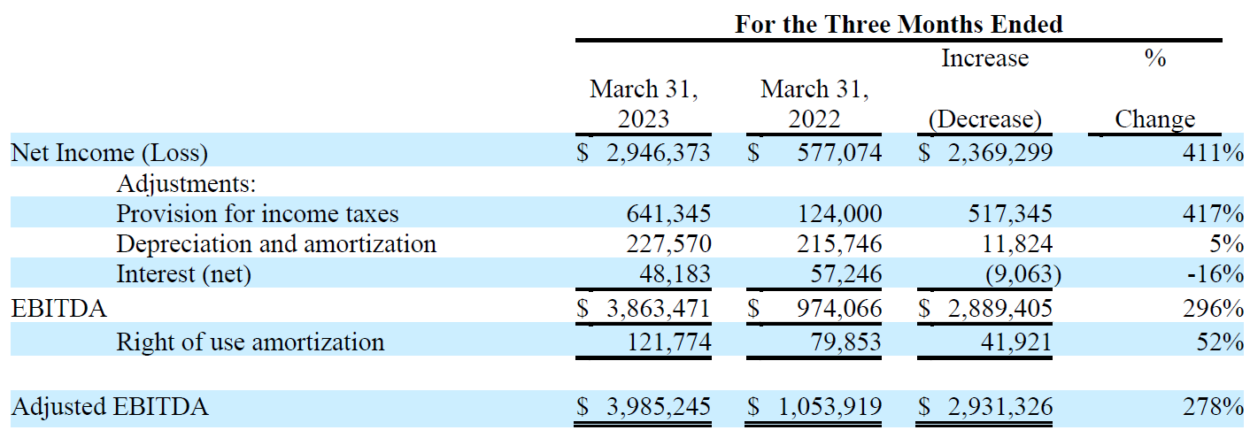

First Quarter 2023 Financial Summary:

- Total revenue increased 48% to a record $10.0 million

- Gross profit increased 88% to $6.9 million, or 69% of total revenue

- Net income increased by $2.4 million to $2.9 million

- Adjusted EBITDA increased to $4.0 million

- Improved strong balance sheet with cash and cash equivalents of $14.3 million at March 31, 2023

First Quarter 2023 Financial Highlights:

Management Commentary

“Coming off our 17th consecutive year of revenue growth in 2022, in Q1 we worked from our record backlog to deliver VirTra’s first ever quarterly revenue performance in the double-digit millions,” said Bob Ferris, chairman and co-CEO of VirTra. “Simultaneously, our actions to improve internal processes and streamline the overall business have significantly enhanced the efficiency of our operations, leading to the strongest bottom-line performance in the Company’s history. To build on our market-leading position and expand our revenue pathways, we are pursuing additional product and content development to make VirTra’s training capabilities even stronger.”

John Givens, co-CEO of VirTra added: “We remain committed to optimizing our business operations and driving profitability while ramping up our sales efforts as we move into the second quarter and beyond. While we are making strides in clearing our backlog and fulfilling orders more efficiently, we recognize that there are still many untapped opportunities in the market, both domestic and international. To capitalize on this potential, we are implementing sales initiatives to maximize our market penetration and prioritize areas with the greatest growth potential. We are focused on continued success in the coming quarters as we execute our growth strategies.”

First Quarter 2023 Financial Results

Total revenue increased 48% to $10.0 million from $6.8 million in the first quarter of 2022. The increase in revenue was the result of the deliveries of two major government contracts and one large international contract.

Gross profit increased 88% to $6.9 million from $3.7 million in the first quarter of 2022. Gross profit margin, defined as total revenue less cost of sales, was 69.3%, an improvement compared to 54.6% in the first quarter of 2022. The increase in gross profit was primarily due to the increased sales achieved while maintaining cost of sales in line with 2022 levels. The increased gross margins resulted from the favorable product mix of systems, accessories and services sold in the quarter.

Net operating expense was $3.5 million, compared to $3.0 million in the first quarter of 2022. The increase in net operating expenses was due to increased R&D expenses additional costs related to the Orlando facility and one-time costs in payroll and related expenses.

Operating income increased by $2.8 million to $3.5 million from $0.7 million in the first quarter of 2022.

Net income was $2.9 million, or $0.27 per diluted share (based on 10.9 million weighted average diluted shares outstanding), compared to net income of $0.6 million, or $0.05 per diluted share (based on 10.8 million weighted average diluted shares outstanding), in the first quarter of 2022.

Adjusted EBITDA, a non-GAAP metric, increased to $4.0 million from $1.0 million in the first quarter of 2022.

Financial Commentary

“Our first quarter financial results represent vast year-over-year improvements and demonstrate the success of our ongoing efforts to drive growth and profitability,” said CFO Alanna Boudreau. “We achieved a strong gross profit margin of 69%, a reflection of our focus on maintaining cost of sales while effectively selling a favorable mix of simulators, accessories, and services. Our record net income of $2.9 million and adjusted EBITDA of $4.0 million highlight our ability to execute even amidst operational transformations. These strong results put us on track to meet our financial targets for 2023 and position us well for continued success in the law enforcement and military simulator markets.”

Conference Call

VirTra’s management will hold a conference call today (May 15, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s chairman and co-CEO, Bob Ferris, co-CEO John Givens and Chief Financial Officer Alanna Boudreau, will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13738125

–

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast simultaneously and is available for replay here and via the investor relations section of the company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through May 29, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13738125

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Tom Colton

Gateway Group, Inc.

949-574-3860

VirTra, Inc.

Condensed Balance Sheets

VirTra, Inc.

Condensed Statements of Operations

(Unaudited)

VirTra, Inc.

Condensed Statements of Cash Flows

(Unaudited)

CHANDLER, Ariz. — May 1, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra” or the “Company”), a global provider of judgmental use of force training simulators, and firearms training simulators for the law enforcement and military markets, will hold a conference call on Monday, May 15, 2023 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss its financial results for the first quarter ended March 31, 2023. Financial results will be issued in a press release prior to the call.

VirTra management will host the presentation, followed by a question-and-answer period.

Date: Monday, May 15, 2023

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: 1-877-407-9208

International dial-in: 1-201-493-6784

Conference ID: 13738125

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through May 29, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13738125

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover and Tom Colton

Gateway Group, Inc.

949-574-3860