Annual Revenue Grows to a Record $38.0 Million, Marking a 34% Increase

Net Income Increases to $8.4 Million in 2023

CHANDLER, Ariz. — April 1, 2024 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the fourth quarter and full year ended December 31, 2023. The financial statements are available on VirTra’s website and here.

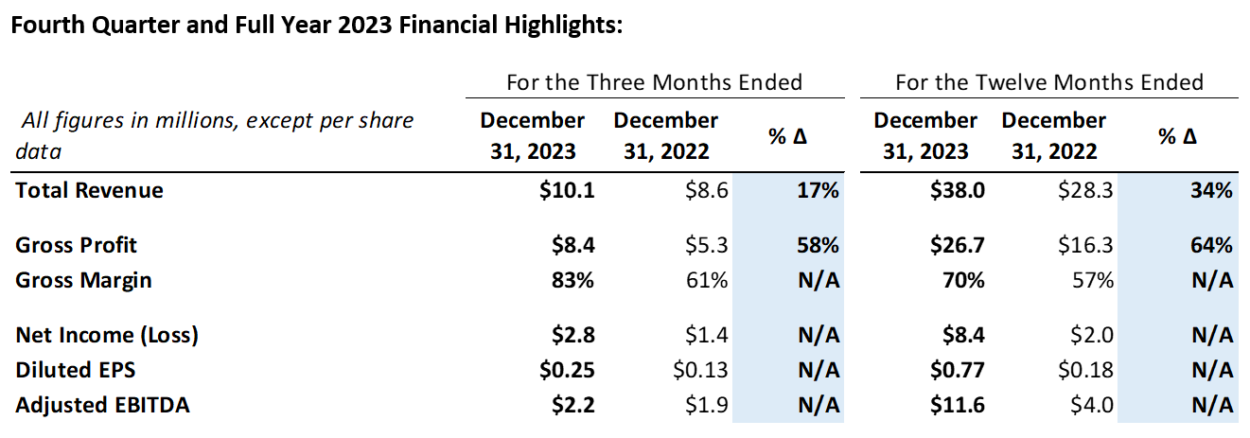

Fourth Quarter 2023 Financial Summary:

- Total revenue increased 17% year-over-year to $10.1 million

- Gross profit increased 58% year-over-year to $8.4 million, or 83% of total revenue

- Net income increased by $1.4 million year-over-year to $2.8 million

- Adjusted EBITDA totaled $2.2 million

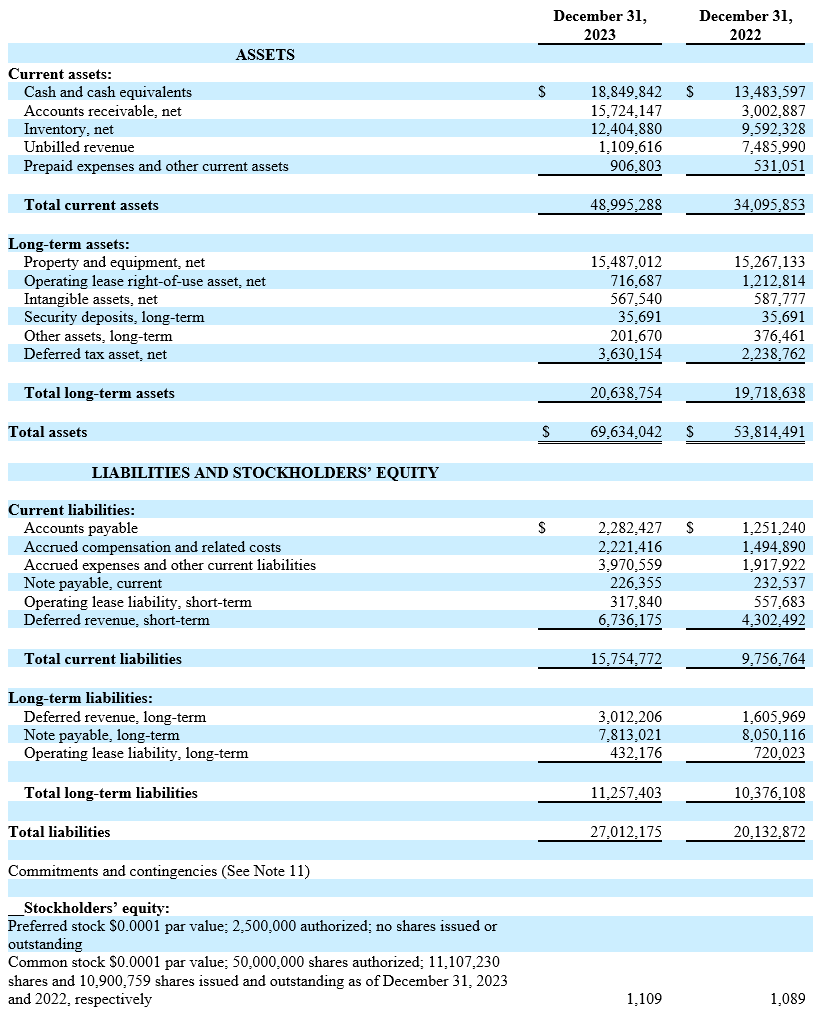

- Cash and cash equivalents of $18.9 million at December 31, 2023

Full Year 2023 Financial Summary:

- Total revenue increased 34% to $38.0 million

- Gross profit increased 64% to $26.7 million, or 70% of total revenue

- Net income increased by $6.4 million to $8.4 million

- Adjusted EBITDA totaled $11.6 million

Fourth Quarter and Full Year 2023 Financial Highlights:

“2023 was a year of substantial transformation, which culminated in a strong fourth quarter with revenue of $10.1 million – our third double-digit million revenue quarter in 2023. This performance led to record-breaking annual revenue of $38.0 million, representing a 34% increase from 2022,” said VirTra CEO John Givens. “Our success has been the result of strategic changes we’ve implemented across our business, particularly in enhancing our internal operations. Last year, we successfully upgraded our machine shop and consolidated production into a single facility, implemented a new ERP system, and revised our processes for scalability, just to name a few of the operational strides we took. These actions have increased our throughput significantly and improved our book-to-ship ratio, all while reducing production costs and maintaining excellent product quality. We are now shipping orders that we receive within days instead of years, and we have set a solid foundation for future success as demand for our solutions continues to rise.”

“This strategic overhaul was instrumental in effectively working through the substantial backlog we faced entering 2023. With that backlog down to $19.4 million entering 2024, growing bookings and our pipeline will be critical to our growth trajectory going forward. To align more closely with future growth opportunities, we also restructured our sales team, introducing new methodologies, adopting a territory-based approach, and revising our compensation structure. We expect these adjustments to enhance our sales productivity and bolster our customer success functions.

“As our newly implemented sales strategies begin to take root, we expect that the technological innovations we made in 2023 will drive further interest from the core law enforcement market and the military sector. The introduction of V-XR®, our extended reality training platform, has been met with great interest, with a very positive market reception setting us up for strong delivery volume starting in the next few months. V-XR’s emphasis on training soft skills, such as managing mental health crises, is set to broaden our reach within our core target markets but also in wider settings, such as in hospitals and educational institutions. Additionally, to better serve military customers, we integrated VBS, a premier military software that facilitates the creation of real-time, geo-specific training into our simulators. Despite the typically longer sales cycles in the military market, our foothold is expanding ahead of schedule.

“Building on our operating momentum, we are moving into the second quarter with high confidence in our trajectory for continued growth for 2024.”

Fourth Quarter 2023 Financial Results

Total revenue increased 16% to $10.1 million from $8.7 million in the fourth quarter of 2022. The increase in revenue was driven by continued demand for training solutions with government customers, both domestically and internationally.

Gross profit increased 58% to $8.4 million from $5.3 million in the fourth quarter of 2022. Gross profit margin was 83%, an increase compared to 61% in the fourth quarter of 2022.

Net operating expense was $5.8 million, compared to $3.4 million in the fourth quarter of 2022. The increase in net operating expense was associated with additional staffing and the opening of the Company’s Orlando facility.

Operating income increased by $0.7 million to $2.6 million from $1.9 million in the fourth quarter of 2022.

Net income was $2.8 million, or $0.25 per diluted share (based on 11.0 million weighted average diluted shares outstanding), an improvement compared to net income of $1.4 million, or $0.13 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in the fourth quarter of 2022.

Adjusted EBITDA, a non-GAAP metric, was $2.2 million, compared to $1.9 million in the fourth quarter of 2022.

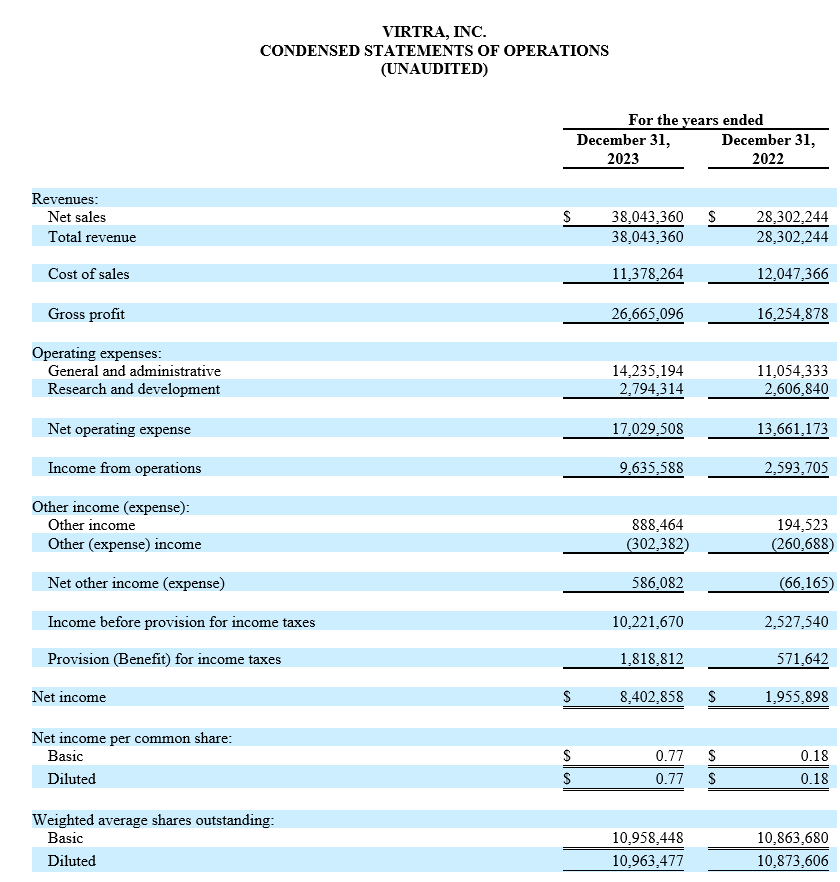

Full Year 2023 Financial Results

Total revenue increased 34% to $38.0 million from $28.3 million in 2022. The increase in revenue was primarily the result of increases in simulator and accessory sales, STEP sales, and design and prototyping revenue.

Gross profit increased 64% to $26.7 million from $16.3 million in 2022. Gross profit margin was 70%, an increase compared to 57% in 2022. The increase in gross profit margin was primarily due to the aforementioned increase in revenue while maintaining cost of sales in line with 2022 levels. Also contributing to this increase was an unusual event of the Company’s receiving a $3 million kickoff milestone payment in connection with a contract for custom work, for which no significant costs were associated.

Net operating expense was $17.0 million in 2023, compared to $13.7 million in 2022. The increase in net operating expense was primarily driven by an increase in salaries and benefits resulting from the addition of new staff, expenses for the new Orlando office, as well as an increase in R&D spend, and the implementation expense related to the launch of the Company’s new ERP system.

Operating income jumped to $9.6 million in 2023, a $7.0 million increase from $2.6 million in the prior year period.

Net income was $8.4 million, or $0.77 per diluted share (based on 11.0 million weighted average diluted shares outstanding), an improvement compared to net income of $2.0 million, or $0.18 per diluted share (based on 10.9 million weighted average diluted shares outstanding), in 2022.

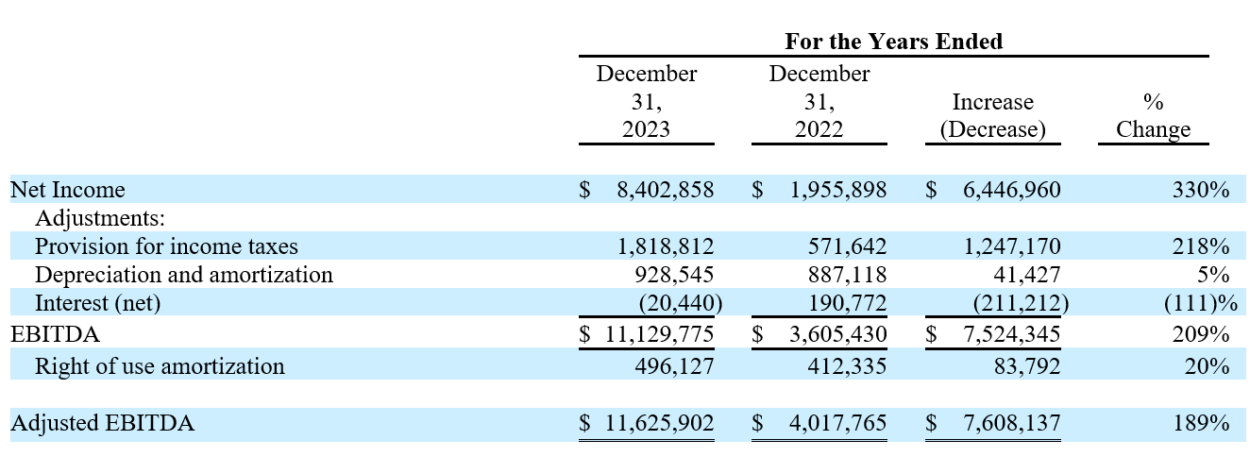

Adjusted EBITDA, a non-GAAP metric, increased to $11.6 million from $4.06 million in 2022.

Financial Commentary

“In the fourth quarter we continued to grow our revenue while making improvements to our profitability metrics,” said VirTra CFO Alanna Boudreau. “The changes we’ve made internally to our operations have also had a significant effect on the margin growth we had in the fourth quarter and throughout the year. Based on our recent performance, we are expecting that our backlog will remain lower than past levels historically as we focus on continuing to improve our book-to-ship ratio moving forward. We anticipate continued revenue and profitability expansion as we move into additional markets outside of law enforcement in 2024.”

Conference Call

VirTra’s management will hold a conference call today (April 1, 2024) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s Chief Executive Officer John Givens and Chief Financial Officer Alanna Boudreau will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13743893

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website.

A replay of the call will be available after 7:30 p.m. Eastern time on the same day through April 14, 2024.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13743893

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

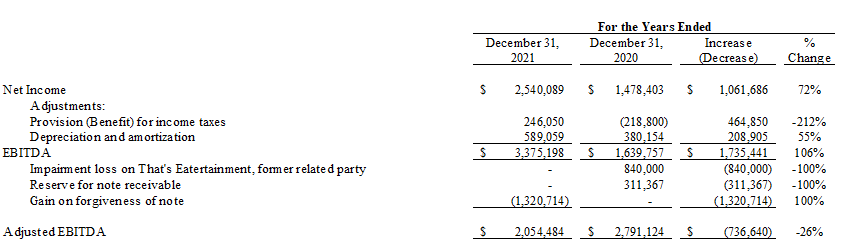

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risks and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Alec Wilson

Gateway Group, Inc.

949-574-3860

– Financial Tables to Follow –

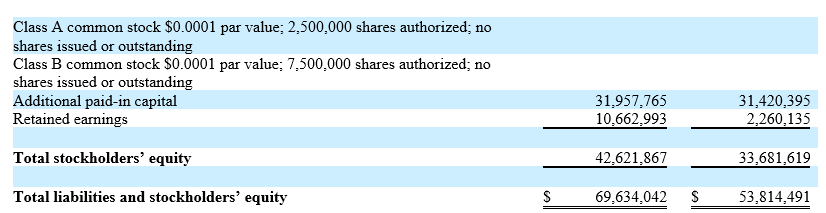

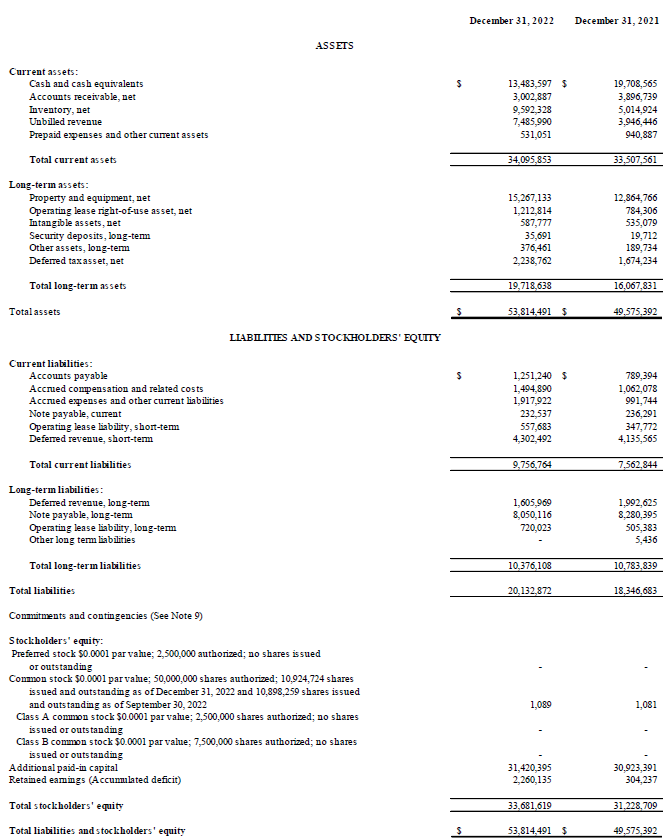

VIRTRA, INC.

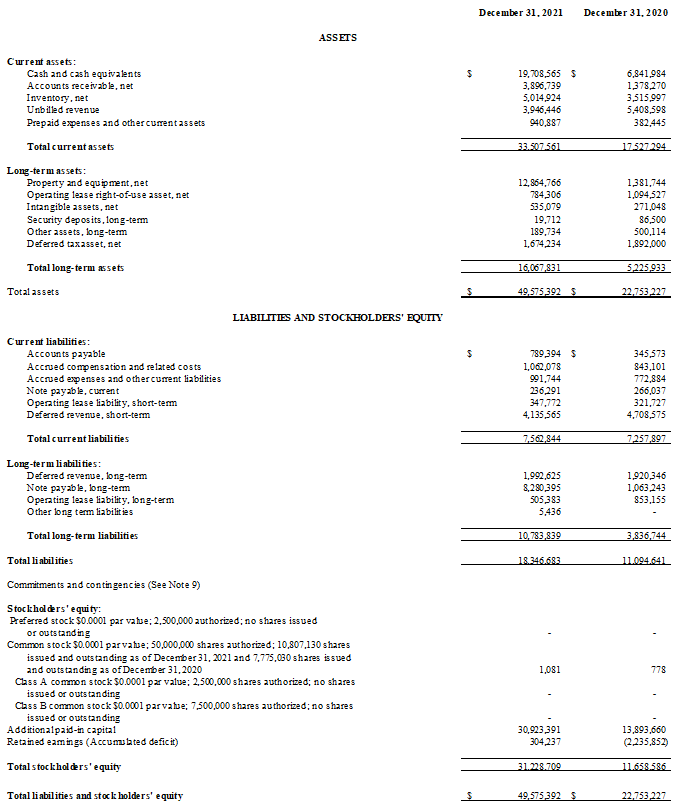

CONDENSED BALANCE SHEETS

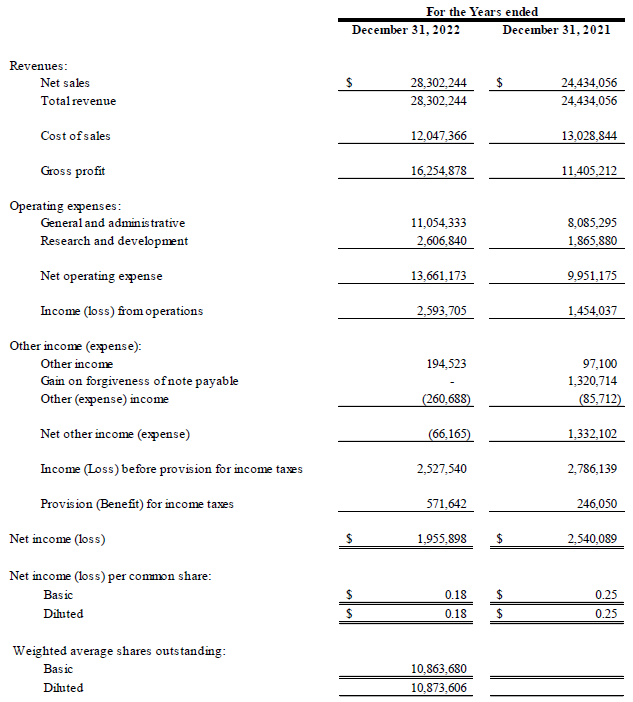

VIRTRA, INC.

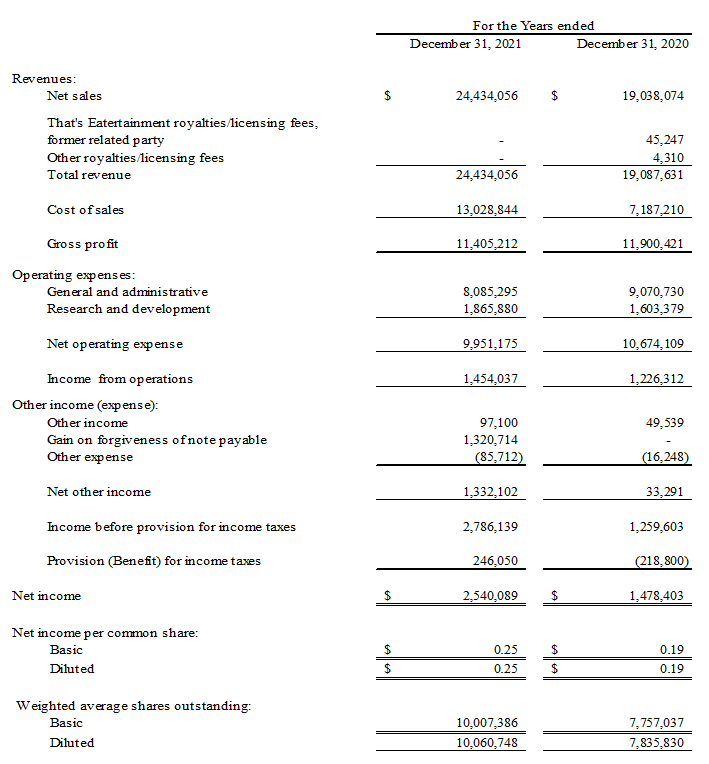

CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

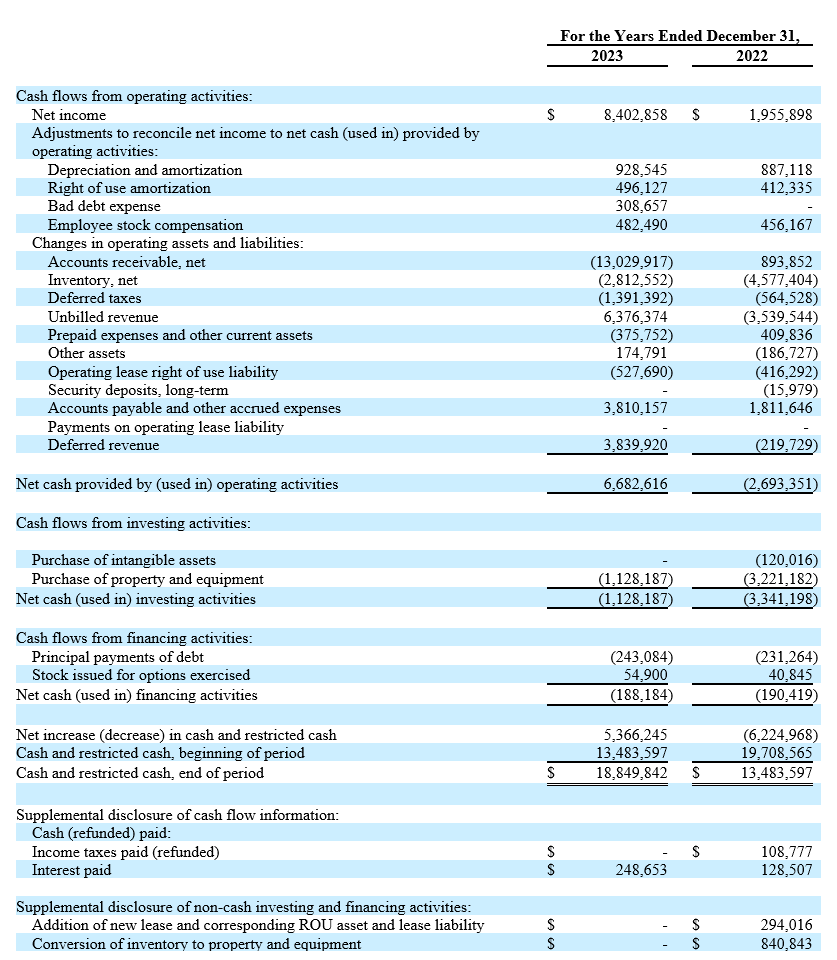

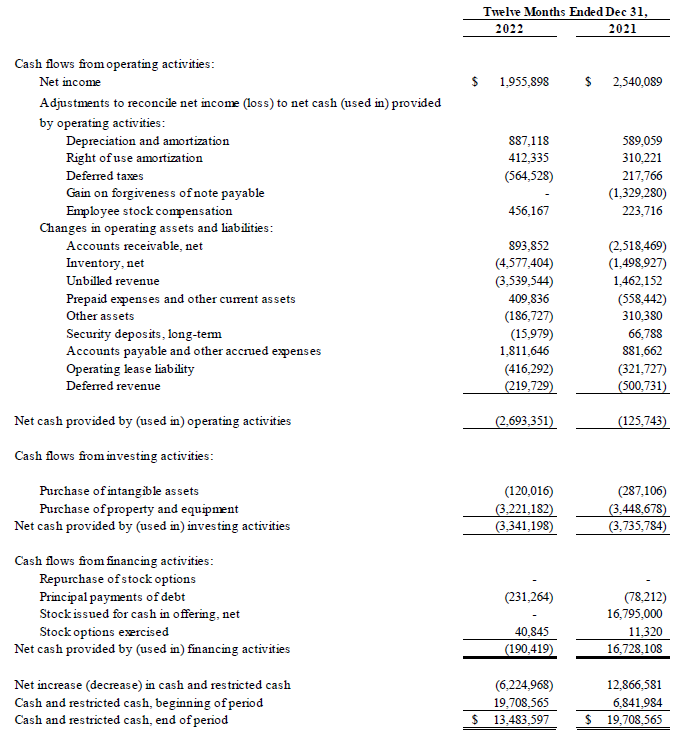

VIRTRA, INC.

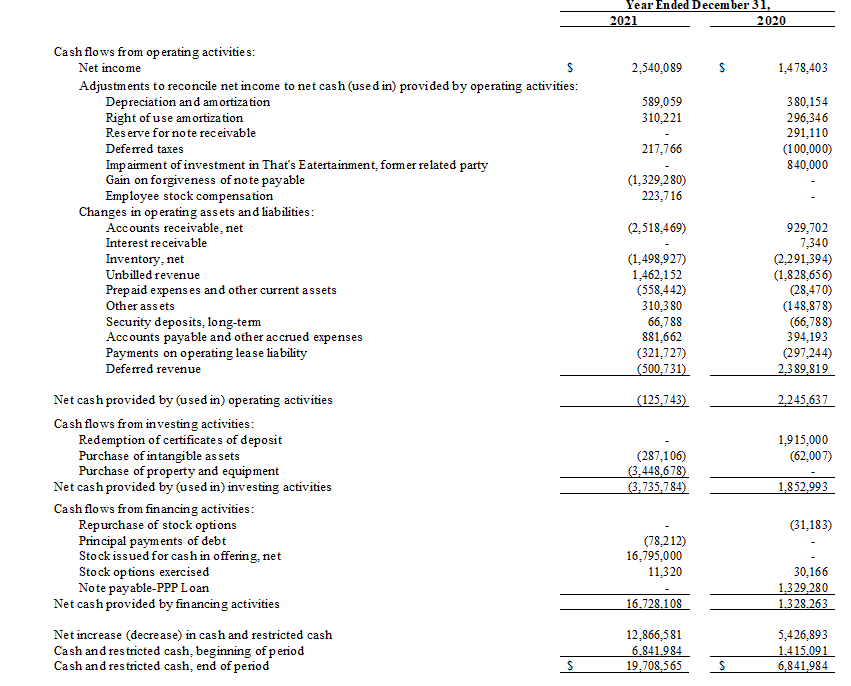

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

16% Revenue Growth for Full Year 2022; Ended the Year with Record Backlog of $27.7 Million

CHANDLER, Ariz. — March 31, 2023 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the fourth quarter and full year ended December 31, 2022. The financial statements are available on VirTra’s website and here.

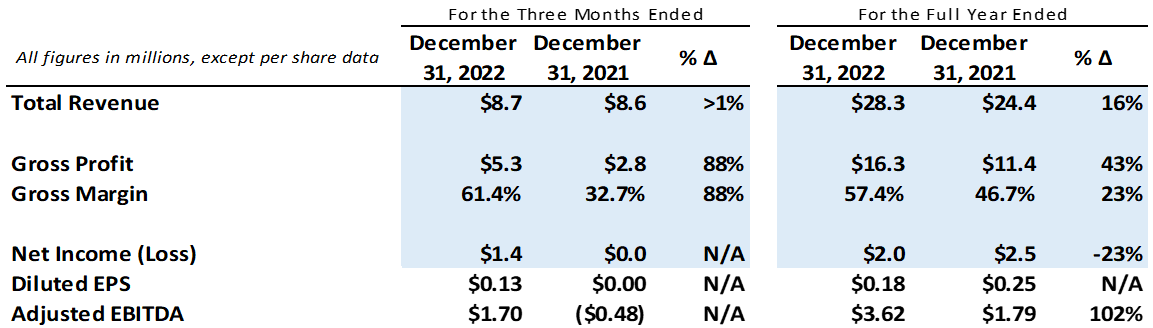

Fourth Quarter 2022 and Full Year 2022 Highlights:

- Bookings of $6.4 million in the fourth quarter of 2022 and $33.0 million for 2022.

- Record backlog at December 31, 2022 of $27.7 million, 20% higher than prior year comparable period.

- Launched operations at a new facility in Orlando, Florida to support strategic growth in military end-market.

- Maintained a strong balance sheet with cash and cash equivalents of $13.5 million at year end.

Fourth Quarter 2022 Financial Summary:

- Total revenue was $8.7 million

- Gross profit was $5.3 million, or 61% of total revenue

- Net income was $1.4 million

- Adjusted EBITDA totaled $1.7 million

Full Year 2022 Financial Summary:

- Total revenue increased 16% to $28.3 million

- Gross profit was $16.3 million, or 57% of total revenue

- Net income was $2.0 million

- Adjusted EBITDA totaled $3.6 million

Fourth Quarter and Full Year 2022 Financial Highlights:

Management Commentary

“Our strong performance in 2022 was the result of continued execution against our business strategy as we generated record revenue and bookings and delivered another period of solid profitability,” said Bob Ferris, chairman and co-CEO of VirTra. “During the year, we made aggressive investments to expand the breadth and effectiveness of our training offerings, including launching VirTra Volumetric Video, a breakthrough technology that has the potential to provide a step-function change in training content. Operationally, we successfully centralized and expanded our Arizona headquarters, opened a new facility in Orlando to support our military growth opportunities, as well as implemented a new ERP system to prepare for greater scale with an eye to improve efficiencies.”

John Givens, co-CEO of VirTra added: “Looking ahead, our operational and technological advancements in 2022 have bolstered our competitive positioning and placed us on a solid growth trajectory for the years ahead. The growing demand and constructive funding environment for VirTra’s innovative trainings solutions gives us confidence in our ability to capitalize on the robust pipeline of opportunities in both the law enforcement and military markets.”

Fourth Quarter 2022 Financial Results

Total revenue was $8.7 million, compared to $8.6 million in the fourth quarter of 2021. The slight increase in revenue was the result of increases in STEP sales, simulator sales, accessories, curriculum and training, and recurring extended warranty revenue, driven by the law enforcement market.

Gross profit was $5.3 million, an improvement compared to $2.8 million in the fourth quarter of 2021. Gross profit margin, defined as total revenue less cost of sales, was 61.4%, an improvement compared to 32.7% in the fourth quarter of 2021. The increase in gross profit was primarily due to lower cost of goods sold and the favorable product mix of systems, accessories and services sold in the quarter.

Net operating expense was $3.4 million, compared to $3.0 million in the fourth quarter of 2021. The increase in net operating expenses was due to increased sales and marketing spend from increased participation in industry trade shows, as well as increases in R&D expenses and an increase in one-time costs related to facility moves.

Operating income (loss) totaled $1.9 million, compared to $(0.2) million in operating income the fourth quarter of 2021.

Net income totaled $1.4 million, or $0.13 per diluted share (based on 10.9 million weighted average diluted shares outstanding), compared to net income of $13,000, or $0.00 per diluted share (based on 10.1 million weighted average diluted shares outstanding), in the fourth quarter of 2021.

Adjusted EBITDA, a non-GAAP metric, totaled $1.7 million, compared to $0.5 million in the fourth quarter of 2021.

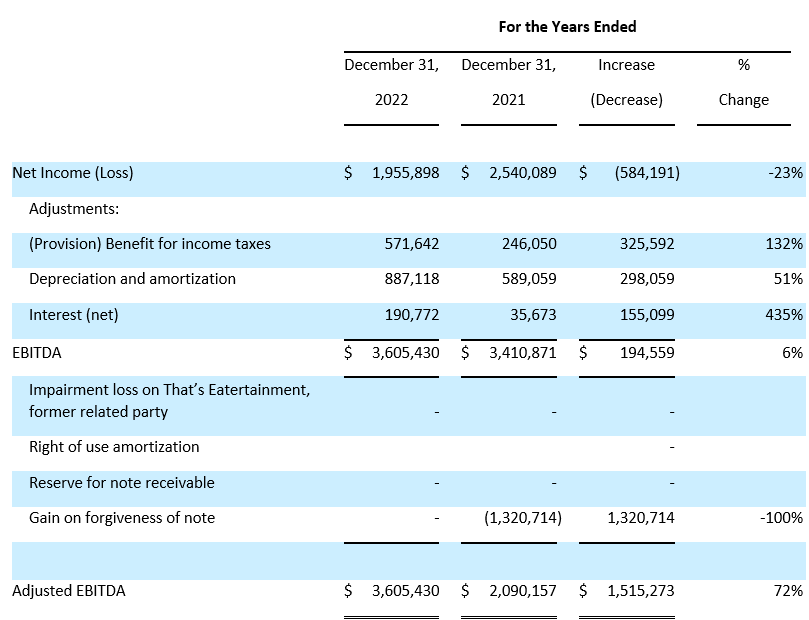

Full Year 2022 Financial Results

Total revenue increased 16% to $28.3 million from $24.4 million in 2021. The increase in revenue was the result of increases in STEP sales, simulator sales, accessories, curriculum and training, and recurring extended warranty revenue in 2022.

Gross profit was $16.3 million, compared to $11.4 million in 2021, representing an increase of 43%. Gross profit margin, defined as total revenue less cost of sales, was 57.4%, compared to 46.7% for the fiscal year of 2021. The increase in gross profit was primarily due to the increase in simulator system sales and recurring STEP revenue that helped to increase revenue while decreasing cost of goods sold.

Net operating expense was $13.7 million, compared to $10.0 million for the fiscal year of 2021. The increase was the result of increases research and development expenses and general and administrative expenses. General and administrative expense increases were driven by an increase in marketing expenses associated with attendance at tradeshows, which began to open back up in 2022 as well as costs related to the moving of facilities and opening the new facility in Orlando.

Operating income increased 78% to $2.6 million, compared to $1.5 million in 2021.

Net income totaled $2.0 million, or $0.18 per basic and diluted share (based on 10.9 million weighted average basic shares and 10.9 million weighted average diluted shares outstanding), compared to net income of $2.5 million, or $0.26 per basic and $0.25 per diluted share (based on 9.7 million weighted average basic and $10.1 million diluted shares outstanding) in 2021. The decrease in net income includes a $1.3 million impact from PPP loan forgiveness in 2021. Without the PPP forgiveness in 2021, net income in 2022 would have increased 60% year-over-year from 2021.

Adjusted EBITDA, a non-GAAP metric, totaled $3.6 million, compared to $2.1 million in 2021.

Financial Commentary

“In 2022, VirTra grew revenue for the 17th consecutive year on its way to expanding gross profit margins over 57% and improving operating income by over $1 million,” added CFO Alanna Boudreau “The Company’s ability to grow profitability amidst operational transformations accentuates the strength of our business model and VirTra’s growing role in the law enforcement and military simulator markets. We rounded out the year with a solid bottom line performance, recording operating income of $1.9 million and net income of $1.4 million in the fourth quarter. Entering 2023, we have a meaningful set of opportunities, as we exited 2022 with record bookings of $33.0 million and a record backlog of $27.7 million.”

Conference Call

VirTra’s management will hold a conference call today (March 31, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s chairman and co-CEO, Bob Ferris, co-CEO John Givens and Chief Financial Officer Alanna Boudreau, will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13736693

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast simultaneously and is available for replay here and via the investor relations section of the company’s website.

A replay of the call will be available after 8:30 p.m. Eastern time on the same through April 14, 2023.

U.S. replay dial-in: 1-844-512-2921

International replay dial-in: 1-412-317-6671

Replay ID: 13736693

About VirTra, Inc.

VirTra (Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Tom Colton

Gateway Group, Inc.

949-574-3860

VirTra, Inc.

Condensed Balance Sheets

VirTra, Inc.

Condensed Statements of Operations

VirTra, Inc.

Condensed Statements of Cash Flows

VirTra Reports Fourth Quarter and Full Year 2021 Financial Results

28% Revenue Growth for Full Year 2021; Ended the Year with Record Backlog of $23.1 Million

CHANDLER, Ariz. — August 2, 2022 — VirTra, Inc. (NASDAQ: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement and military markets, reported results for the fourth quarter and full year ended December 31, 2022. The financial statements are available on VirTra’s website and here.

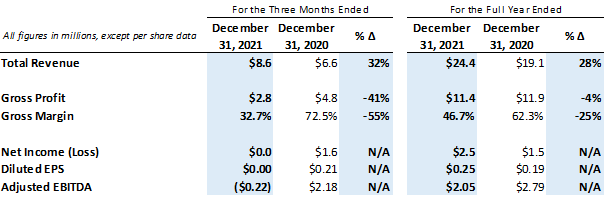

Fourth Quarter 2021 and Full Year 2021 Highlights:

- Bookings of $8.4 million in the fourth quarter of 2021 and $32.9 million in full year 2021, representing growth of 53% and 44% from the prior year comparable periods, respectively

- Record backlog at December 31, 2021 of $23.1 million, 58% higher than December 31, 2020

- Purchased industrial building in Chandler, Arizona on August 25, 2021, for new VirTra headquarters to scale manufacturing capabilities and improve operational efficiencies

- Cash and cash equivalents as of December 31, 2021 totaled $19.7 million

Fourth Quarter 2021 Financial Summary:

- Total revenue increased 32% to $8.6 million

- Gross profit was $2.8 million, or 33% of total revenue

- Net income was $13,000

- Adjusted EBITDA loss totaled $(220,000)

Full Year 2021 Financial Summary:

- Total revenue increased 28% to $24.4 million

- Gross profit was $11.4 million, or 47% of total revenue

- Net income was $2.5 million

- Adjusted EBITDA totaled $2.1 million

Fourth Quarter and Full Year 2021 Financial Highlights:

Management Commentary

“Our 2021 results demonstrate the strength of our business and growth opportunities we are executing upon as we generated record revenue and bookings of $24.4 million and $32.9 million, respectively, while ending the year with record backlog of $23.1 million,” said Bob Ferris, chairman and co-CEO of VirTra. “We continue to successfully compete in the law enforcement market and saw impressive international and military market revenue growth during 2021 as we delivered on contracts and COVID restrictions eased internationally. We expect continued healthy growth from these sectors and are particularly excited about the commercial market, which includes military opportunities through a prime contractor. Keep in mind our new co-CEO, John Givens, has significant military experience and relationships that we expect to greatly benefit VirTra shareholders as we execute on our growth plans.

“Gross margins in 2021 and the fourth quarter in particular, were negatively impacted by materials and labor cost inflation, product mix and a strategically important military contract with initial work done at a materially lower margin than our historical results. The revenue from this military contract was heavily weighted to the fourth quarter and the lower margin was justified as it funded new VirTra product capabilities needed for military training. Further, we expect this experience will position us to be highly competitive for future military opportunities with margins more akin to our historical results.

“Looking ahead, our sales pipeline remains robust with tailwinds from a return to normalized business practices globally, allowing us to get more active with business development activities such as exhibiting at tradeshows and expanding demos for prospective customers. Additionally, our move-in to our new headquarters in Chandler, Arizona is progressing well and expected to be completed by the end of 2022. The operational efficiencies from this move, our industry-leading capabilities, and a strong balance sheet position us well to successfully compete in our targeted law enforcement and military growth markets in the years to come.

“While we are disappointed in the length of time it took to file our audited financial results for 2021, we are committed to getting our financial filings up to date this month as our ERP system is sufficiently integrated and we are operating with a more efficient process in tandem with our new independent auditors. Going forward, we expect to report our financial results in-line with our traditional cadence.”

Fourth Quarter 2021 Financial Results

Total revenue increased 32% to $8.6 million from $6.6 million in the fourth quarter of 2020. The increase in revenue was the result of increases in sales of simulators, STEP (Subscription Training and Equipment Partnership) subscriptions, accessories, curriculum and training sales, and recurring extended warranty revenue.

Gross profit was $2.8 million, compared to $4.8 million in the fourth quarter of 2020. Gross profit margin, defined as total revenue less cost of sales, was 32.7%, which was lower than the 72.5% in the fourth quarter of 2020. The decrease in gross profit was primarily due to a specific military contract with a lower margin profile, differences in the quantity and type of simulator systems, type of accessories and variety of services sold, combined with an increase in cost of sales.

Net operating expense was $3.0 million, compared to $3.4 million in the fourth quarter of 2020. The decrease in net operating expenses was due to a $434,000 impairment charge and $327,000 in bad debt expense in the fourth quarter of 2020, partially offset by increased depreciation associated with the new Chandler, Arizona headquarters and related moving expenses to the new office.

Operating loss totaled $196,000, compared to $1.3 million in operating income the fourth quarter of 2020.

Net income totaled $13,000, or $0.00 per diluted share (based on 10.0 million weighted average diluted shares outstanding), compared to net income of $1.6 million, or $0.21 per diluted share (based on 7.8 million weighted average diluted shares outstanding), in the fourth quarter of 2020.

Adjusted EBITDA, a non-GAAP metric, totaled $(220,000), compared to $2.2 million in the fourth quarter of 2020.

Full Year 2021 Financial Results

Total revenue increased 28% to $24.4 million from $19.1 million in 2020. The increase in revenue was due to an increase in the number of simulators and accessories completed, delivered and revenue recognized compared to the same period in 2020.

Gross profit was $11.4 million, compared to $11.9 million in 2020. Gross profit margin, defined as total revenue less cost of sales, was 46.7%, compared to 62.3% for the fiscal year of 2020. The decrease in gross profit margin was primarily due to a specific military project with a lower margin profile, differences in the quantity and type of simulator systems, type of accessories and variety of services sold, combined with an increase in cost of sales.

Net operating expense was $10.0 million, compared to $10.7 million for the fiscal year of 2020. The decrease was, primarily due to a $346,000 allowance for bad debt on accounts and note receivable and a one-time $840,000 impairment charge both incurred in 2020.

Operating income was $1.5 million, compared to $1.2 million in 2020.

Net income totaled $2.5 million, or $0.25 per basic and diluted share (based on 10.0 million weighted average basic shares and 10.1 million weighted average diluted shares outstanding), compared to net income of $1.5 million, or $0.19 per basic and diluted share (based on 7.8 million weighted average basic and diluted shares outstanding) in 2020.

Adjusted EBITDA, a non-GAAP metric, totaled $2.1 million, compared to $2.8 million in 2020.

Upcoming Earnings Release Timing

VirTra expects to release its first quarter 2022 results ended March 31, 2022 on August 11, 2022 after market close. The Company also expects to release its second quarter 2022 results ended June 30, 2022 on August 19, 2022 before market open. VirTra plans to host a conference call August 19, 2022 to discuss its first quarter 2022 and second quarter 2022 results. The Company expects these announcements and associated filings to meet the requirements for continued listing of its common stock on Nasdaq.

Conference Call

VirTra’s management will hold a conference call today (August 2, 2022,) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results. VirTra’s chairman and CEO, Bob Ferris, and chief accounting officer, Marsha Foxx, will host the call, followed by a question-and-answer period.

U.S. dial-in number: 1-877-407-9208

International number: 1-201-493-6784

Conference ID: 13731787

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization.

The conference call will be broadcast simultaneously and is available for replay here.

A replay of the call will be available through Tuesday, August 16, 2022.

U.S. replay dial-in: 1-844-512-2921

International replay dial-in: 1-412-317-6671

Replay ID: 13731787

About VirTra, Inc.

VirTra (NASDAQ: VTSI) is a global provider of judgmental use of force training simulators and firearms training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

About the Presentation of Adjusted EBITDA

Adjusted earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “could,” “predicts,” “potential,” “continue,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements, you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors, uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risk and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Investor Relations Contact:

Matt Glover and Jeff Grampp, CFA

Gateway Group, Inc.

949-574-3860

VirTra, Inc.

Condensed Balance Sheets

VirTra, Inc.

Condensed Statements of Operations

(Unaudited)

VirTra, Inc.

Condensed Statements of Cash Flows

(Unaudited)

Provides Update on its Independent Audit

TEMPE, AZ – March 21, 2022 – VirTra, Inc. (NASDAQ: VTSI) (“VirTra”), a global provider of judgmental use of force training simulators, and firearms training simulators for the law enforcement and military markets, will hold a conference call on Thursday, March 31, 2022 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss preliminary unaudited financial results for the fourth quarter and full year ended December 31, 2021. These preliminary unaudited financial results will be issued in a press release prior to the call.

VirTra plans to file a Form 12b-25 with the U.S. Securities and Exchange Commission requesting a 15-day extension to file its Annual Report on Form 10-K for the year ended December 31, 2021. The Company does not anticipate having the audit of its financial statements completed in order to meet the March 31, 2022 deadline due primarily to the integration of a previously disclosed new company-wide ERP (Enterprise Resource Planning) system.

“We are working diligently to complete the independent audit and file our Form 10-K with the U.S. Securities and Exchange Commission as soon as possible, but we do not anticipate meeting the March 31 filing deadline,” said VirTra CEO and Chairman Bob Ferris. “Our continued and anticipated growth necessitated the complete changeover of our production and accounting systems from three independent systems to a new ERP system to improve internal operating efficiency. The integration of this system has caused delays in completing the independent audit. Despite this delay, VirTra continues to be in a strong operating position and we expect 2021 financial results to be among the best in our history.”

VirTra management will host the presentation, followed by a question-and-answer period.

Date: Thursday, March 31, 2022

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: 1-877-407-9208

International dial-in: 1-201-493-6784

A live audio webcast of the conference call will be available in listen-only mode simultaneously and available for replay here and via the investor relations section of the company’s website.

Please call the conference telephone number five minutes prior to the start time. An operator will register your name and organization.

A replay of the call will be available on the same day through Thursday, April 14, 2022.

U.S. replay dial-in: 1-844-512-2921

International replay dial-in: 1-412-317-6671

Replay ID: 13728165

About VirTra, Inc.

VirTra (NASDAQ: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover and Jeff Grampp, CFA

Gateway Group, Inc.

949-574-3860

TEMPE, Ariz. — March 15, 2021 — VirTra, Inc. (NASDAQ: VTSI), a global provider of training simulators for the law enforcement, military, educational, and commercial markets, will hold a conference call on Monday, March 29, 2021 at 4:30 p.m. Eastern time to discuss its financial results for the fourth quarter and full year ended December 31, 2020. Financial results will be issued in a press release prior to the call.

VirTra management will host the conference call, followed by a question and answer period.

Date: Monday, March 29, 2021

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in number: 888-506-0062

International number: 973-528-0011

Conference Code: 767811

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through April 29, 2021.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 40315

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover or Charlie Schumacher

[email protected]

949-574-3860

TEMPE, Ariz. — March 9, 2020 — VirTra, Inc. (NASDAQ: VTSI), a global provider of training simulators for the law enforcement, military, educational, and commercial markets, will hold a conference call on Monday, March 23, 2020 at 4:30 p.m. Eastern time to discuss its financial results for the fourth quarter and full year ended December 31, 2019. Financial results will be issued in a press release prior to the call.

VirTra management will host the conference call, followed by a question and answer period.

Date: Monday, March 23, 2020

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in number: 844-369-8770

International number: 862-298-0840

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through April 6, 2020.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 33519

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators and driving simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations Contact:

Matt Glover or Charlie Schumacher

[email protected]

949-574-3860

TEMPE, Ariz. — March 12, 2019 — VirTra, Inc. (NASDAQ: VTSI), a global provider of training simulators for the law enforcement, military, educational and commercial markets, will hold a conference call on Thursday, March 28,

VirTra management will host the conference call, followed by a question and answer period.

Date: Thursday, March 28, 2019

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in number: 877-407-8031

International number: 201-689-8031

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Liolios at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through April 11, 2019.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 45322

About VirTra

VirTra (NASDAQ: VTSI) is a global provider of training simulators for the law enforcement, military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real-world situations. VirTra’s mission is to save and improve lives worldwide through practical and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Conference Call Scheduled for Thursday, March 29, 2018 at 4:30 p.m. ET

Tempe, Ariz. March 13, 2018 — VirTra, Inc. (OTCQX: VTSI), (the “Company”), a global provider of training simulators for the law enforcement, military, educational and commercial markets, announced today that it will release its financial results for the fourth quarter and year ended December 31, 2017 after the market closes on Thursday, March 29, 2018. The Company will host a fourth quarter and year end 2017 results and business update investor conference call on Thursday, March 29, 2018 at 4:30 p.m. ET.

Conference Call Details:

Date: Thursday, March 29, 2018

Time: 4:30 p.m. ET

Dial-in Number: (877) 407-8031

International Dial-in Number: (201) 689-8031

Webcast: http://www.investorcalendar.com/event/26948

Participants are recommended to dial-in approximately 10 minutes prior to the start of the event. A replay of the call will be available approximately two hours after completion through April 12, 2018. To listen to the replay, dial (877) 481-4010 (domestic) or (919) 882-2331 (international) and use replay ID 26948. The webcast replay will be available through June 29, 2018.

About VirTra

VirTra is a global provider of training simulators for the law enforcement, military, educational and commercial markets. The Company’s patented technologies, software and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship and related training that mimics real world situations. VirTra’s mission is to save and improve lives worldwide through realistic and highly-effective virtual reality and simulator technology. Learn more about the company at www.VirTra.com.

Investor Relations

Brett Maas

Hayden IR

(646) 536-7331

[email protected]

Tempe, Arizona (January 8, 2013) — VirTra Systems (OTC Pink: VTSI), a leading provider of firearms training simulation systems to military, law enforcement agencies and other organizations, today announced that the company has generated a record amount of sales orders for the month of December and for the fourth quarter of 2012. During December 2012 VirTra received purchase orders totaling approximately $1.21 million, which marks a high point during the company’s history for sale orders received in the month of December. These purchases were made by a wide spectrum of agencies from state and local law enforcement, military, international agencies and private security companies.